Cocoa Commodity Elliott Wave Technical Analysis

Function: Counter-trend

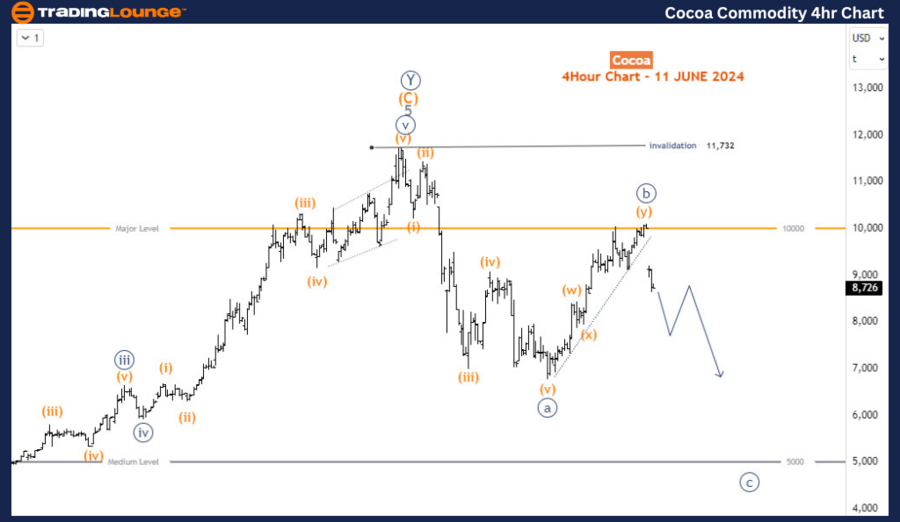

Mode: Corrective

Structure: Double Zigzag

Position: Blue wave ‘b’

Direction: Blue wave ‘b’ remains active

Details: Cocoa encountered resistance at the critical 10,000 level, as anticipated. A minimum three-wave decline below 8000 is expected, with a potential impulse breakdown toward 5,000 for wave c (circled).

Cocoa Elliott Wave Technical Analysis

After a two-week recovery, Cocoa appears set for another downturn, placing sellers in control for the short term. Despite the long-term bullish trend, the current bearish retracement from the all-time high is expected to continue lower in the coming weeks.

Cocoa Daily Chart Analysis:

In April 2024, Cocoa completed a long-term bullish impulse wave that began in October 2022, when prices were around 2198. Reaching a peak at 11732 in April 2024, Cocoa started a bearish retracement, forming a bearish impulse wave. From this peak, we anticipate at least a three-wave pullback or a larger bearish correction. Given the path of least resistance, a three-wave drop is projected, labeled as waves a-b-c (circled in navy blue). The first two legs, waves a and b, seem complete, with wave b encountering resistance at the 10,000 major level, as shown on the H4 chart. If wave c declines from the 10,000 level, it could target the 5,000 medium level.

Cocoa Commodity H4 Chart Analysis:

The H4 chart indicates that the price broke below the trend line connecting the sub-waves of wave b (circled in navy blue), potentially marking the start of wave c of the same degree. Confirmation requires a more decisive move to the downside. The invalidation level for this bearish scenario is at 11732. A break above this level would indicate the continuation of the long-term bullish impulse trend. Current price action, however, suggests a downward movement toward the 5,000 level in the short and medium term.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold XAUUSD Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Summary:

Cocoa's recent two-week recovery appears to be a temporary pause in the larger bearish retracement that began from the all-time high. The daily chart shows a completed long-term bullish impulse wave from October 2022 to April 2024, followed by a bearish correction. The anticipated three-wave pullback, labeled a-b-c, has waves a and b seemingly complete, with wave b facing resistance at 10,000. The H4 chart supports the beginning of wave c, with potential downside targets around 5,000. The key invalidation level is 11732; a break above this would negate the bearish outlook and resume the long-term bullish trend. Traders should monitor for further downside movement, focusing on the 5,000 target in the short to medium term.