ASX: NORTHERN STAR RESOURCES LTD – NST Elliott Wave Technical Analysis | TradingLounge

Market Overview

The latest Elliott Wave analysis updates the near-term forecast for Northern Star Resources Ltd (ASX:NST). Recent price behavior indicates short-term bearish momentum. Our projection anticipates a downward trend targeting the 16.86 support level. At this stage, the technical structure does not support any bullish reversal signals.

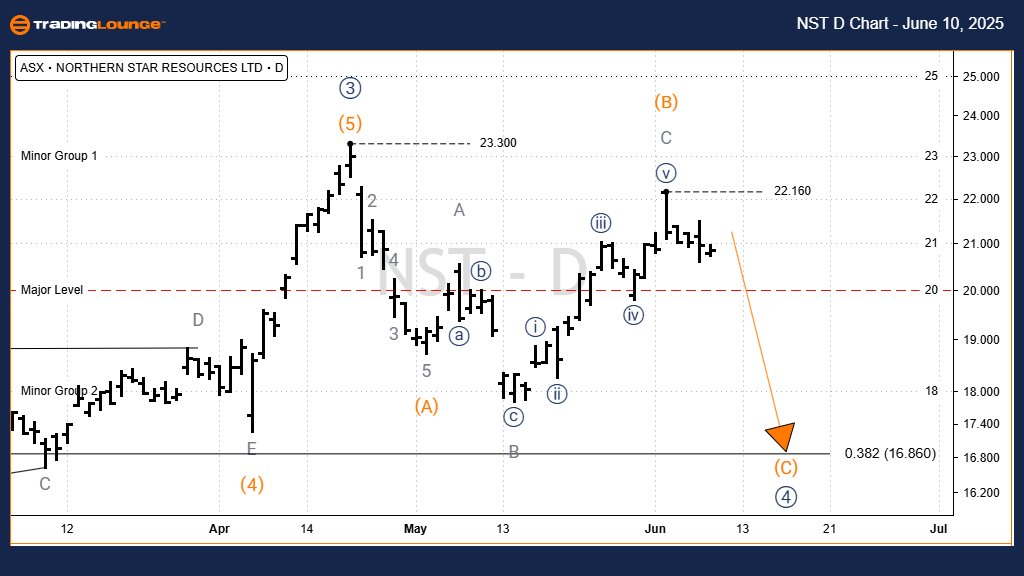

Technical Analysis: 1D Chart (Semilog Scale)

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Current Position: Wave C (Orange) of Wave 4 (Navy)

Details

Wave 4 (Navy) continues forming an ABC Zigzag correction pattern. Waves A and B (Orange) have already completed. Now, Wave C (Orange) is in progress and expected to reach 16.86. Since peaking at 22.16, the stock has displayed a firm bearish setup. This wave structure is invalidated if price action crosses 23.30.

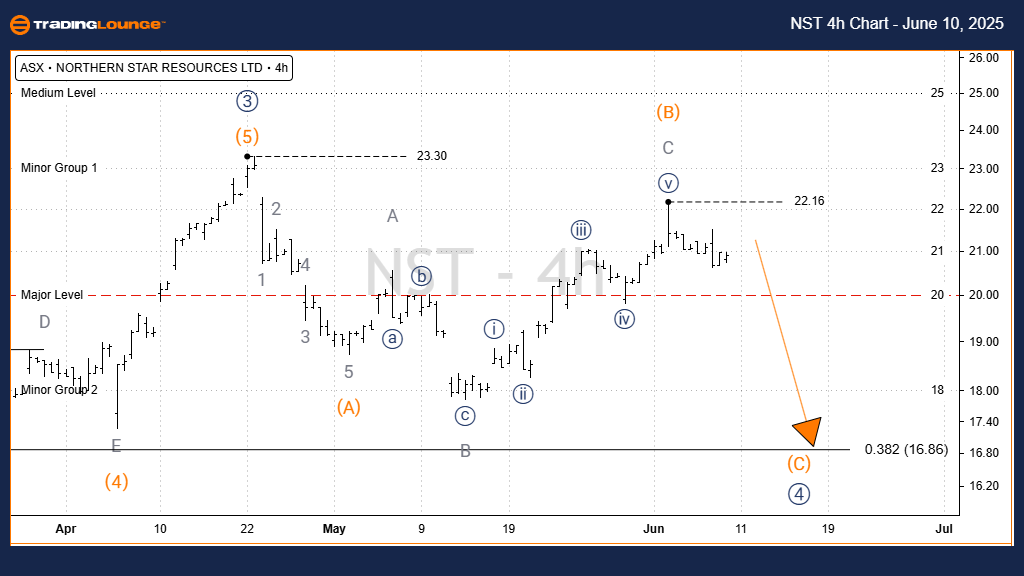

ASX: NST Elliott Wave Technical Analysis | TradingLounge (4-Hour Chart)

NORTHERN STAR RESOURCES LTD 4-Hour Chart Analysis

Technical Analysis: 4-Hour Chart

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Current Position: Wave C (Orange) of Wave 4 (Navy)

Details

Consistent with the 1D chart, the 4-hour timeframe confirms a downward move in Wave C (Orange), which began at the 22.16 resistance level. The current Elliott Wave structure supports a further decline to the 16.86 target area. The bearish outlook remains valid unless prices surpass 22.16.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave-based analysis for ASX:NST provides traders with a focused view of the current market path. With defined support and resistance levels, it delivers a reliable technical roadmap for navigating short-term price movement. This structured forecast approach strengthens decision-making during volatile trading sessions.