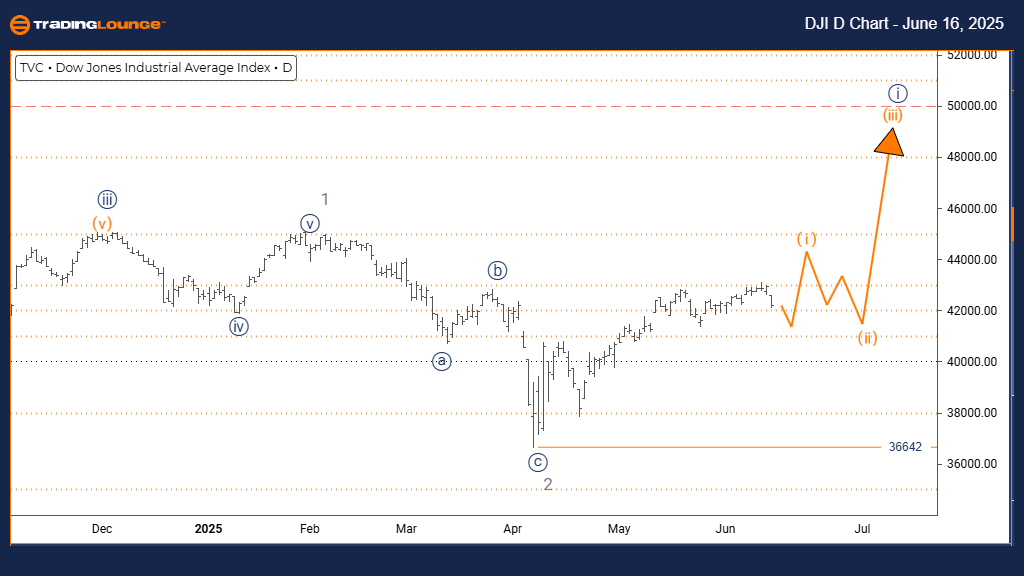

DOW JONES - DJI Elliott Wave Analysis | Trading Lounge Day Chart

DOW JONES - DJI Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Gray Wave 2 is likely complete. Orange Wave 1 of Navy Blue Wave 1 is now unfolding.

Wave Cancel Invalidation Level: 36642

The DOW JONES Industrial Average (DJI) shows a bullish Elliott Wave structure on the daily timeframe. The market behavior is impulsive, indicating strong upward pressure. The current configuration identifies Orange Wave 1, which is developing within the framework of Navy Blue Wave 1. This suggests the index has entered an early stage of a broader bullish cycle.

Recent price action confirms the end of Gray Wave 2, marking the initiation of Orange Wave 1. Traders should anticipate the next correction as Orange Wave 2, which will likely serve as a short-term retracement before the upward trend continues.

A critical technical level to watch is 36642. Falling below this wave invalidation point would invalidate the present Elliott Wave count and necessitate a reassessment of the bullish scenario. As long as the index stays above this support, the outlook favors continued gains.

The current wave pattern aligns with sustained upward momentum under Navy Blue Wave 1, supported by the impulsive move of Orange Wave 1. With Gray Wave 2 confirmed complete, this reinforces the expectation for further buying activity and higher index levels.

DOW JONES - DJI Elliott Wave Analysis | Trading Lounge Weekly Chart

DOW JONES - DJI Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 is complete. Navy Blue Wave 1 of Gray Wave 3 is in progress.

Wave Cancel Invalidation Level: 36642

The weekly Elliott Wave forecast for the DOW JONES (DJI) maintains a bullish trajectory, with an impulsive price structure. The wave label Navy Blue Wave 1 is part of a more extensive formation identified as Gray Wave 3, suggesting the index is initiating a significant uptrend.

Evidence shows the completion of Gray Wave 2, making way for Navy Blue Wave 1 within Gray Wave 3. The next logical step is Navy Blue Wave 2, expected to act as a moderate correction before bullish momentum resumes.

The wave invalidation level at 36642 serves as a critical benchmark. A move below this support would nullify the current wave setup. However, as long as the price remains above this line, the upward wave pattern stays intact.

The overall technical outlook indicates a strong potential for continued growth, with Navy Blue Wave 1 advancing under the influence of Gray Wave 3. The market's impulsive nature supports extended buying interest and rising prices in the coming sessions.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: S&P/TSX 60 Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support