DAX (Germany) Elliott Wave Analysis – Trading Lounge Day Chart

DAX (Germany) Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Gray Wave 4

Position: Orange Wave 3

Direction Next Higher Degrees: Gray Wave 5

Details: Gray Wave 3 appears completed; now, Gray Wave 4 of Orange Wave 3 is in play.

Wave Cancel Invalid Level: 19,734.00

The DAX (Germany) Elliott Wave Analysis for the daily chart provides critical insights into the index's current trend and potential future price movements. The analysis suggests that the market is undergoing a counter-trend phase, which is corrective in nature rather than a continuation of a strong directional trend.

Elliott Wave Pattern Overview

The primary wave structure under observation is Gray Wave 4, which forms part of a broader corrective pattern.

Positioned within Orange Wave 3, Gray Wave 4 signifies a transitional phase before the next potential trend emerges.

The analysis indicates that Gray Wave 3 has likely completed, and the market is now progressing through Gray Wave 4 of Orange Wave 3.As a corrective wave, it may exhibit sideways movement or retracement before the next impulsive trend takes shape.

Key Market Levels and Next Steps

- The next higher-degree wave to monitor is Gray Wave 5, expected to develop once Gray Wave 4 concludes.

- A critical price level to observe is 19,734.00, which serves as the wave cancellation threshold. If the price surpasses this level, it would invalidate the current wave structure, potentially indicating a shift in market conditions.

Trading Strategy and Market Outlook

- Traders should closely monitor Gray Wave 4’s development, as it provides key trading opportunities.

- The transition into Gray Wave 5 could define the next major price movement, requiring strategic positioning.

- This Elliott Wave analysis enhances market structure comprehension, helping traders make more informed trading decisions.

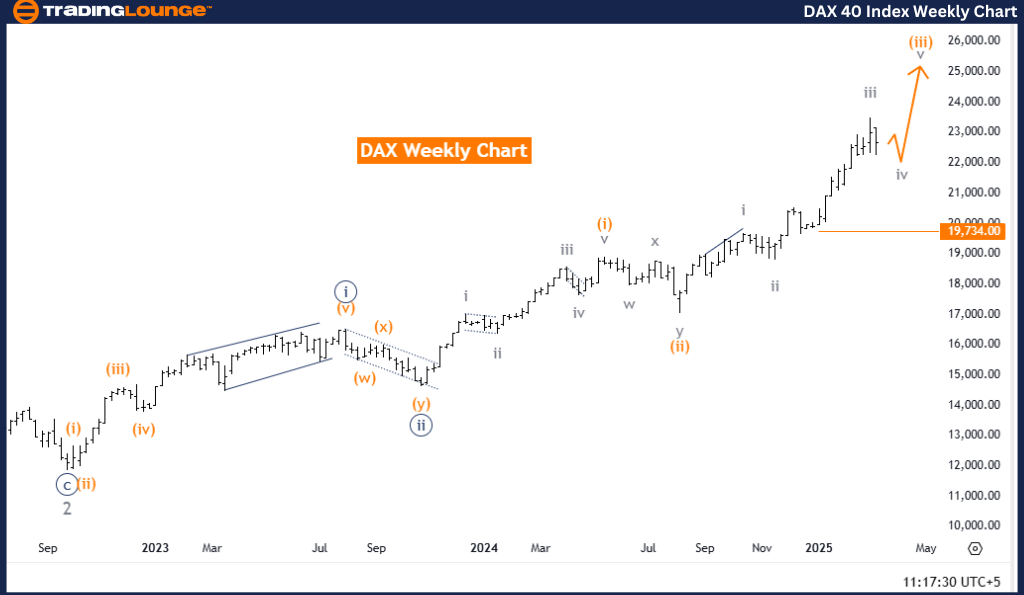

DAX (Germany) Elliott Wave Analysis – Trading Lounge Weekly Chart

DAX (Germany) Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Gray Wave 4

Position: Orange Wave 3

Direction Next Higher Degrees: Gray Wave 5

Details: Gray Wave 3 appears completed; now, Gray Wave 4 of Orange Wave 3 is in play.

Wave Cancel Invalid Level: 19,734.00

The DAX (Germany) Elliott Wave Analysis for the weekly chart offers a broader perspective on the index’s trend, supporting long-term market positioning. The analysis highlights that the market remains in a counter-trend phase, characterized by corrective wave activity rather than a sustained trend continuation.

Elliott Wave Structure Breakdown

- The primary wave under review is Gray Wave 4, a key part of a larger corrective pattern.

- Positioned within Orange Wave 3, it marks an important phase within the Elliott Wave framework.

- The completion of Gray Wave 3 suggests that Gray Wave 4 is currently in play, potentially leading to sideways movement or retracement.

Critical Market Levels and Next Moves

- The next wave to monitor is Gray Wave 5, expected to emerge following Gray Wave 4's completion.

- The invalid level remains 19,734.00; a price movement beyond this point could invalidate the current Elliott Wave structure, signaling a possible shift in market dynamics.

Strategic Trading Approach

- Traders should focus on Gray Wave 4’s progression to identify potential market entry and exit points.

- The transition into Gray Wave 5 may mark a pivotal moment, demanding adaptive trading strategies.

- Analyzing the weekly timeframe provides a macro view of market trends, aiding traders in aligning strategies with long-term trends.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: S&P BSE Sensex (India) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support