ASX: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis (1D Chart)

Greetings, our latest Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) listed company, SOUTH32 LIMITED (S32). The current outlook shows a prolonged downtrend, differing from our previous forecasts, but consistent with recent market movements. Our prior analysis helped traders exit unfavorable long positions, and we now anticipate S32 to continue its downward trajectory.

ASX: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis

ASX: SOUTH32 LIMITED – S32 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minor degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy of Wave A - grey

Details: Wave ((iii)) - navy is developing and expected to push further downward before completing. After this, Wave ((iv)) - navy is projected to move slightly higher, followed by Wave ((v)) - navy, which will continue the downward movement.

Invalidation Point: 3.58

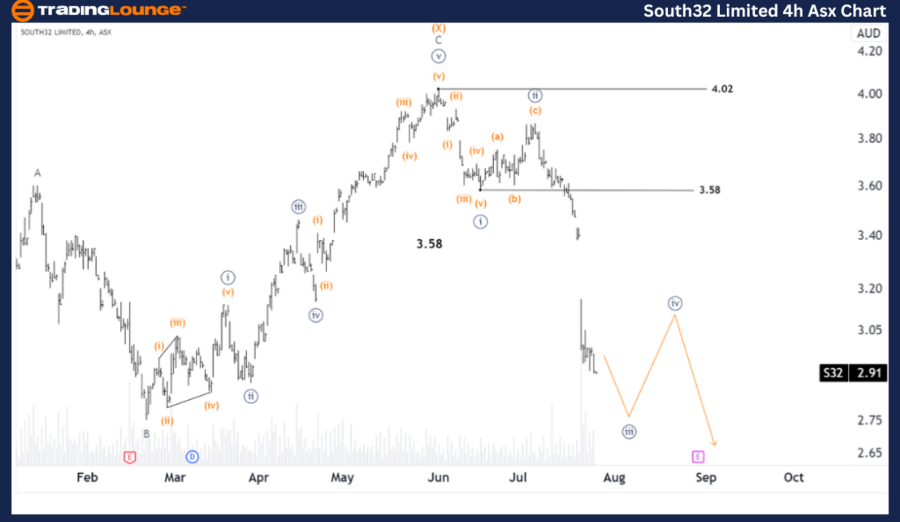

ASX: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis (4-Hour Chart)

ASX: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis

ASX: SOUTH32 LIMITED – S32 4-Hour Chart Analysis

Function: Major Trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy

Details: The current decline in Wave ((iii)) - navy suggests limited potential for further downward movement, indicating an imminent end. Subsequently, Wave ((iv)) - navy is expected to trend slightly higher before Wave ((v)) - navy resumes the downward trajectory.

Invalidation Point: 3.87

Conclusion:

Our analysis provides a detailed forecast of the contextual trends and short-term outlook for ASX: SOUTH32 LIMITED (S32), offering valuable insights for traders navigating the current market conditions. By identifying specific price points that validate or invalidate our wave counts, we aim to enhance confidence in our projections. This analysis offers a professional and objective perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: SCENTRE GROUP (SCG) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support