The Coca-Cola Company, Elliott Wave Technical Analysis

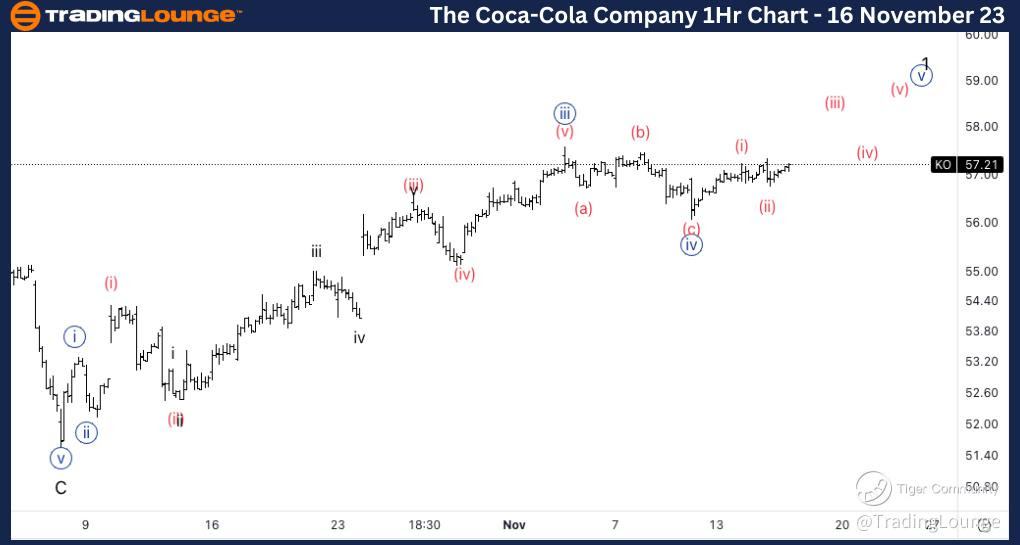

The Coca-Cola Company, (KO:NYSE): 4h Chart 16 November 23

KO Stock Market Analysis: Looking for continuation higher into a wave {v} as we have found support on 55$ and we are aiming to at least 58 for Minor Group 2.

KO Elliott Wave Count: Wave {iv} of 1.

KO Technical Indicators: Below 200EMA and above 20EMA.

KO Trading Strategy: Looking for longs into wave {v}.

TradingLounge Analyst: Alessio Barretta

Source : Tradinglounge.com get trial here!

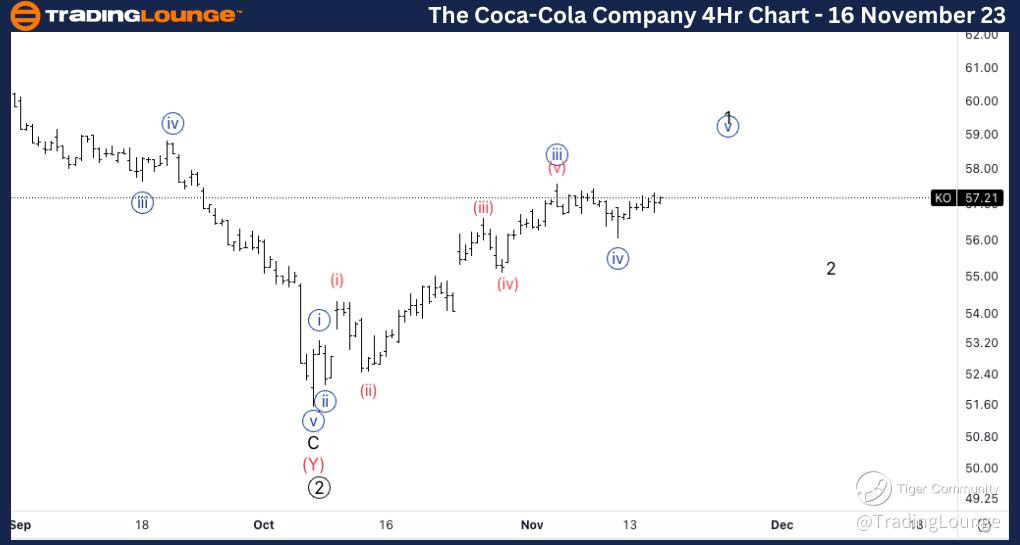

The Coca-Cola Company, KO: 1-hour Chart 16 November 23

The Coca-Cola Company, Elliott Wave Technical Analysis KO Stock Market Analysis: Looking for continuation higher into wave {v} as we seem to have completed wave (ii) of {v}. Invalidation level stands on the bottom of wave {iv}.

KO Elliott Wave count: Wave (ii) of {v}.

KO Technical Indicators: Above all averages.

KO Trading Strategy: Looking longs into wave (iii) of {v}.