COCHLEAR LIMITED (COH) Elliott Wave Technical Analysis | TradingLounge

Market Insight

In today's updated Elliott Wave analysis for COCHLEAR LIMITED (ASX:COH), the recent completion of a corrective ABC wave pattern suggests a shift toward a new impulse wave higher. This technical forecast includes projected price movements, trend expectations, and critical invalidation points that reinforce a bullish perspective, supported by chart-based data.

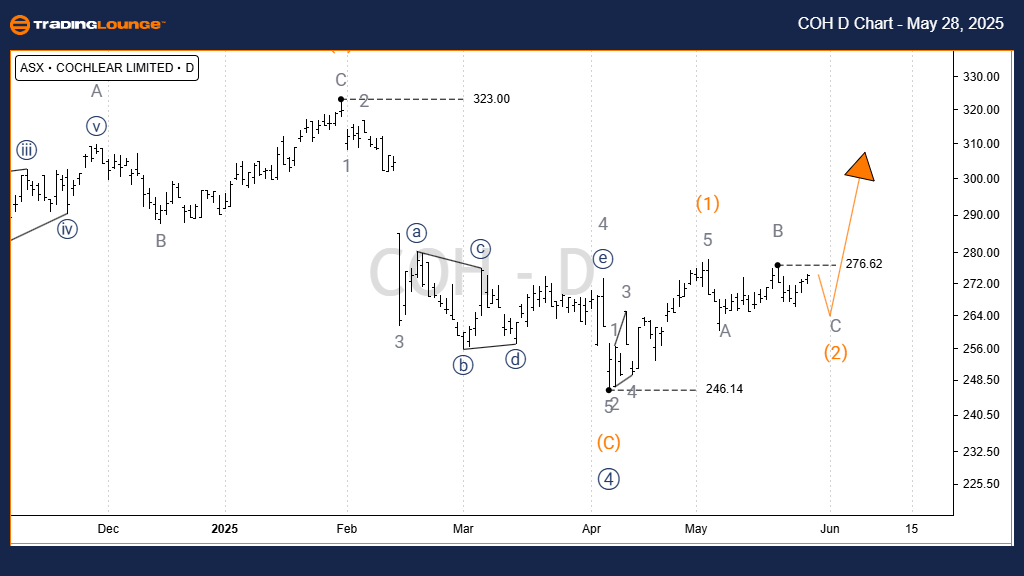

COCHLEAR LIMITED – COH 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Intermediate Degree – Orange)

Mode: Motive

Structure: Impulse

Position: Wave 5)) – Navy

Analysis:

Wave 4)) – navy, marked by the completion of the corrective A,B,C) structure (orange), appears finalized. This development points to the beginning of wave 5)) – navy, indicating an upward market direction. The target level is aligned with the prior wave 3)) – navy high, situated at $350.00.

Confirmation Level: $276.62

Invalidation Level: $246.14

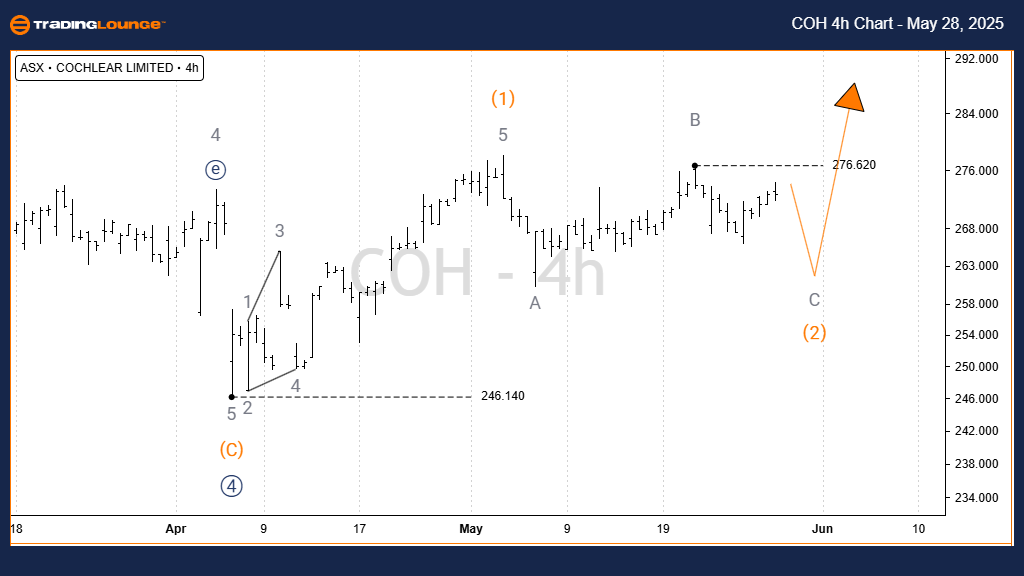

COCHLEAR LIMITED – COH Elliott Wave Technical Analysis | TradingLounge 4-Hour Chart

Function: Major Trend (Intermediate Degree – Orange)

Mode: Motive

Structure: Impulse

Position: Wave B – Grey of Wave 2) – Orange

Analysis:

Following the low of $246.14, a Leading Diagonal marked the formation of wave 1) – orange. This was succeeded by a pullback in wave 2) – orange, now showing completion of waves A and B. Currently, a downward extension in wave C – grey is anticipated before wave 3) – orange triggers a significant bullish trend.

Confirmation Level: $276.62

Invalidation Level: $246.14

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis for COCHLEAR LIMITED (COH) presents a structured technical outlook on the ASX stock. With precise confirmation and invalidation levels, this forecast equips traders with clear signals to strategize their entries and exits, based on current wave formations.