Welcome to our Weekly Elliott Wave Analysis Report, offering insightful perspectives and trade ideas on some of the Forex, Crypto, and Stocks we have on our watchlist next week.

In this edition, we will focus on EURUSD, GBPAUD, AUDJPY, GBPJPY, ADAUSD, BTCUSD, and Exxon Mobil. The analysis aims to provide traders with succinct yet comprehensive insights, enabling informed decisions in the swiftly evolving financial markets.

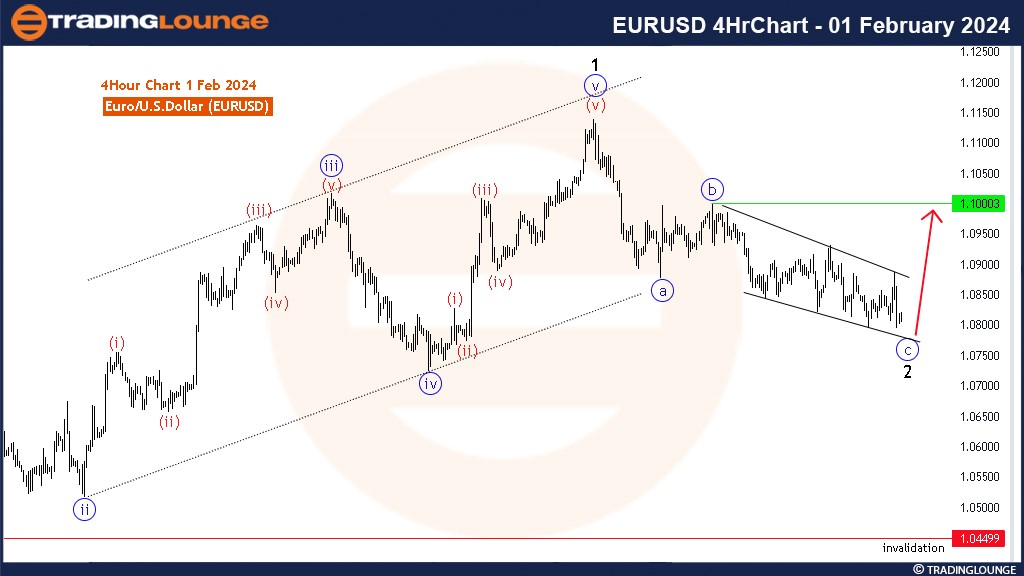

EURUSD

The currency pair recently concluded a bearish corrective Elliott wave zigzag pattern that commenced on December 28. Identified as wave 2 correction within the broader impulse wave rally from October 4 to December 29, 2023, wave c of the higher degree corrective wave 2 completed an ending diagonal structure. We anticipate an upside breakout post-diagonal, resuming the bullish trend after finding support near the psychological level of 1.08. A potential impulsive breakout next week is expected to propel the pair towards 1.1

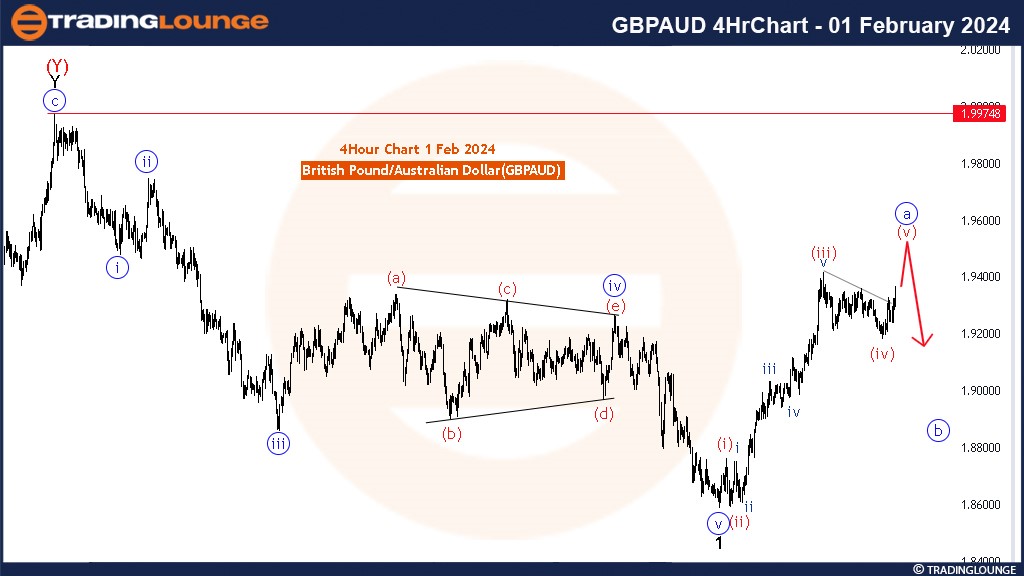

GBPAUD

Having completed a bearish impulse wave near the 1.86 psychological level, GBPAUD experienced an impulsive run towards 1.94. Wave (iv) (in red) found support at 1.92, suggesting an opportunity for a run towards 1.96 to complete the impulse wave. While the pair touched 1.945, caution is advised as wave a may be near completion, potentially leading to a 3-wave bearish correction next week. Traders should also monitor potential divergences on momentum indicators.

