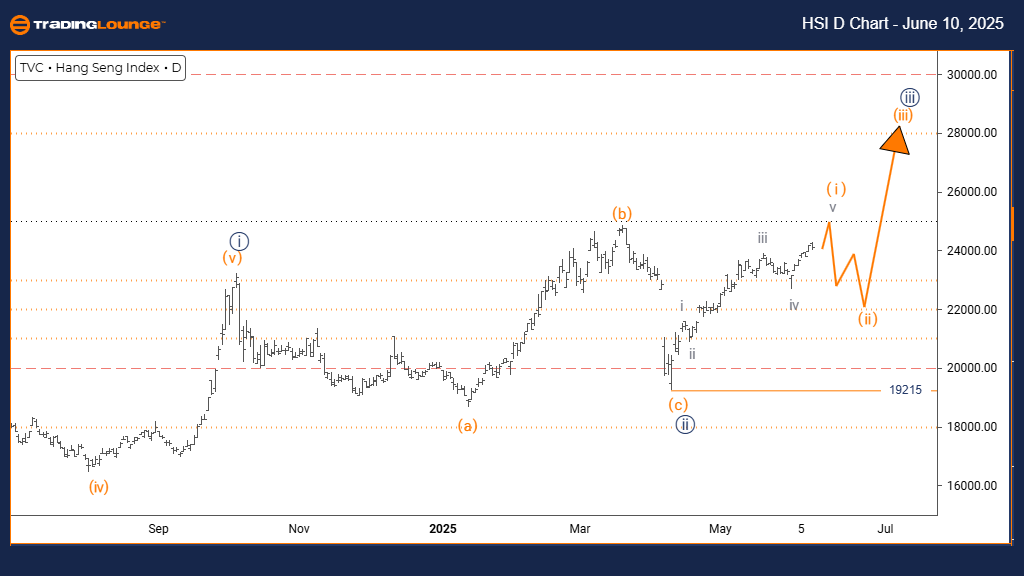

Hang Seng Index – Elliott Wave Analysis Day Chart

Hang Seng Index Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 3

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Navy Blue Wave 2 appears complete; Orange Wave 1 of 3 is now in progress.

Wave Cancellation Invalidation Level: 19215

The daily Elliott Wave analysis for the Hang Seng Index indicates a bullish market trend with impulsive characteristics. The current wave structure suggests that Orange Wave 1 is underway as part of the broader Navy Blue Wave 3, signaling the beginning of a potential major upward cycle.

Navy Blue Wave 2 has likely ended its corrective phase, setting the stage for Orange Wave 1 of Navy Blue Wave 3. This development marks the start of a new upward impulse within a strong bullish trend. The next anticipated movement in the wave sequence is Orange Wave 2—a corrective pullback typically following an impulsive advance.

Traders should watch the 19215 level carefully. A move below this threshold would invalidate the current bullish wave structure and prompt a reevaluation of the market position. Until then, the trend remains firmly upward.

This setup places the Hang Seng Index in a favorable position for further gains. With Orange Wave 1 actively developing after the completion of Navy Blue Wave 2, the current phase suggests increased buying strength and further upside potential in the near term.

Hang Seng Index – Elliott Wave Analysis Weekly Chart

Hang Seng Index Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave

DETAILS: Navy Blue Wave 2 appears complete; Navy Blue Wave 3 is now developing.

Wave Cancellation Invalidation Level: 19215

The weekly Elliott Wave overview for the Hang Seng Index confirms a sustained bullish outlook, supported by impulsive price action. The index is currently forming Navy Blue Wave 3, part of the larger Gray Wave 1 structure. This stage is typically associated with strong bullish momentum and significant upward price moves.

The transition from Navy Blue Wave 2 to Wave 3 marks the beginning of one of the most aggressive phases in the Elliott Wave cycle. Investors can expect further internal developments within Navy Blue Wave 3 as this powerful uptrend unfolds.

The invalidation level remains at 19215. A close below this point would challenge the bullish wave setup and necessitate a revised analysis. As long as prices stay above this level, the current outlook supports continued strength.

In summary, the Hang Seng Index remains in a bullish phase with Navy Blue Wave 3 progressing. This configuration suggests ongoing market momentum, offering potential growth opportunities within the wider Gray Wave 1 pattern.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Bovespa Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support