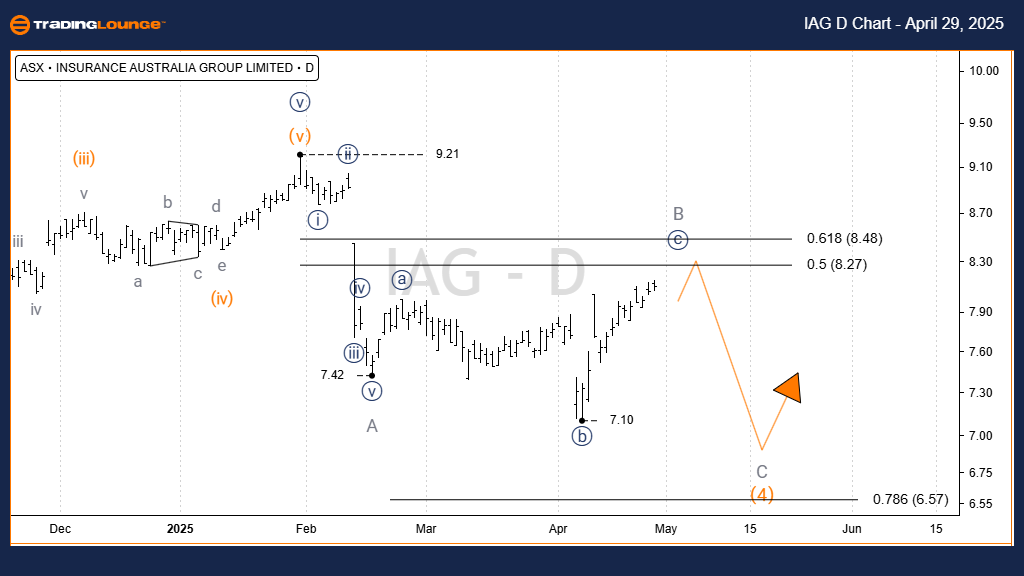

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis by TradingLounge (1D Chart)

Greetings,

This update provides the latest Elliott Wave analysis for Insurance Australia Group Limited (ASX:IAG). The stock is currently approaching the end of a corrective B-grey wave, indicating a potential decline ahead. As there is no confirmation of a bullish reversal, long positions remain high-risk at this point in the cycle.

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave c))-navy of Wave B-grey

Details: Wave 3)-orange has completed as a classic five-wave impulse. Wave 4)-orange is now retracing lower in a Zigzag pattern labeled A, B, C-grey.

- Wave A-grey is finalized.

- Wave B-grey is forming an Expanded Flat, with wave c))-navy expected to target the 8.27–8.48 range.

Invalidation Point: The completion of wave b))-navy.

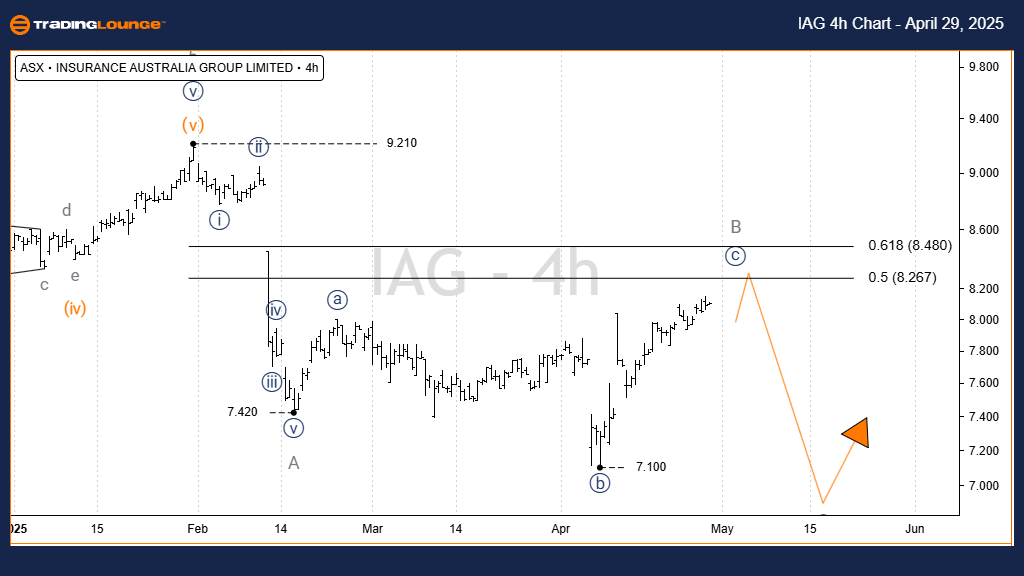

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave c))-navy of Wave B-grey

Details:

Zooming into the 4H chart, from the 7.420 low, wave B-grey has been evolving as an Expanded Flat—highlighting weak directional strength.

- Wave b))-navy is more complex than wave a))-navy.

- Wave c))-navy is now advancing with stronger momentum, typical of Flat patterns.

- Resistance is expected between 8.267–8.480 before wave B-grey ends and wave C-grey begins its downward path.

Invalidation Point: 7.100

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: BLOCK, INC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This ASX:IAG Elliott Wave forecast outlines the current corrective phase and potential downside risk for Insurance Australia Group Limited. Traders should remain cautious as price nears key resistance. Our technical analysis highlights pivotal levels that validate or invalidate the wave count, helping refine strategic entry and exit points.

TradingLounge remains committed to delivering expert Elliott Wave insights and accurate trend analysis for active traders on the ASX.