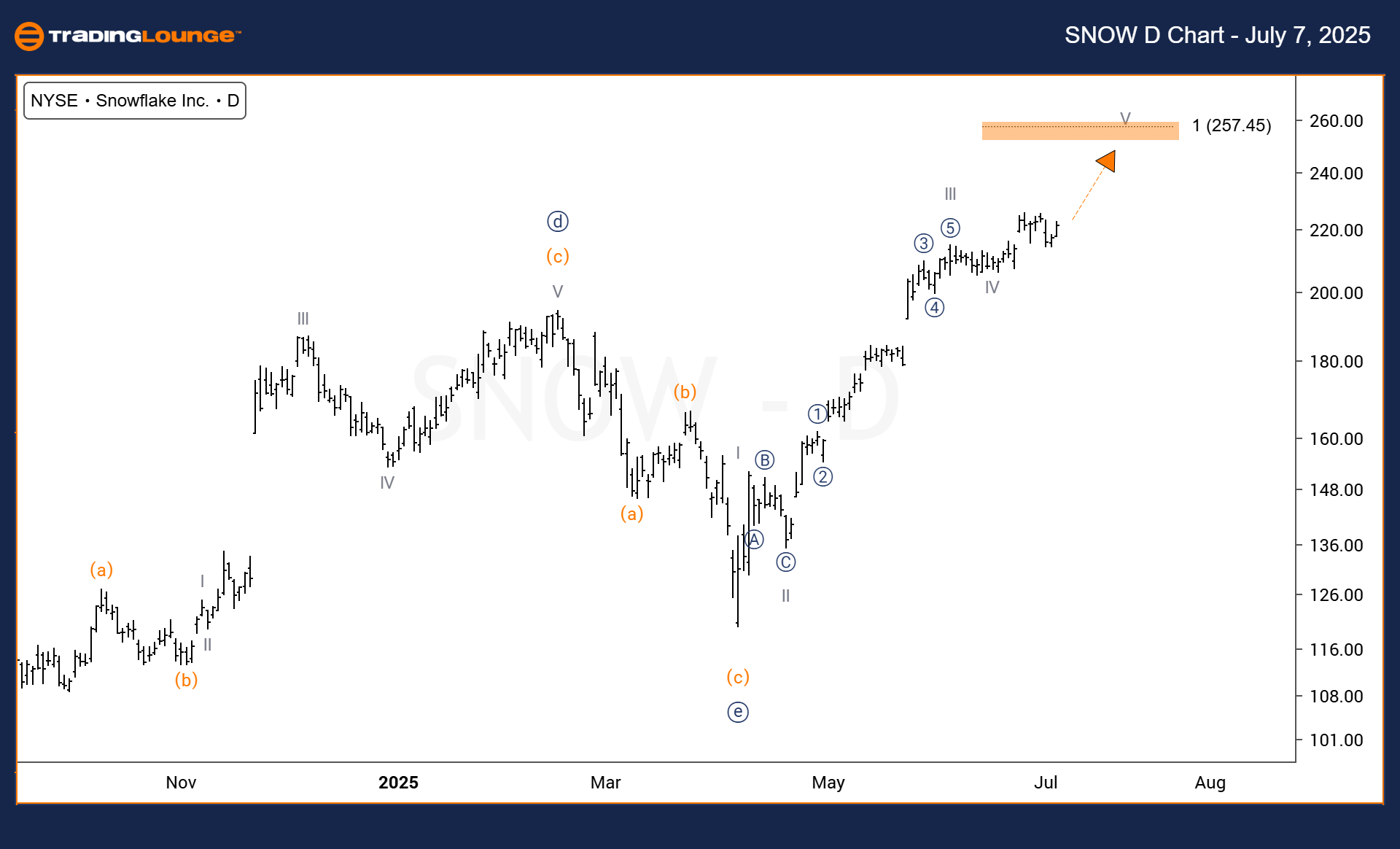

Snowflake Inc. (SNOW) – Elliott Wave Analysis | Trading Lounge Daily Chart

Snowflake Inc. (SNOW) Daily Chart Analysis and Overview

Snowflake Inc. (SNOW) Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Impulsive

Position: Wave V

Direction: Uptrend toward Wave V

Details: A bullish impulsive wave is in progress, with Wave V expected to mirror the length of Wave I, signaling strong upward potential.

Daily Chart Summary:

Snowflake Inc. (NASDAQ: SNOW) is showing a continued bullish trend on the daily chart, suggesting further upside movement. The Elliott Wave count identifies the stock in Wave V, which is developing after Wave III extended earlier in the cycle. Based on this pattern, Wave V is likely to match the length of Wave I, indicating a potential bullish breakout. The price is approaching key resistance levels, and a confirmed breakout could solidify the trend continuation. This offers a promising setup for short-term traders seeking bullish exposure.

