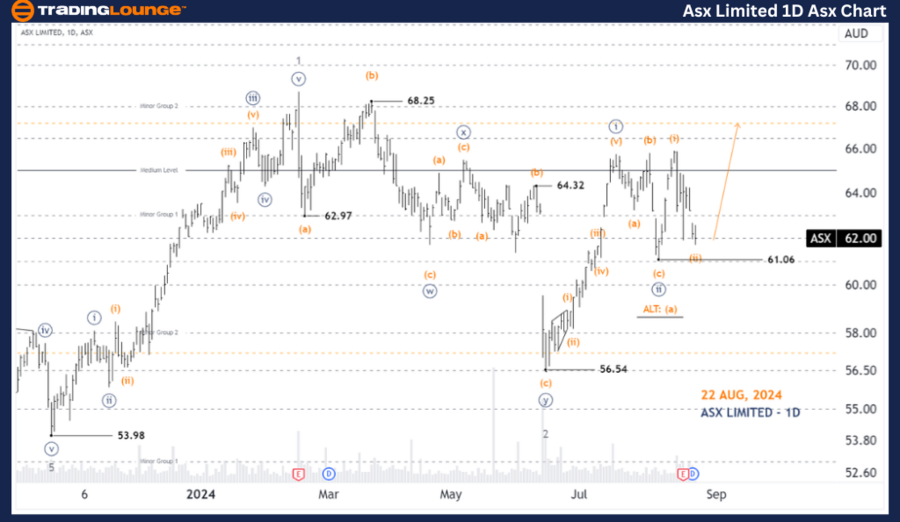

ASX LIMITED – ASX Elliott Wave Analysis TradingLounge (1D Chart)

Greetings! Today's Elliott Wave analysis focuses on ASX LIMITED, listed on the Australian Stock Exchange (ASX). Our analysis suggests that ASX LIMITED could rise soon as it advances through wave ((iii))-navy.

ASX: ASX LIMITED – ASX Elliott Wave Technical Analysis

ASX: ASX LIMITED – ASX 1D Chart (Semilog Scale) Analysis

- Function: Major (Minor degree, gray)

- Mode: Motive

- Structure: Impulse

- Position: Wave (ii)-orange of Wave ((iii))-navy of Wave 3-gray

Details: ASX LIMITED is currently in a critical phase where wave ((iii))-navy could be unfolding higher. However, the recent deep retracement of wave (ii)-orange indicates that the bullish momentum might be weakening. To validate this bullish outlook, the price needs to push higher in the coming days. If it fails to do so, the alternative scenario suggests that wave ((ii))-navy might extend longer than anticipated. A potential Long Trade Setup may emerge around the Medium Level of 65.00.

- Invalidation Point: 61.06

ASX: ASX LIMITED – ASX Elliott Wave Analysis TradingLounge (4-Hour Chart)

ASX: ASX LIMITED – ASX Elliott Wave Technical Analysis

ASX: ASX LIMITED – ASX 4-Hour Chart Analysis

- Function: Major Trend (Minute degree, navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave (ii)-orange of Wave ((iii))-navy

Details: A closer examination of the 4-hour chart reveals a potential Zigzag pattern in the wave (ii)-orange retracement, which is nearing its completion. For the bullish scenario to remain intact, the price needs to rise above 64.24 and consistently hold above 61.08. This would signal a high-quality Long Trade Setup. However, a drop below 61.06 would indicate that wave ((ii))-navy is developing into a more complex and extended pattern, although wave ((iii))-navy is still expected to push higher eventually.

- Invalidation Point: 61.06

- Confirmation Point: 64.24

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: V300AEQ ETF UNITS – VAS Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our analysis provides insights into ASX LIMITED's current market trends, focusing on short-term outlooks and potential trading opportunities. We highlight key price levels that serve as validation or invalidation points for our wave count, helping to bolster confidence in our forecast. Through this approach, we aim to offer a clear and professional perspective on market dynamics, enabling informed decision-making.