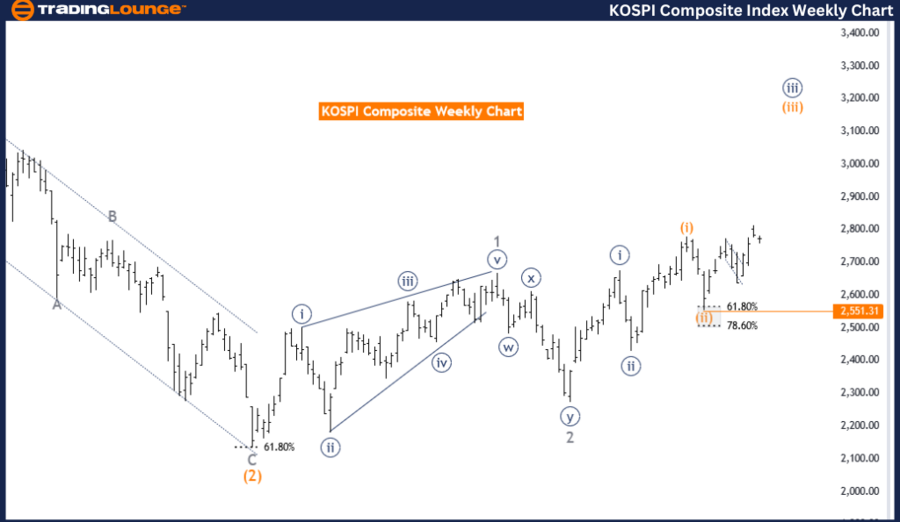

KOSPI Composite Elliott Wave Analysis TradingLounge - Daily Chart

KOSPI Composite Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 3

Direction Next Lower Degrees: Gray Wave 4

Details: Gray wave 2 appears completed. Now gray wave 3 of 3 is in play.

Wave Cancel Invalid Level: 2636.93

The KOSPI Composite Elliott Wave analysis on the daily chart provides an insightful view of the market's trend and potential future movements based on Elliott Wave theory. This analysis identifies the primary function as a trend, indicating directional market movement.

The trend is described as impulsive, meaning a strong and dominant market movement in the direction of the primary trend. This impulsive nature is evident in the wave structure, identified as gray wave 3. Gray wave 3 is part of a larger sequence, crucial for understanding overall market momentum.

Currently, the market is positioned in orange wave 3, within the larger gray wave 3 sequence. The third wave in Elliott Wave theory is often the most powerful and extended, suggesting significant market activity and price movement.

The next lower degrees direction focuses on the development of gray wave 4. This implies that once gray wave 3 is completed, the market will transition into a corrective phase characterized by gray wave 4. This wave typically interrupts the impulsive trend temporarily before the market resumes its primary direction.

Detailed observations indicate that gray wave 2 seems completed. The completion of gray wave 2 suggests the market has finished a corrective phase and has now transitioned into gray wave 3 of 3. This phase is significant because wave 3 of 3 often involves the strongest price movements within the impulsive sequence, indicating robust market momentum.

An essential aspect of this analysis is the wave cancel invalid level, set at 2636.93. This level is a key threshold for validating the current wave count. If the market price exceeds this level, it would invalidate the existing wave structure, necessitating a reassessment of the Elliott Wave count and potentially altering the market outlook.

Summary: The KOSPI Composite daily chart analysis indicates an impulsive trend within gray wave 3, currently positioned at orange wave 3. It suggests the completion of gray wave 2, with gray wave 3 of 3 now in play. The wave cancel invalid level at 2636.93 is critical for validating the current wave structure and guiding future market expectations.

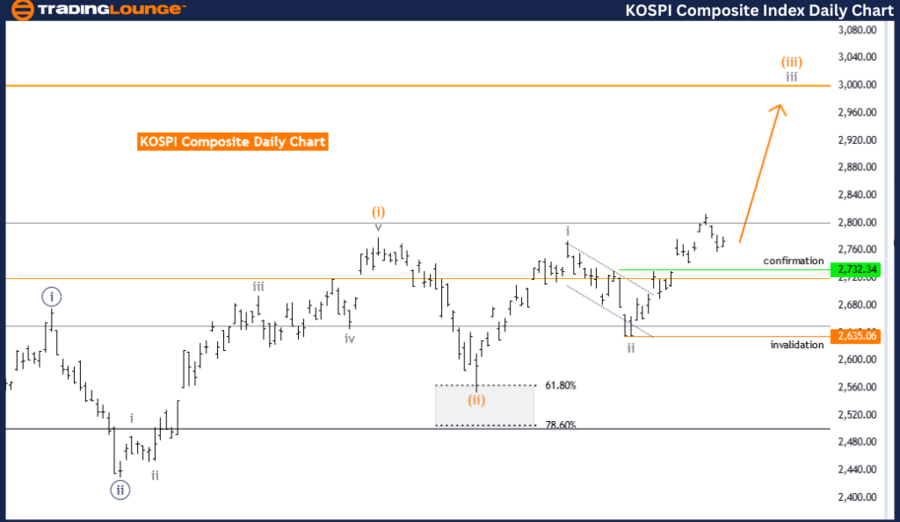

KOSPI Composite Elliott Wave Technical Analysis - Weekly Chart

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Direction Next Lower Degrees: Orange Wave 4

Details: Orange wave 2 appears completed. Now orange wave 3 of 3 is in play.

Wave Cancel Invalid Level: 2551.31

The KOSPI Composite Elliott Wave analysis on the weekly chart provides a comprehensive view of the long-term market trend using Elliott Wave theory. This analysis identifies the primary function as a trend, indicating directional market movement.

The trend is described as impulsive, meaning a strong, dominant movement aligned with the primary market momentum. The structure of the market movement is identified as orange wave 3, suggesting the market is currently in the third wave of this sequence. In Elliott Wave theory, the third wave is often the most powerful and extended, indicating significant market activity and price progression.

The current position within this structure is navy blue wave 3, implying that the market is advancing within a larger, overarching navy blue wave sequence. This signifies continued strong movement in the market.

The analysis indicates that the market is expected to transition into orange wave 4 after completing the current wave. Orange wave 4 represents a corrective phase typically following the completion of an impulsive wave. This phase is essential for consolidating gains before potentially resuming the primary trend.

Detailed observations highlight that orange wave 2 appears completed, suggesting the market has finished its corrective phase and is now transitioning into orange wave 3 of 3. This phase is crucial as wave 3 of 3 is generally associated with the strongest and most dynamic movements within the wave sequence, indicating robust market momentum.

A critical aspect of this analysis is the wave cancel invalid level, set at 2551.31. This level acts as a threshold for validating the current wave count. If the market price exceeds this level, it would invalidate the existing wave structure, necessitating a reassessment of the Elliott Wave count and potentially altering the market outlook.

Summary: The KOSPI Composite weekly chart analysis identifies an impulsive trend within orange wave 3, currently positioned at navy blue wave 3. The completion of orange wave 2 signals the beginning of orange wave 3 of 3. The wave cancel invalid level at 2551.31 is crucial for validating the current wave structure and guiding future market expectations.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: Dow Jones DJI Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support