NFLX Elliott Wave Analysis – Technical Outlook and Forecast

In this Elliott Wave analysis, we will examine the trend structure of Netflix Inc. (NFLX) using both the daily and 1-hour charts, aiming to evaluate the current wave position and anticipate potential price movements.

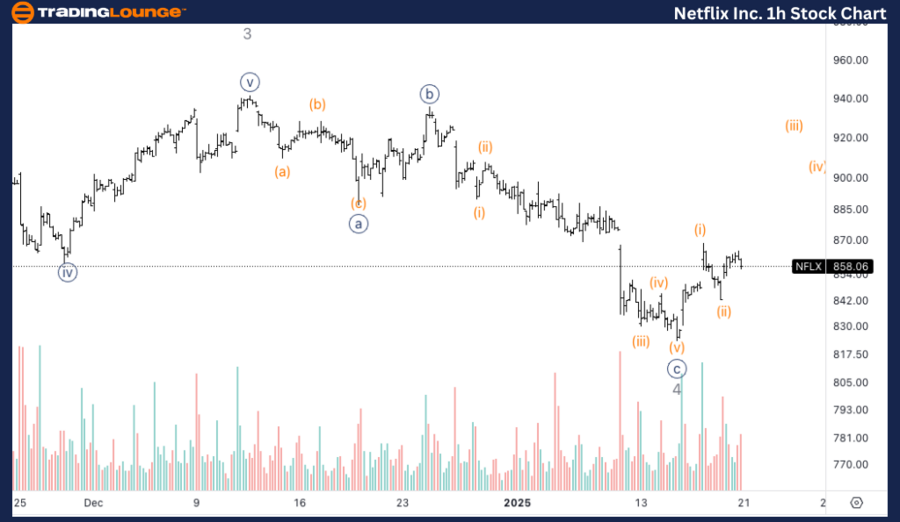

Netflix Inc. (NFLX) Elliott Wave Analysis – Trading Lounge Daily Chart

NFLX Technical Analysis Summary:

Function: Counter Trend

Mode: Corrective

Structure: Flat

Current Position: Wave 4 of (5)

Expected Direction: Upside in wave 5

Analysis Details:

A potential bottom in wave {c} of 4 may have formed, indicating the corrective phase could be nearing completion. If confirmed, the price is expected to advance higher toward Trading Level 1 at $1000, marking the beginning of wave 5.

NFLX Elliott Wave Technical Analysis – Daily Chart

We are closely observing a potential bottom formation in wave {c} of 4, suggesting that the ongoing corrective phase might be concluding. If this bottom is confirmed, the next anticipated move is an upward trajectory targeting Trading Level 1 at $1000, aligning with the continuation of the impulsive wave 5 cycle.

Key Takeaways:

- Potential bottom in wave {c} of 4

- Upside projection toward $1000 target

- Expected continuation in wave 5 if bottom holds

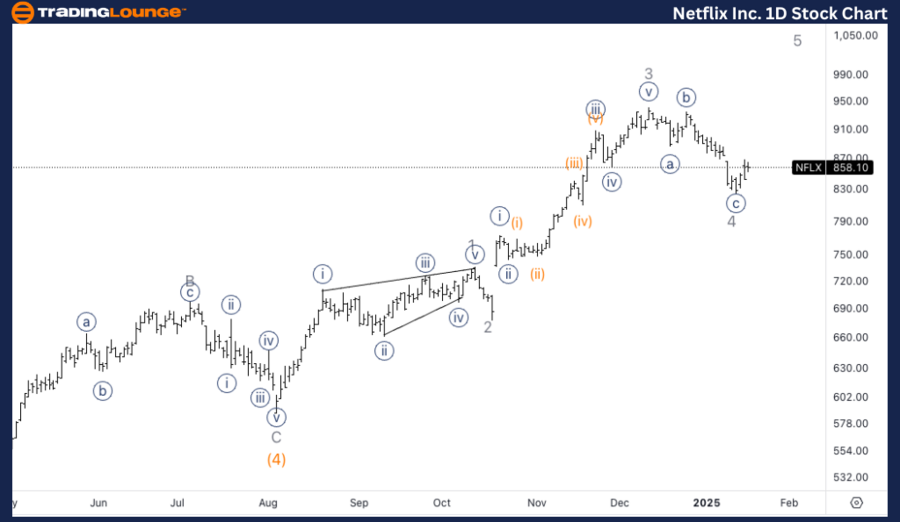

NFLX Elliott Wave Technical Analysis – Trading Lounge 1-Hour Chart

NFLX Technical Analysis Summary:

Function: Counter Trend

Mode: Corrective

Structure: Flat

Current Position: Wave (ii) of {i}

Expected Direction: Upside in wave (iii)

Analysis Details:

Monitoring for a bottom in wave {c} of 4, with growing volume around the lows signaling that the bottom could already be in place. The next move is expected as wave (ii) of {i}, which may be either completed or approaching completion, setting the stage for an upward push into wave (iii).

NFLX Elliott Wave Technical Analysis – 1H Chart Insights

We are looking for signs confirming the bottom in wave {c} of 4, supported by increasing volume near the lows, which may indicate that the corrective phase is over. Once wave (ii) of {i} completes, a strong upward movement into wave (iii) is anticipated as the next phase of the uptrend develops.

Key Takeaways:

- Bottom formation in wave {c} of 4

- Increased volume suggests reversal confirmation

- Anticipation of strong upside movement in wave (iii)

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Amazon Inc. (AMZN) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support