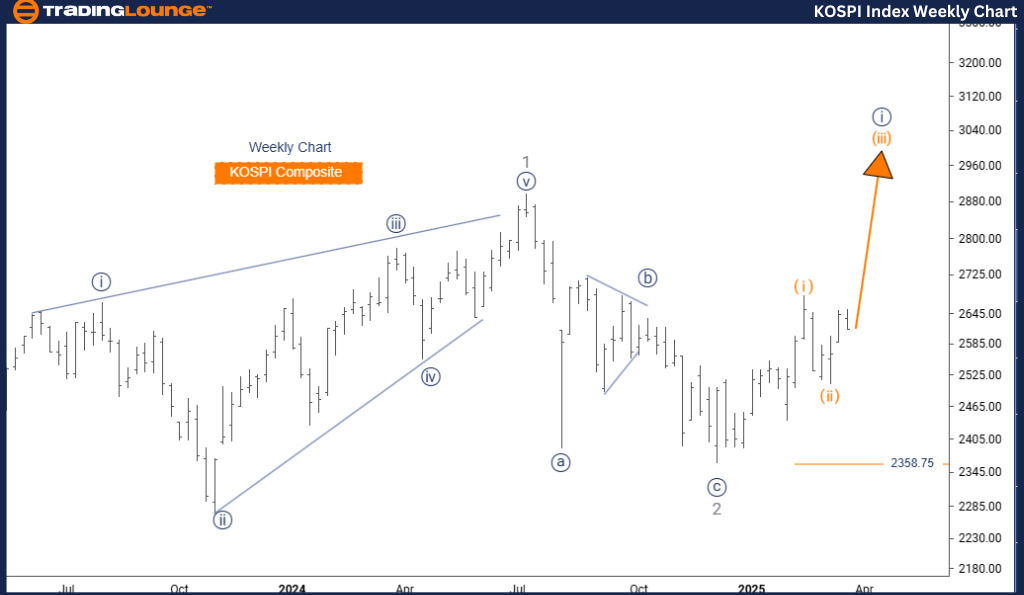

KOSPI Composite Elliott Wave Analysis Trading Lounge Day Chart

KOSPI Composite Index Day Chart Analysis

KOSPI Composite Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 1

Next Higher Degree Direction: Orange Wave 3 (Started)

Wave Cancel Invalid Level: 2,358.75

The daily Elliott Wave analysis of the KOSPI Composite Index presents a bullish outlook for South Korea's primary stock market index. The wave pattern is impulsive, emphasizing the ongoing Orange Wave 3, positioned within Navy Blue Wave 1 at a higher degree. Completion of Orange Wave 2 suggests a transition into a new upward cycle, reinforcing the continuation of bullish momentum.

Orange Wave 3 usually indicates sustained and expansive price advances, matching the present technical setup. The critical invalidation level stands at 2,358.75; a drop below this figure would challenge the current Elliott Wave count.

With Orange Wave 3 likely in motion, price action and trading volume should be closely watched for signals typical of impulsive wave behavior. The chart structure provides a firm base for short-to-intermediate term bullish strategies. Understanding wave degrees is vital for aligning with the dominant trend, particularly in accelerating markets.

Current wave positioning favors bullish entries, with attention on the invalidation threshold to manage potential risk.

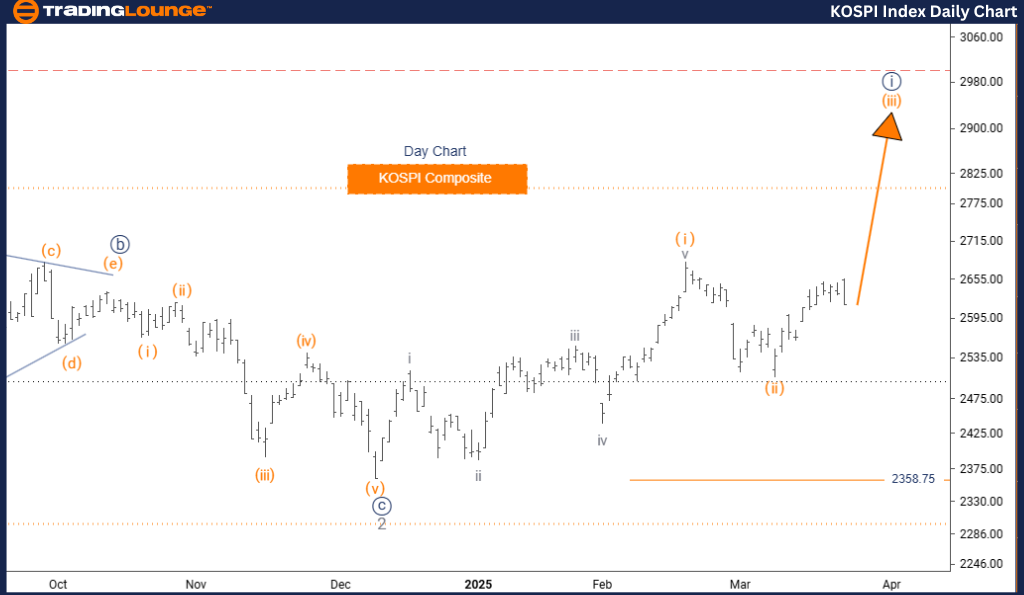

KOSPI Composite – Elliott Wave Analysis Trading Lounge Weekly Chart

KOSPI Composite Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 1

Next Higher Degree Direction: Orange Wave 3 (Started)

Wave Cancel Invalid Level: 2,358.75

The weekly Elliott Wave outlook for the KOSPI Composite Index remains firmly bullish. The index continues its upward move within an impulsive framework, now progressing through Orange Wave 3 under the larger umbrella of Navy Blue Wave 1.

Following the expected conclusion of Orange Wave 2, the index appears to have started a new rally leg. This third wave phase is known for robust price momentum, which aligns with the ongoing positive trend. The 2,358.75 level remains the invalidation marker—falling beneath it would disrupt the current wave expectation.

Given the weekly timeframe, this analysis supports long-term bullish strategies, providing clarity for traders and investors aiming to align with macro-level market movements. Volume and price acceleration should serve as key indicators for validating the strength of Orange Wave 3.

This structure illustrates a longer-term growth phase, giving traders a tactical advantage within the broader bullish market environment. The trend remains intact, with risk closely tied to the invalidation level.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: S&P 500 Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support