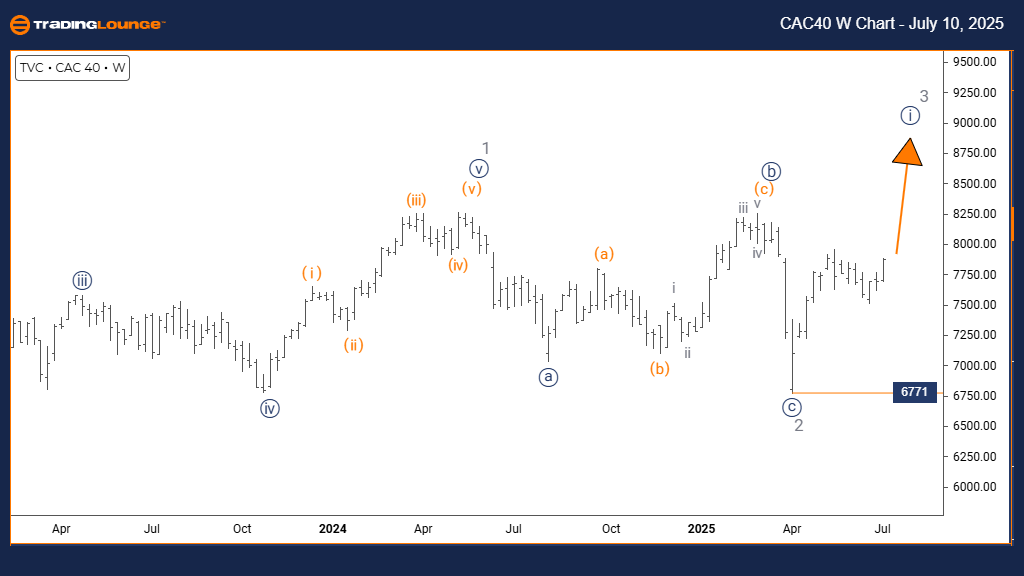

CAC 40 (France) Elliott Wave Analysis - Trading Lounge Daily Chart

CAC 40 (France) Index Daily Chart Analysis

CAC 40 (France) Wave Technical Analysis

Function: Bullish Market Trend

Mode: Impulsive Structure

Structure: Orange Wave 3 Development

Position: Formation of Navy Blue Wave 1

Next Higher Degree Direction: Orange Wave 3 In Progress

Details: Completion of Orange Wave 2 is likely. Orange Wave 3 is currently unfolding.

Wave Invalidation Level: 6771

Daily Chart Overview

The CAC 40 Index on the daily timeframe signals a bullish structure aligned with Elliott Wave theory. The current pattern shows progression into Orange Wave 3—an impulsive wave within the broader Navy Blue Wave 1. This early-phase movement points toward the potential for a longer-term rally in the French stock market.

Momentum indicators suggest Orange Wave 2 has finished, confirming a shift into a bullish phase led by Orange Wave 3. The key invalidation level stands at 6771; any move below this level would question the existing wave setup. Present wave behavior shows increased buying strength and indicates a foundation for a steady upward trend.

This bullish formation offers a favorable trade setup with solid risk-to-reward potential, provided the market holds above critical support. Monitoring wave development is essential for traders aiming to ride the current upward momentum.

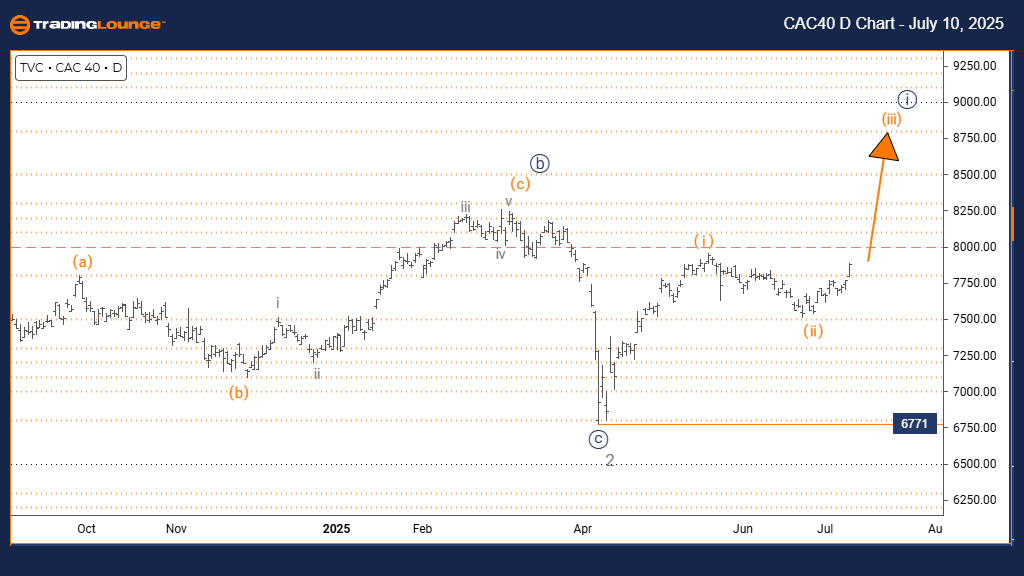

CAC 40 (France) Elliott Wave Analysis - Trading Lounge Weekly Chart

CAC 40 (France) Wave Technical Analysis

Function: Long-Term Trend Direction

Mode: Impulsive Market Behavior

Structure: Navy Blue Wave 1 Initiation

Position: Gray Wave 3 Under Formation

Next Lower Degree Direction: Development of Navy Blue Wave 2

Details: Gray Wave 2 appears to be completed. Navy Blue Wave 1 within Gray Wave 3 is progressing.

Wave Invalidation Level: 6771

Weekly Chart Insight

The weekly view of the CAC 40 Index reflects a solid uptrend supported by Elliott Wave structure. The price is moving through Navy Blue Wave 1, which is part of Gray Wave 3—typically a strong bullish leg. Completion of Gray Wave 2 strengthens the possibility of a sustained impulsive rally.

Wave alignment and bullish momentum support the scenario of continued gains as long as the price remains above 6771. This level serves as a key benchmark for validating the current Elliott Wave count and long-term market outlook.

The weekly chart provides deeper market insight by accounting for institutional trends and broader investor sentiment. Traders should remain alert for potential gains while preparing for corrective price actions, which are typical within Elliott Wave cycles.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NIFTY 50 index Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support