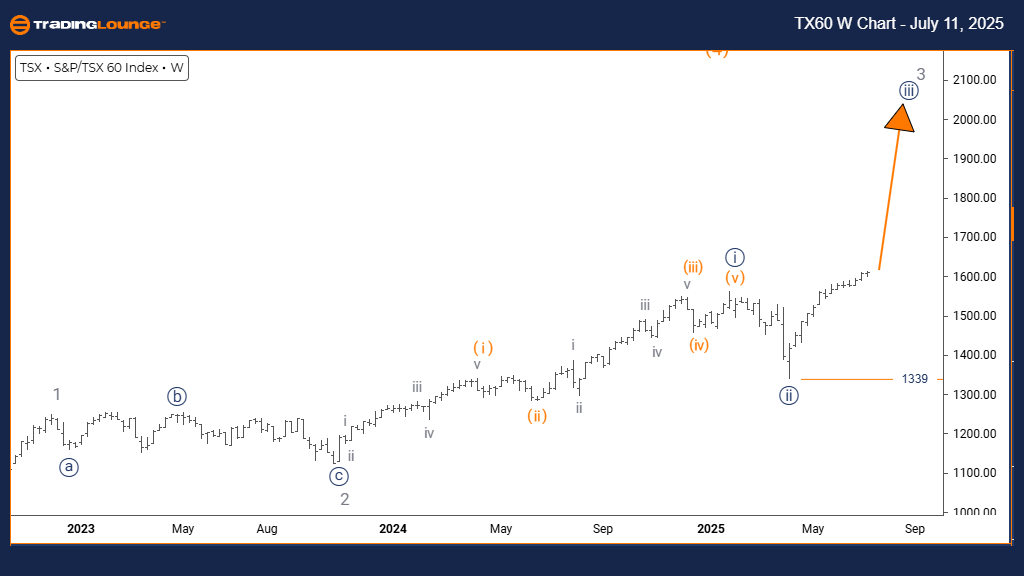

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Day Chart

S&P/TSX 60 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange wave 1

POSITION: Navy blue wave 3

DIRECTION NEXT LOWER DEGREES: Orange wave 2

DETAILS: Navy blue wave 2 seems completed; orange wave 1 is now forming within wave 3.

Invalidation Level: 1339

The latest Elliott Wave analysis for the S&P/TSX 60 on the daily chart outlines a bullish market trend reinforced by impulsive wave structure. Currently, orange wave 1 is evolving within navy blue wave 3, indicating a developing upward cycle. The anticipated next move at a lower degree is orange wave 2, expected to be a corrective retracement following the completion of wave 1.

Market analysis confirms the end of navy blue wave 2, with orange wave 1 pushing higher. This progression strengthens the bullish sentiment and sets the stage for continued upward momentum. A price drop below 1339 would negate the current wave count and signal the need for reassessment.

This impulsive pattern signals strong buying interest, with 1339 acting as a key support level. As long as the market holds above this threshold, the bullish Elliott Wave setup remains valid. Traders should focus on identifying the conclusion of orange wave 1 and prepare for orange wave 2’s correction before the likely continuation into wave 3.

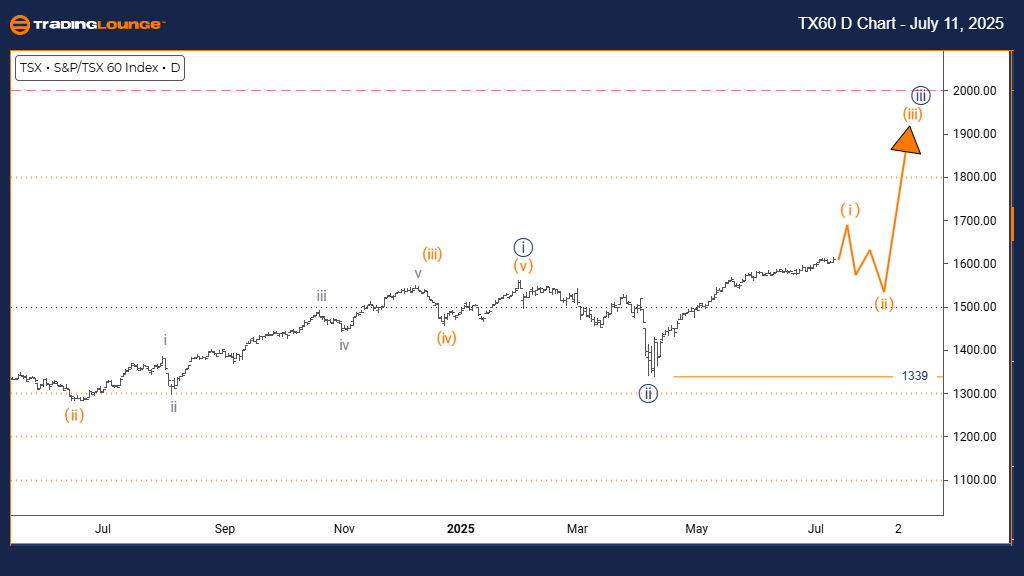

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy blue wave 3

POSITION: Gray wave 3

DIRECTION NEXT LOWER DEGREES: Navy blue wave 4

DETAILS: Navy blue wave 2 has ended; wave 3 of gray wave 3 is in progress.

Invalidation Level: 1339

The weekly Elliott Wave chart of the S&P/TSX 60 index reveals a persistent bullish trend. The structure highlights navy blue wave 3 progressing within a larger gray wave 3, showing impulsive upside movement. The next lower-degree expectation is navy blue wave 4, typically a short corrective stage before the trend resumes.

The analysis suggests navy blue wave 2 has likely concluded, and wave 3 is currently unfolding—indicating increasing upward momentum. If the index falls below 1339, this would invalidate the existing wave count and warrant a technical review.

The impulsive wave behavior continues to reflect robust buying power. Traders should watch for navy blue wave 3’s final stages and the early signs of wave 4. The invalidation mark at 1339 serves as a key benchmark supporting the ongoing bullish outlook.

This technical setup offers insights into potential price developments, helping traders align strategies with the prevailing Elliott Wave structure. Provided the price holds above the invalidation level, the S&P/TSX 60 index is poised for further upside movement.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: CAC 40 (France) index Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support