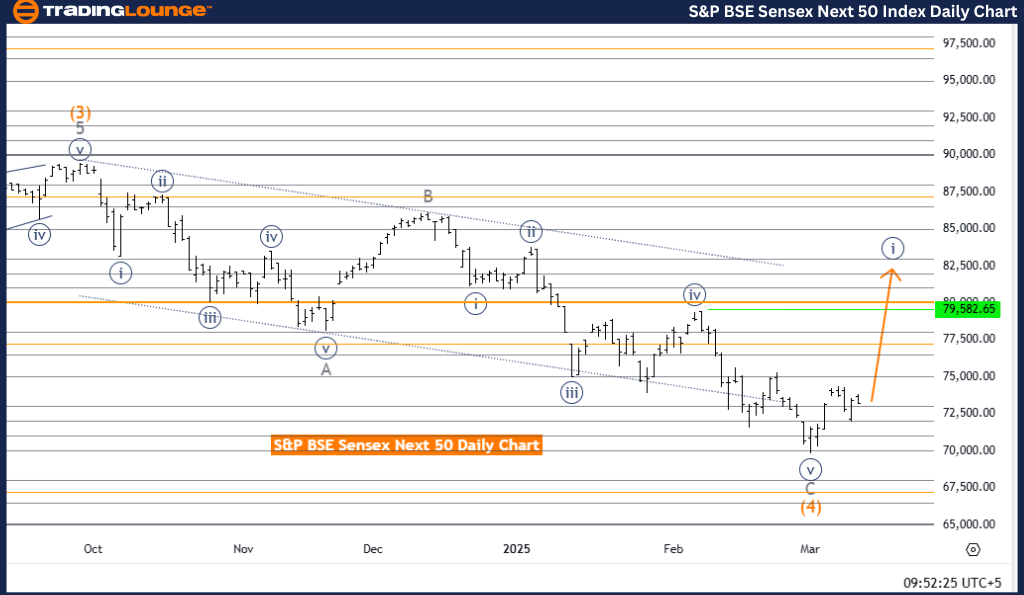

S&P BSE Sensex (India) Elliott Wave Analysis – Trading Lounge Day Chart

S&P BSE Sensex (India) Day Chart Analysis

S&P BSE Sensex (India) Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Next Higher Degree Direction: Navy Blue Wave 1 (Started)

S&P BSE Sensex Analysis Overview

The S&P BSE Sensex India Elliott Wave Analysis on the daily chart confirms a strong bullish trend, indicating upward momentum. The market is currently developing an impulsive wave, with Navy Blue Wave 1 forming within a larger wave structure. This wave is positioned within Gray Wave 1, reinforcing the emerging trend in the market.

This analysis suggests that a new bullish trend has begun, led by Navy Blue Wave 1. As this wave represents the initial phase of a larger uptrend, further market gains are likely. Additionally, the next higher-degree wave (Navy Blue Wave 1) has already started, strengthening the bullish outlook.

Key Trading Insights

✔ Wave 1 in an impulsive sequence often sets the foundation for further price increases.

✔ Market corrections during this phase can offer strategic entry points for traders.

✔ The current strong uptrend in S&P BSE Sensex suggests potential long-term growth.

The bullish Elliott Wave structure signals continued upside potential, with Wave 1 actively developing. Traders should closely monitor price movements and wave formations to identify optimal trading opportunities.

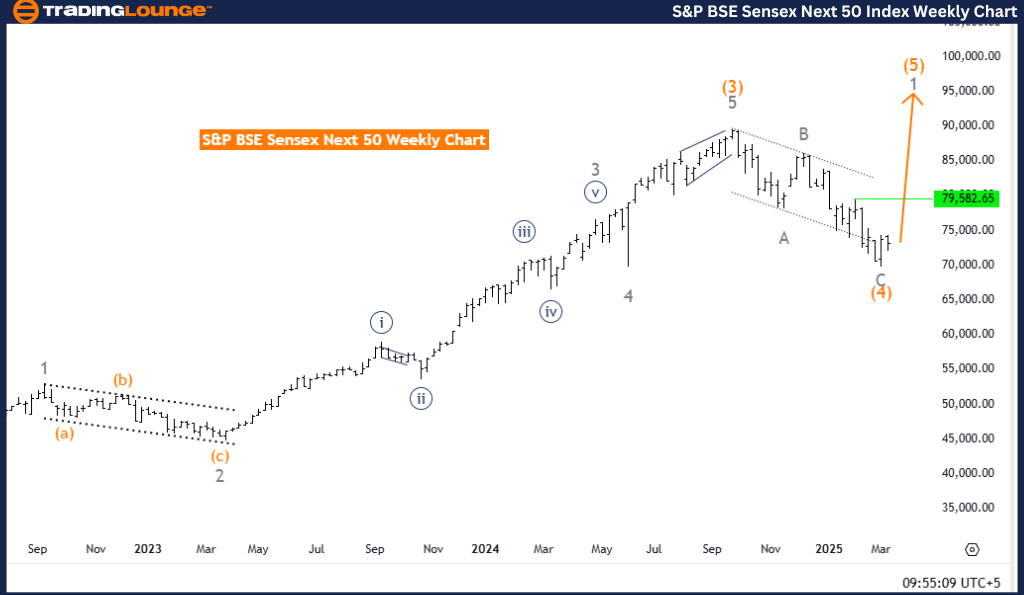

S&P BSE Sensex (India) Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P BSE Sensex (India) Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray Wave 1

Position: Orange Wave 5

Next Higher Degree Direction: Gray Wave 1 (Started)

S&P BSE Sensex (India) Analysis Overview

The S&P BSE Sensex India Elliott Wave Analysis on the weekly chart confirms a bullish market structure, reflecting strong upward momentum. The market remains in an impulsive phase, with Gray Wave 1 actively developing within Orange Wave 5.

The analysis indicates that the previous corrective phase (Orange Wave 4) has likely concluded, allowing the market to progress into Gray Wave 1 of Orange Wave 5. Since Wave 5 often marks the final phase of an impulsive sequence, further market gains are expected before a potential long-term correction.

Key Trading Insights

✔ Wave 1 within Wave 5 signals the early stages of a new bullish movement.

✔ This phase presents opportunities for strategic trade entries.

✔ Traders should closely watch key resistance levels to confirm trend continuation.

Currently, the S&P BSE Sensex is maintaining a strong uptrend, with Wave 1 of Wave 5 actively unfolding. The bullish Elliott Wave structure suggests further growth potential. Monitoring market behavior and wave progressions will be crucial for making well-informed trading decisions in this ongoing uptrend.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Shanghai Composite Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support