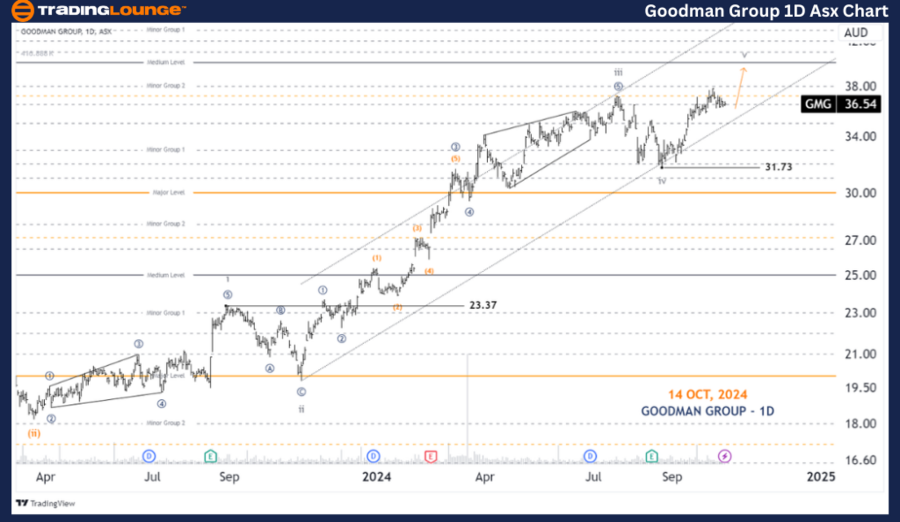

Goodman Group – GMG Elliott Wave Analysis TradingLounge 1D Chart

Greetings, today's Elliott Wave update covers the Australian Stock Exchange (ASX) with a focus on Goodman Group (GMG). Our analysis indicates GMG is poised for a short-term rise, aligning with the development of a grey v-wave.

ASX: GOODMAN GROUP (GMG) 1D Chart Analysis (Semilog Scale)

GMG Elliott Wave Technical Analysis

Trend Function: Major trend (Minute degree, navy)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave v-grey of Wave (iii)-orange of Wave ((iii))-navy

Details:

- Wave iv-grey has concluded, and wave v-grey is now forming with a bullish push higher. The price targets are between 38.00 and 40.00, which will be explored further in our 4-hour chart analysis.

- Invalidation Point: 31.73

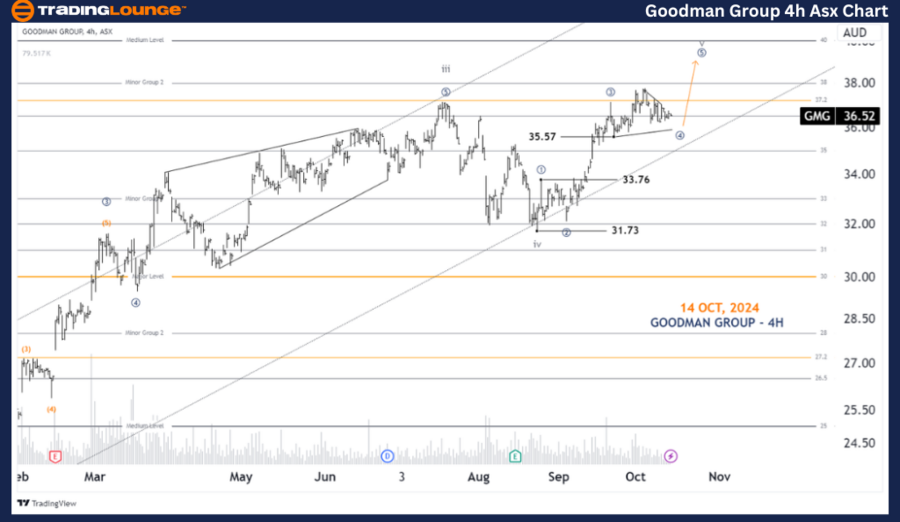

GMG Elliott Wave Analysis TradingLounge 4-Hour Chart

ASX: GOODMAN GROUP (GMG) 4-Hour Chart Analysis

Trend Function: Major trend (Subminuette degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave ((4))-navy of Wave ((5))-navy

Details:

- Wave ((3))-navy appears to have completed, and wave ((4))-navy is unfolding as a Triangle. Once the triangle formation concludes, the trend is expected to resume with wave ((5))-navy, targeting the 38.00 - 40.00 range.

- The triangle remains valid as long as the price stays above 35.57.

Invalidation Point: 33.76

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Commonwealth Bank of Australia Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave forecast for ASX: Goodman Group (GMG) outlines key trends and price movements. This analysis offers actionable insights, empowering traders to better understand how to navigate the current wave cycles. Key validation and invalidation points are included to reinforce our perspective, providing clarity on when specific wave counts are either confirmed or voided. With this detailed view, we strive to equip readers with the most professional and objective market outlook to support informed trading decisions.