ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis – TradingLounge (Daily Chart)

Welcome!

Today’s Elliott Wave analysis focuses on CAR GROUP LIMITED (ASX: CAR). Based on our technical outlook, the stock appears to have completed a wave (4) – orange Zigzag correction, suggesting the potential beginning of a bullish wave (5) movement. Below, we provide key price levels and trend projections.

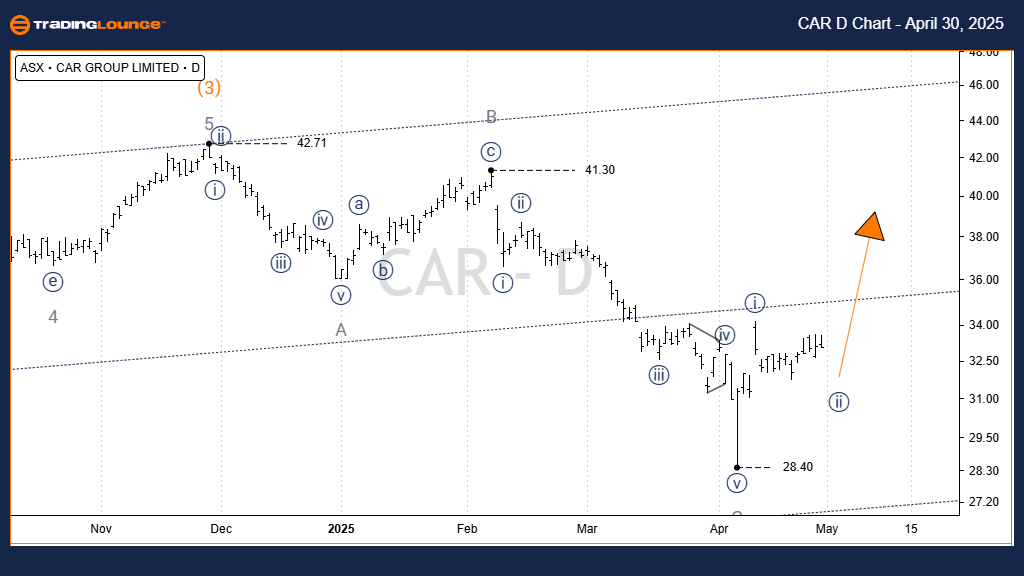

ASX: CAR GROUP LIMITED Elliott Wave Analysis – TradingLounge (Daily Chart)

ASX: CAR GROUP LIMITED 1d Chart – Technical Overview (Semilog Scale)

Trend Type: Intermediate (Orange Degree)

Wave Mode: Motive

Structure Type: Impulse

Current Position: Wave ii)) navy of Wave (5) orange

Details:

Wave (4) – orange likely concluded after declining from the 42.71 high to a low of 28.40 in a classic A-B-C Zigzag formation (grey). The C wave clearly subdivided into five smaller waves, indicating completion. This opens the door for wave (5) – orange to advance. The initial move, wave i)) – navy, is complete. Currently, wave ii)) – navy is unfolding and may dip slightly further before wave iii)) – navy resumes the upward trend.

Invalidation Point: 28.40 – A price drop below this level would invalidate the current bullish wave count.

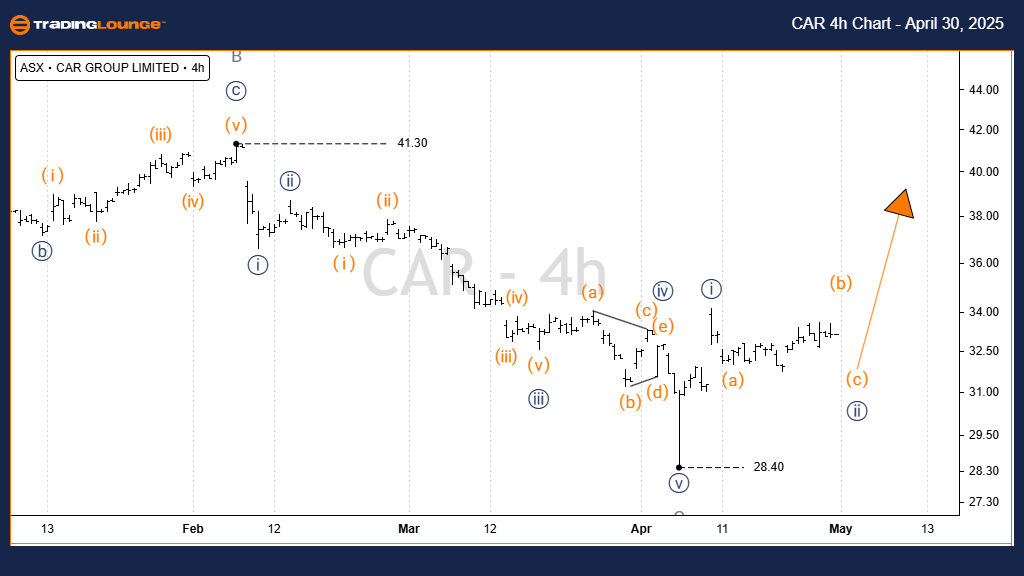

ASX: CAR GROUP LIMITED Elliott Wave Analysis – TradingLounge (4-Hour Chart)

Trend Type: Minor (Grey Degree)

Wave Mode: Motive

Structure Type: Impulse

Current Position: Wave ((ii)) navy of Wave (5) orange

Details:

Following the low at 28.40, the stock initiated wave i)) – navy, which has now completed. The market is currently correcting in wave ii)) – navy, which is still in progress. Once this retracement completes, wave iii)) – navy is expected to push higher, potentially revisiting the prior swing high near 41.30.

Invalidation Point: 28.40 – Price must stay above this support level to maintain the current bullish Elliott Wave forecast.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: IAG Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for CAR GROUP LIMITED (ASX: CAR) identifies key trend phases and invalidation levels to guide strategic trading. With a completed correction and a developing impulse structure, the setup provides a roadmap for potential upside—supported by precise price validation points for confidence in trading execution.