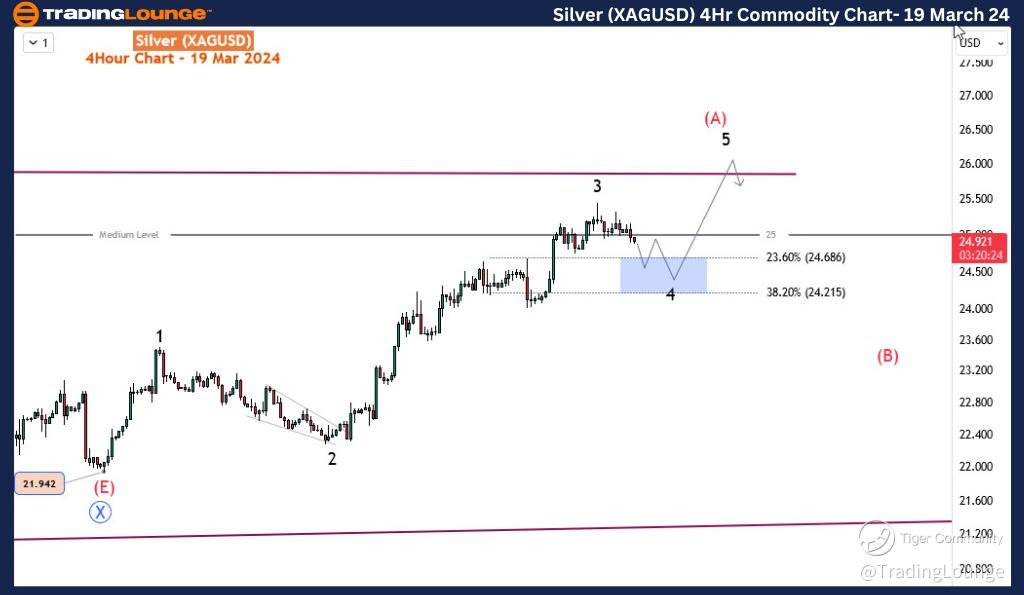

Silver Elliott Wave Analysis: 'Buy the Dip' Strategy to Sustain the Rally

Silver (XAGUSD) Daily Chart Analysis:

Silver Elliott Wave Technical Analysis

Function - Counter-trend

Mode - Impulse

Structure - Impulse

Position - Wave 3 of (A)

Direction - Wave 4 of (A)

Details - Wave 4 dip is ongoing. Expected to be shallow probably toward 24.5 before resuming higher for wave 5 of (A).

Over a brief period, Silver has witnessed a remarkable surge of over 13%, indicative of a bullish impulse wave rally. This surge signals a potential breakthrough from the one-year range initiated in February 2023. A pivotal point lies ahead as the commodity aims to surpass the $26.5 mark, representing its first significant ascent since March 2022. This marks a key trend reversal in the overarching multi-month trend.

Zooming into shorter time frames, Silver has encountered a dip following its peak in 2024. Despite this temporary setback, market anticipations remain bullish, targeting the psychological threshold of $26. In this Silver Elliott wave analysis, we'll delve into the underlying structures, pivotal levels, and anticipated outcomes.

Analyzing the daily timeframe, Silver's price action reveals a corrective rally initiated at 16.56 in September 2022. A discernible double zigzag pattern suggests further upside potential, extending towards the $30-30.18 range in the medium term. Wave W concluded with a zigzag, succeeded by X showcasing a triangle pattern. Emerging from wave (E) of X, wave Y is ascending higher, likely subdividing into three waves (A)-(B)-(C). Wave (A) is nearing completion around the $25 mark. For swing traders, a strategic approach would involve buying into the anticipated dip after wave (B). It's worth noting that wave (A) may witness one final upward leg before the dip materializes, as depicted on the 4-hour chart.

Silver Elliott Wave Analysis Trading Lounge 4-Hour Chart

Silver 4-Hour Chart Analysis:

Silver price and Elliott Wave forecast

On the 4-hour chart, wave 3 of (A) is transitioning to a wave 4 pullback, potentially finding support within the Fibonacci retracement zone of 24.686-24.215. Should this zone indeed offer support, followed by a rebound, another rally towards 25.5-26 is foreseeable before a larger pullback for (B) ensues?

In conclusion, Silver's Elliott wave analysis suggests a continuation of the bullish rally, with a shallow dip anticipated before resuming the upward trajectory. Employing a 'buy the dip' strategy could prove advantageous for traders eyeing potential opportunities in the Silver market.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybean

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.