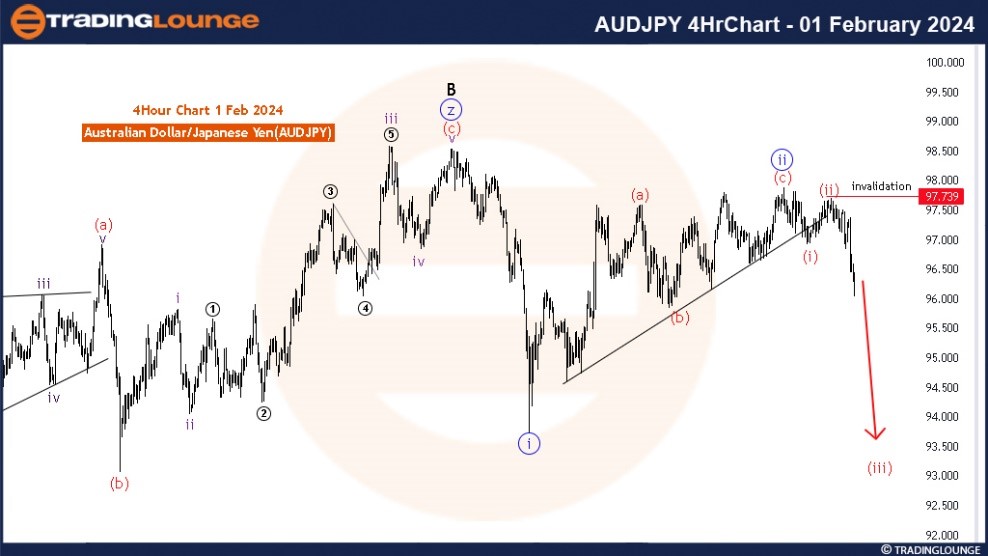

AUDJPY

Breaking below 97 last week, AUDJPY initiated a decline within wave (iii) (in red) of iii (in blue). A double zigzag completed near 98, leading to a fall to 95.5. Anticipating a further decline to complete red wave (iii) to (v) towards 94.5-94 support.

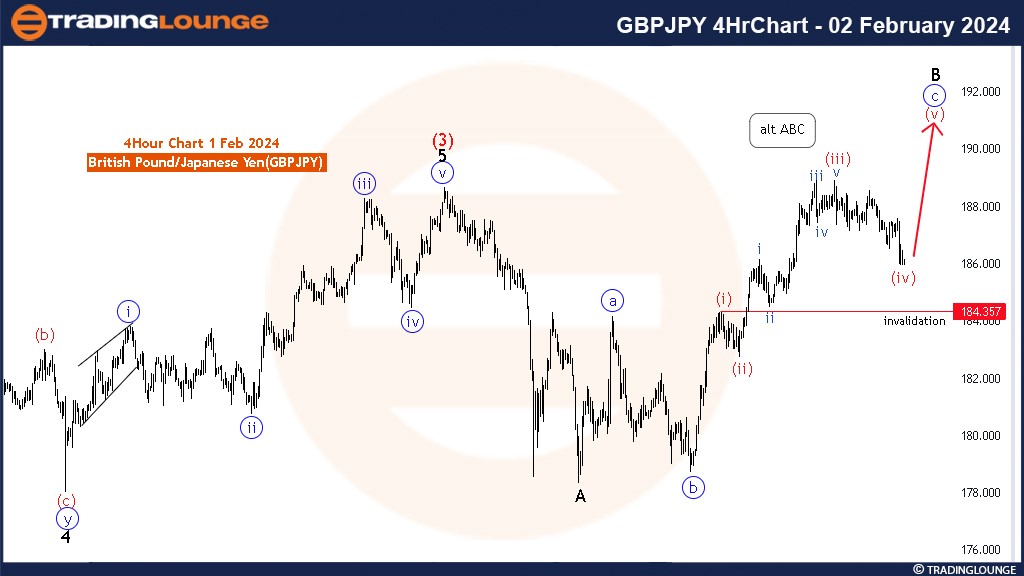

GBPJPY

Wave (4) completion is anticipated in an expanding flat pattern, with wave B currently in progress. Sub-wave (iv) (in red) is expected as part of the impulse, with a further rally projected above 188 towards 190 and 191 next week. The invalidation level is set at 184.35.

