COCHLEAR LIMITED - COH Elliott Wave Technical Analysis TradingLounge

Greetings,

Welcome to our latest Elliott Wave analysis for the Australian Stock Exchange (ASX) stock COCHLEAR LIMITED (ASX: COH).

A corrective ABC Elliott Wave pattern has recently completed, opening fresh bullish opportunities for COH stock.

This technical report outlines key target prices, forecasted market trends, and critical invalidation levels needed to sustain the upward momentum, presented in a precise and professional format.

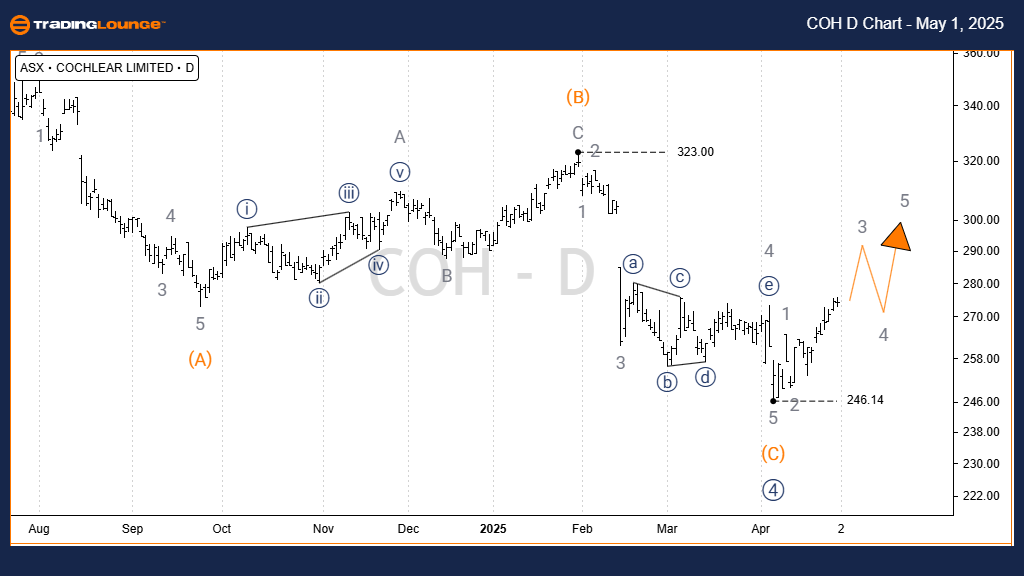

COCHLEAR LIMITED - COH Elliott Wave Analysis (1d Chart Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 5)) - Navy

Analysis Details:

Wave 4)) - Navy appears to have finished an A-B-C corrective structure at the Intermediate Degree (Orange).

Following this, conditions favor the development of Wave 5)) to the upside, reinforcing a strong bullish Elliott Wave outlook for COCHLEAR LIMITED.

Price targets suggest a possible rally back toward previous highs near $350.00.

Invalidation Point: 246.14 (A drop below this level would invalidate the current bullish wave count.)

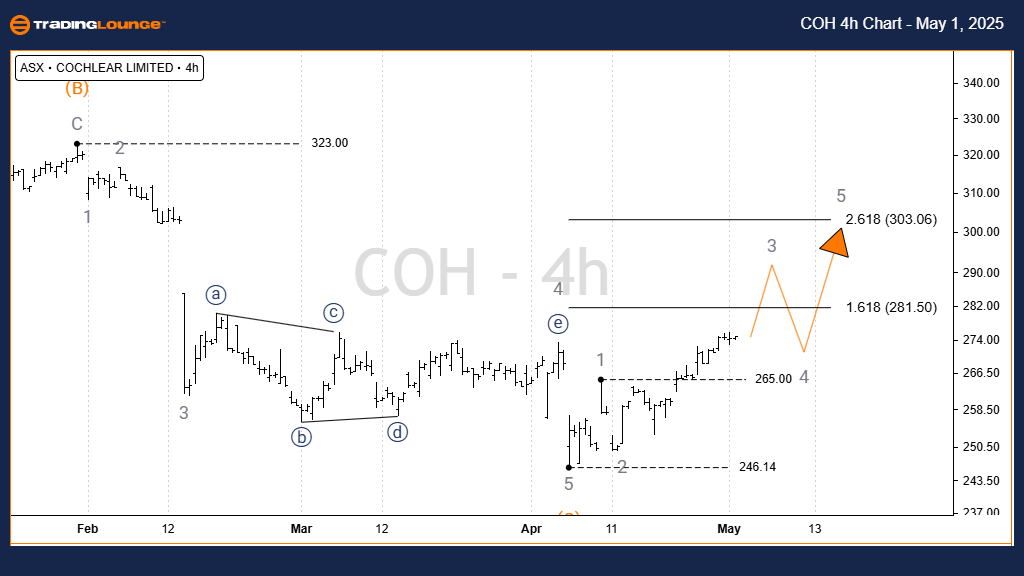

COCHLEAR LIMITED - COH Elliott Wave Analysis (4-Hour Chart Analysis)

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave 3 - Grey of Wave 5)) - Navy

Analysis Details:

Starting from the key support at 246.14, a five-wave impulse structure labeled 1 - Grey to 5 - Grey is actively developing.

Currently, Wave 3 - Grey is unfolding upward, aiming for a target range between 281.50 and 303.06.

After Wave 3 - Grey completes, a correction in Wave 4 - Grey is expected, but it must hold above 265.00 to maintain the bullish structure, ensuring continuation into Wave 5 - Grey.

Invalidation Point: 265.00 (Wave 4 must not overlap Wave 1 to preserve the impulse count.)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

- This Elliott Wave forecast for COCHLEAR LIMITED (ASX: COH) offers traders and investors a structured, technical roadmap for potential market direction.

- Validation and invalidation levels are clearly outlined to strengthen confidence in the analysis.

- By combining professional Elliott Wave techniques with clear forecasting, TradingLounge aims to support effective trading and investment decisions.