Berkshire Hathaway Inc. (BRK.B) Elliott Wave Analysis – Daily & 1H Chart

This Elliott Wave analysis for Berkshire Hathaway Inc. (BRK.B) evaluates both the daily and 1-hour charts, providing insights into market trends and potential price movements.

BRK.B Elliott Wave Analysis – TradingLounge Daily Chart

Berkshire Hathaway Inc. (BRK.B) Daily Chart Overview

BRK.B Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3 of (5)

Direction: Upside within wave (5)

Details: The intermediate wave (5) is expected to continue its steady rise, approaching Trading Level 5 at $500. The equality projection of wave (5) vs. wave (1) at $543 suggests there is still room for further upside momentum.

BRK.B Elliott Wave Daily Chart Analysis

Berkshire Hathaway Inc. (BRK.B) is currently in an impulsive wave structure, positioned in wave 3 of (5). The upward trend is expected to persist, with intermediate wave (5) targeting $500. The price action suggests further growth potential, as the equality of wave (5) to wave (1) indicates a possible target of $543. Traders should watch for continued bullish momentum as wave (5) unfolds.

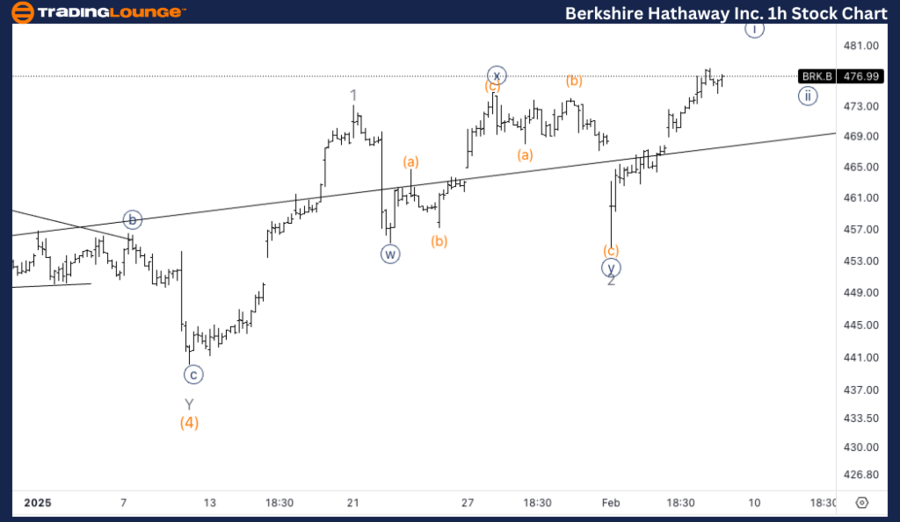

BRK.B Elliott Wave Analysis – TradingLounge 1H Chart

Berkshire Hathaway Inc. (BRK.B) 1-Hour Chart Overview

ASX BRK.B Stock Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 3

Direction: Approaching wave {i} top

Details: The wave {i} top is nearing completion, followed by a potential corrective pullback, which may present a buying opportunity.

BRK.B Elliott Wave 1H Chart Analysis

On the 1-hour chart, BRK.B appears to be reaching the top of wave {i} of 3. Once this wave tops out, a corrective pullback is anticipated, which could provide an opportunity for traders to enter long positions before the next bullish move into wave {iii}. Monitoring support levels during the retracement will be crucial to identifying a strong continuation setup for further upside momentum.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Boeing Company (BA) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support