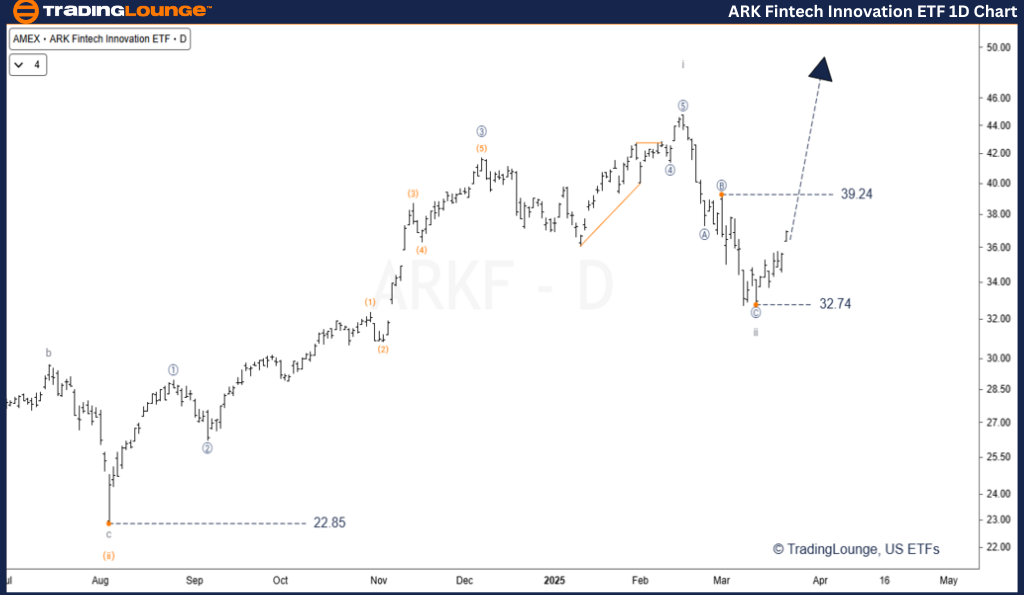

ARK Fintech Innovation ETF – ARKF (1D) Elliott Wave Technical Analysis Daily Chart

ARK Fintech Innovation ETF – ARKF Elliott Wave Technical Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse Wave

Position: Wave iii

Direction: Uptrend

Details:

The ongoing bullish trend in ARKF is part of the third wave (wave iii), recognized for its powerful upward momentum.

This stage in the Elliott Wave cycle is historically linked to high trading volumes and aggressive price gains.

New price highs are anticipated as this phase progresses.

A full retracement of wave ii is expected as confirmation.

Invalidation Level: $47.22

ARK Fintech Innovation ETF – ARKF (4H) Elliott Wave Technical Analysis 4-Hourly Chart

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave [1] of iii

Direction: Uptrend

Details:

Wave ii completed at $32.75 in a classic zigzag pattern, setting the stage for the next bullish leg.

A minor bullish breakout occurred when price exceeded subwave 4 of [C] within wave ii.

Short-term price consolidation is expected near $37.82, which could precede a new upward thrust.

The previous high of $44.73 is likely to be broken during this phase.

Key support to monitor is $35.00 for potential retracement or continuation patterns.

Invalidation Level: $32.75

Technical Analyst: Siinom

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: ARK Israel Innovative Technology ETF – IZRL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

The ARKF ETF is currently positioned in wave iii, typically the most dynamic and powerful segment of an Elliott Wave impulse.

Wave 3 phases often indicate strong upside potential, driven by high investor interest and trading volume.

This setup offers a positive outlook for bullish traders and ETF investors focusing on growth opportunities.

Strict adherence to Elliott Wave principles and close monitoring of invalidation levels like $47.22 and $32.75 are crucial for effective risk management.