Natural Gas Commodity Elliott Wave Technical Analysis

Natural Gas Elliott Wave Analysis

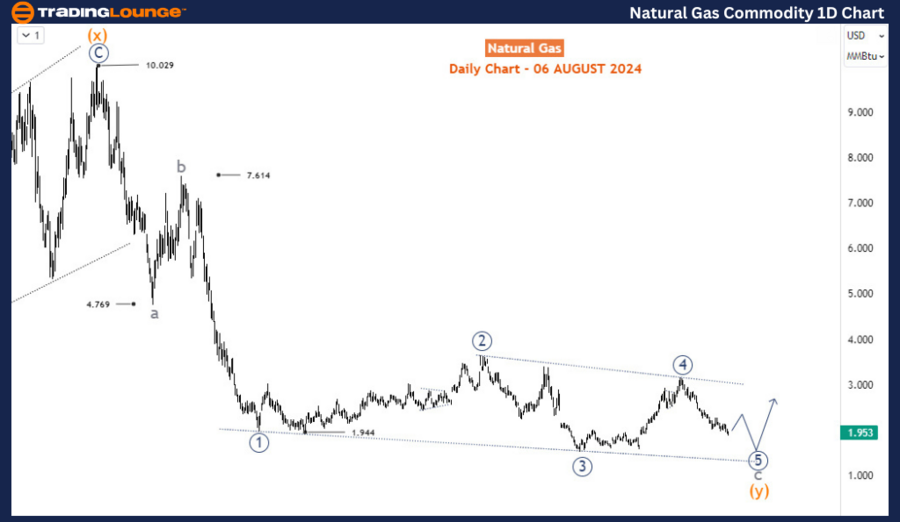

Natural gas is showing a persistent bearish trend, declining by about 40% in 2024 alone. This downtrend is expected to deepen in the coming weeks. After a strong recovery from the February 2024 low, natural gas has retraced more than two-thirds of those gains, suggesting a potential revisit to the lows of 2020. The broader picture indicates a downward trajectory that has been ongoing since August 2022. With prices currently below $2 and a potential drop to $1.3 on the horizon, identifying where a significant reversal might occur is crucial for traders, particularly for those holding short positions.

Daily Chart Analysis

On the daily chart, the decline from the $10 high in August 2022 is unfolding as a corrective structure, labeled as waves a-b-c of the cycle degree. Wave a completed around 4.77, and wave b ended near 7.61. Since November 2022, wave c has been developing into an ending diagonal pattern. Within this diagonal, the 5th leg (wave 5, circled) is currently in progress, and it is expected to continue lower in a three-wave structure. This movement is likely to break below the low of the 3rd wave (wave 3, circled) at 1.524, indicating that the price could dip further before the structure completes. The 5th wave (circled) of c of (y) is anticipated to form a three-wave structure, which is more clearly visible on the H4 chart.

H4 Chart Analysis

On the H4 chart, the price is presently in wave 5 of (A), suggesting that a corrective bounce for wave (B) is imminent. After wave (B) completes, one more decline is expected to follow for wave (C). This final wave should conclude wave 5 (circled), potentially setting the stage for a larger bullish correction on the daily chart.

Conclusion

Natural gas is in the late stages of its current bearish cycle, with the potential for further declines before a significant reversal occurs. Traders should be cautious as the market approaches key support levels, and any corrective bounces should be viewed as opportunities to reassess positions. The Elliott Wave structure suggests that while the near-term outlook remains bearish, a larger bullish correction could be on the horizon once the current wave sequence concludes.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: GX URA ETF Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support