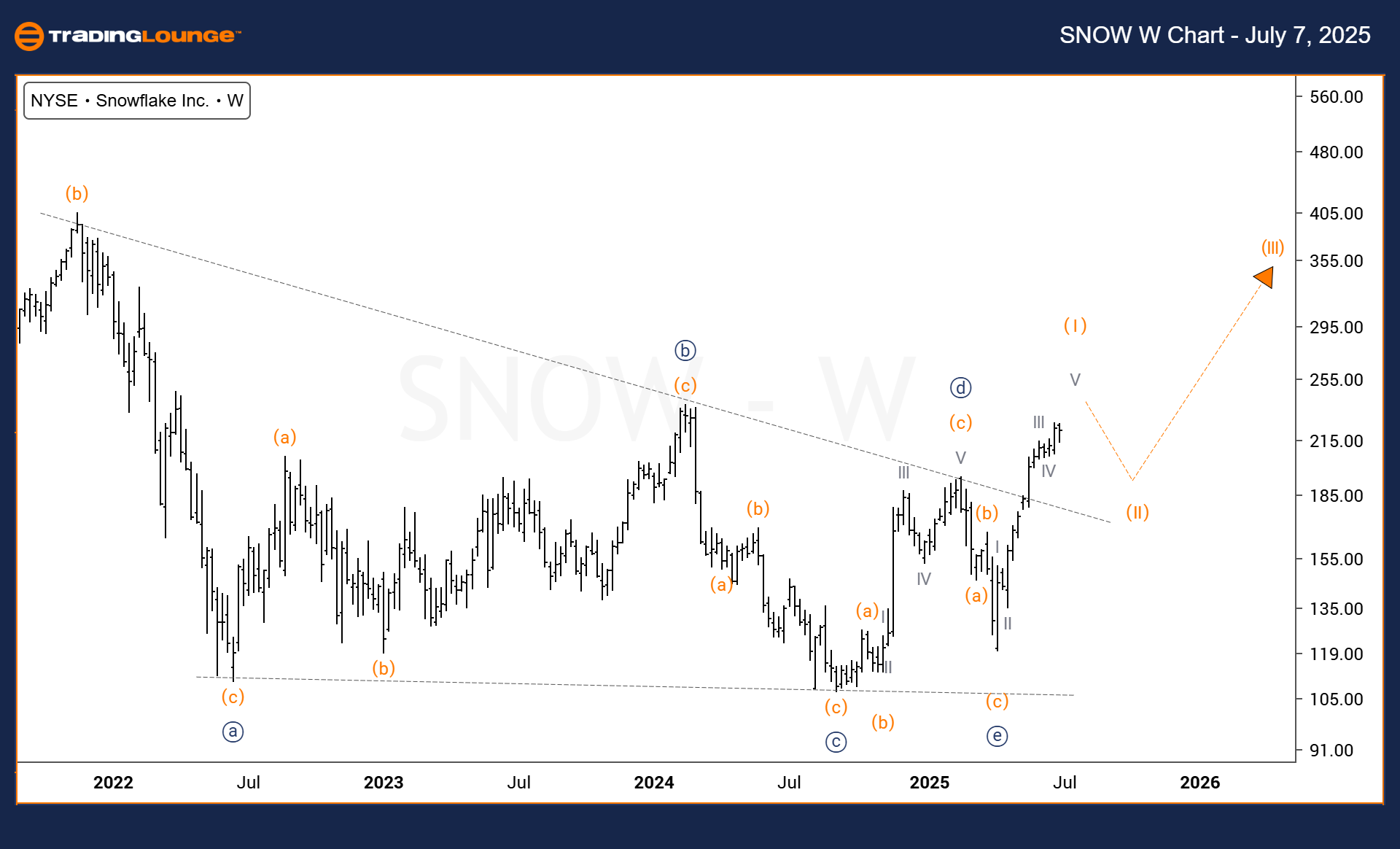

Snowflake Inc. (SNOW) – Elliott Wave Analysis | Weekly Chart

Technical Analysis Overview – Trading Lounge

Function: Trend

Mode: Impulsive

Structure: Impulsive

Position: Wave (III)

Direction: Uptrend toward Wave (III)

Details: Following a breakout from a triangle consolidation, Wave (I) has completed. Wave (III) is projected to begin once Wave (II) completes its corrective move.

Weekly Chart Summary:

On the weekly timeframe, Snowflake (SNOW) is advancing within a robust Elliott Wave impulsive sequence. The initial rally completed Wave (I) after breaking out from a consolidation triangle. The current pullback appears to be Wave (II), and once this corrective phase ends, Wave (III) is expected to trigger a strong upward movement. Wave (III) often represents the most dynamic part of an impulsive sequence, offering traders a high-probability entry point. Watch for minor consolidations and resistance zones as potential confirmation before the trend resumes higher.

Technical Analyst: Dhiren Pahuja

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: Visa Inc. (V) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support