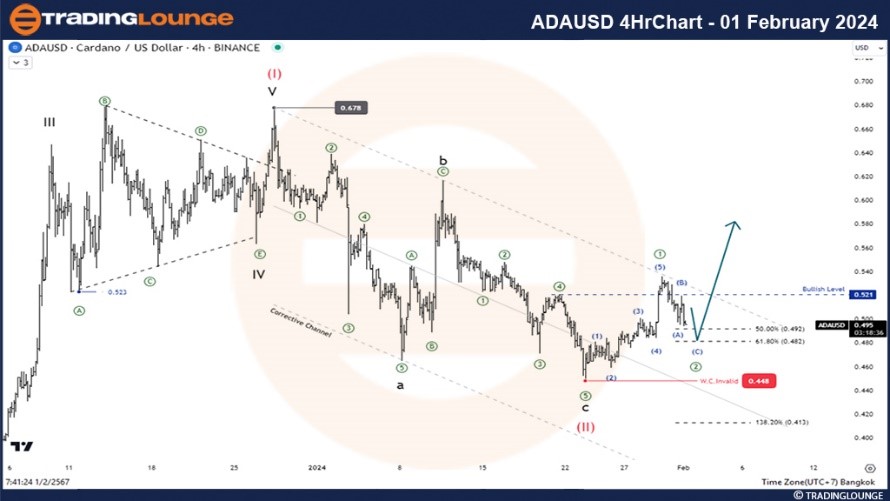

ADAUSD

After a bullish impulse wave trend ending at 0.678, Cardano underwent a corrective decline to 0.447. A bullish reaction post-0.448 hints at a potential resumption of the long-term bullish trend in February. A break above 0.537 is crucial for confirming an impulse wave move towards the 0.678 resistance. Conversely, a break below 0.448 before 0.537 may suggest a bearish correction.

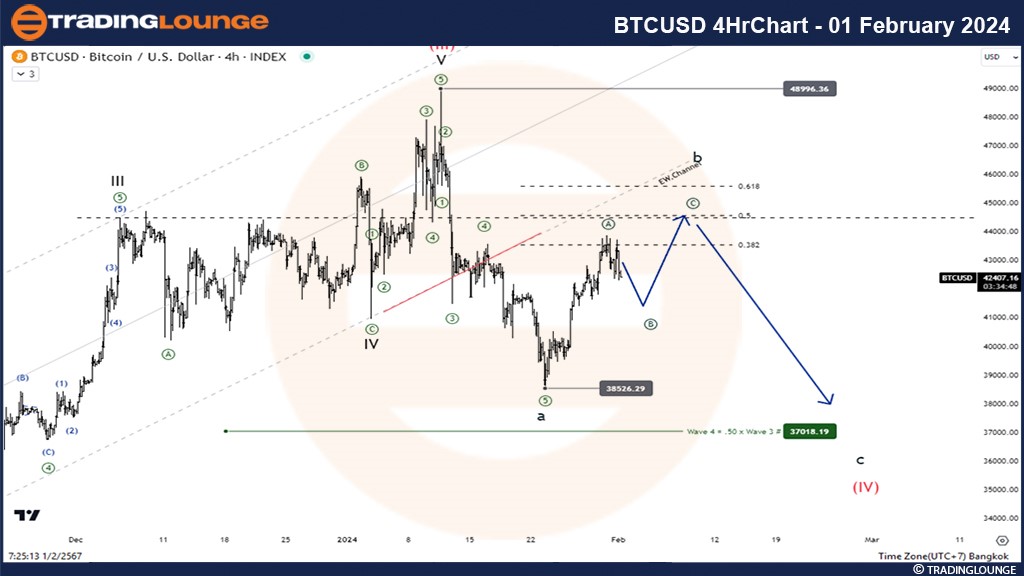

BTCUSD

Following over two years of a sustained bullish trend, Bitcoin initiated a dip in January, completing a bearish impulse wave. A 3-wave bullish correction is underway, with wave a (circled in green) around 43,900. Expecting a decline for wave b before rallying to 45,000-46,000. Subsequent bearish correction from 49,000 will continue for wave c of (IV) (in red).

Exxon Mobil

EXO's impressive rally from $96 to almost $105 is likely in response to the completion of wave (4) in red, spanning 8 months. A minor correction is anticipated next week before the stock progresses further above $110 and potentially towards higher prices.