BA Elliott Wave Technical Analysis: The Boeing Company (BA) – Daily & 1H Chart Breakdown

This Elliott Wave analysis of The Boeing Company (BA) provides insights into both the daily and 1-hour chart structures, outlining the ongoing trends and potential price movements.

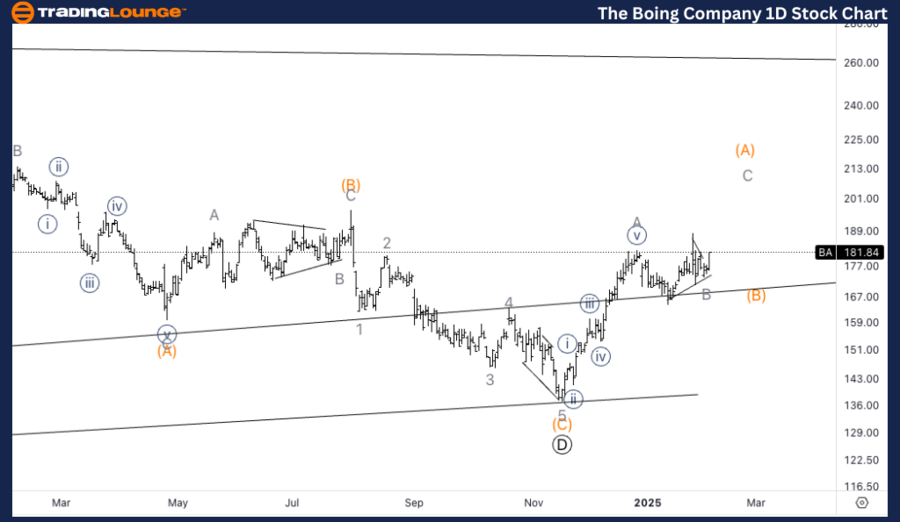

BA Elliott Wave Analysis – TradingLounge Daily Chart

The Boeing Company (BA) Daily Chart Overview

BA Stock Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Triangle

- Position: Wave (A) of E

- Direction: Upside in wave C of (A).

- Target: $200

The Boeing Company Share Technical Analysis – Daily Chart

The Boeing Company (BA) is currently unfolding in a corrective triangle pattern, specifically in wave (A) of E. We anticipate an upward movement into wave C of (A), with an alternative scenario suggesting that it could be wave (C) of E, which is one degree higher.

Key price action levels indicate a potential upside target near Trading Level 2 at $200. As the stock approaches this resistance, traders should watch for signals confirming the completion of wave (A) or a more extended bullish correction.

This technical setup suggests an opportunity for traders looking for trend continuation signals within the Elliott Wave framework.

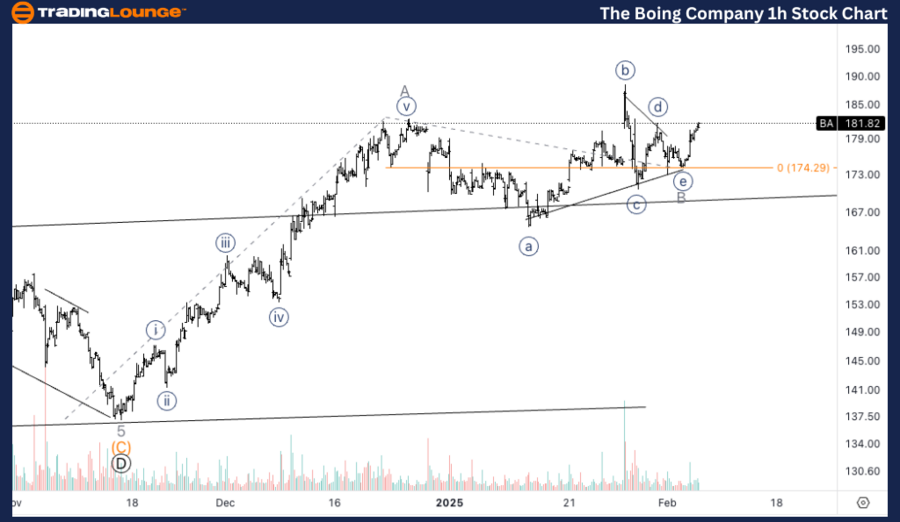

BA Elliott Wave Analysis – TradingLounge 1-Hour Chart

The Boeing Company (BA) 1H Chart Overview

BA Elliott Wave Technical Analysis

- Function: Counter Trend

- Mode: Corrective

- Structure: Triangle

- Position: Wave B of (A)

- Direction: Upside in wave C

- Target: $200

BA Share Technical Analysis – 1H Chart

On the 1-hour chart, BA appears to have completed a triangle formation in wave B of (A). The current wave C is expected to push higher, indicating further upside potential.

One key technical indicator supporting this movement is increasing volume at the bottom of wave B, suggesting that a low may already be in place. If momentum continues to build, a breakout targeting $200 as a minimum upside objective would confirm the expected wave C movement.

Traders should closely monitor price action, volume spikes, and key resistance levels to validate this Elliott Wave setup and assess whether the corrective structure extends further.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SMCI Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Key Takeaways from BA Elliott Wave Analysis