Texas Instruments Inc., Elliott Wave Technical Analysis

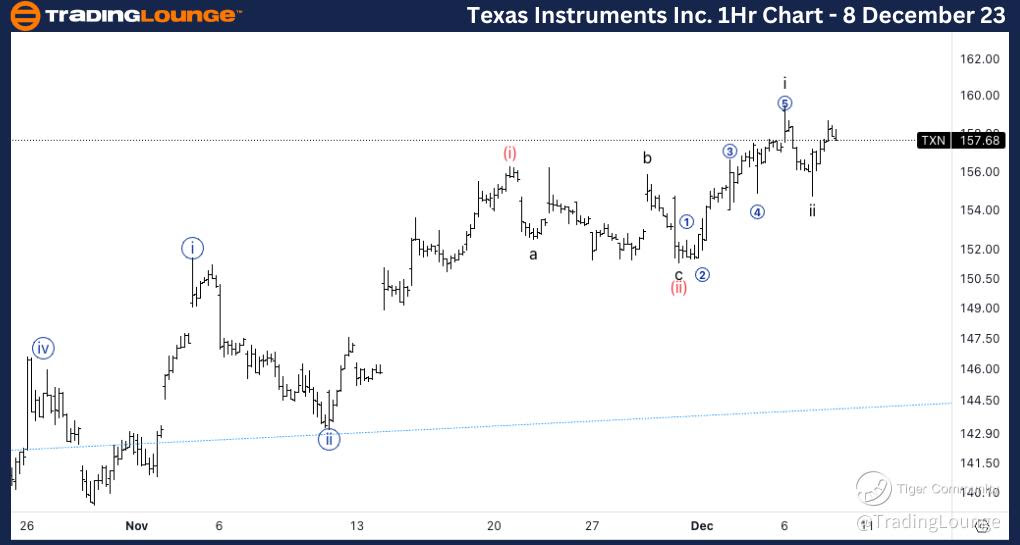

Texas Instruments Inc., (TXN:NASDAQ): 4h Chart 8 December 23

TXN Stock Market Analysis: We have been looking for upside into wave (iii) with the previous update and we have successfully continued higher. We are now seeing resistance at the end of Minor Group 2 as we could enter a potential wave ii.

TXN Elliott Wave Count: Wave ii of (iii).

TXN Technical Indicators: 200EMA as resistance

TXN Trading Strategy: Looking for longs after a break and retest of 158$.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

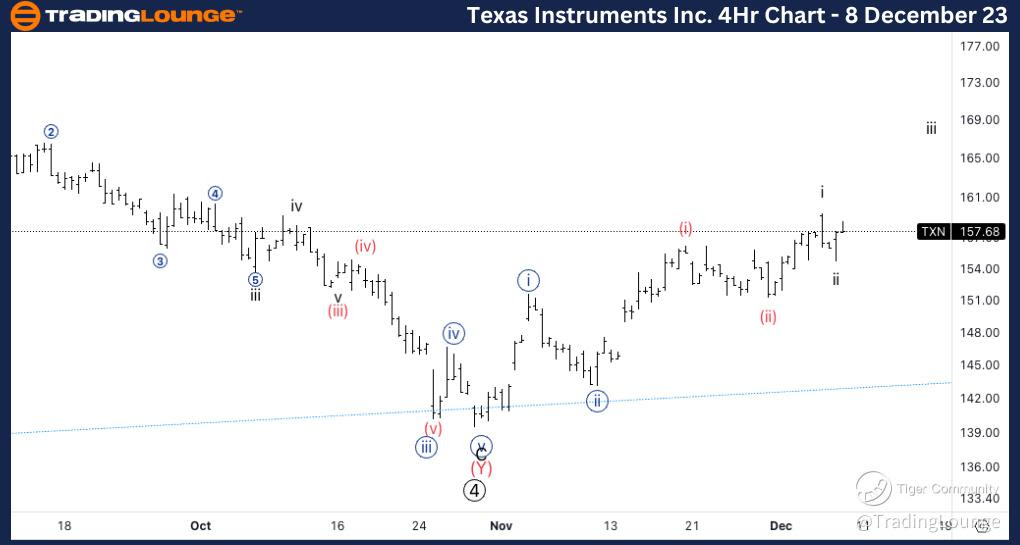

Texas Instruments Inc., TXN: 1-hour Chart 8 December 23

Texas Instruments Inc., Elliott Wave Technical Analysis

TXN Stock Market Analysis: We are looking for either a wave ii in place of wave a of ii completed. Looking for further upside into wave ii as long as 155 keeps holding as support and we break through the end of Minor Group 2.

TXN Elliott Wave count: Wave ii of (iii)

TXN Technical Indicators: Above all averages.

TXN Trading Strategy: Looking for longs after a break and retest of 158$.