S&P/ASX 200 Elliott Wave Analysis Trading Lounge Day Chart

S&P/ASX 200 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 3

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3 (initiated)

DETAILS: Gray Wave 2 appears completed, with Gray Wave 3 now in progress.

Wave Cancel Invalid Level: 7,066.9

The S&P/ASX 200 Day Chart Elliott Wave Analysis highlights a bullish trend forming in an impulsive mode, actively unfolding within Gray Wave 3. Following the apparent conclusion of Gray Wave 2, the chart now shows the emergence of Gray Wave 3, a phase typically associated with strong upward momentum.

Key Insights:

Critical Levels:

Summary:

The S&P/ASX 200 Day Chart analysis confirms a strong bullish trend, progressing in an impulsive Gray Wave 3 phase. Positioned in Orange Wave 3, the market is primed for further gains with minimal corrections, consistent with a typical Wave 3 scenario. The 7,066.9 invalidation level serves as a pivotal marker, ensuring the current wave structure remains intact.

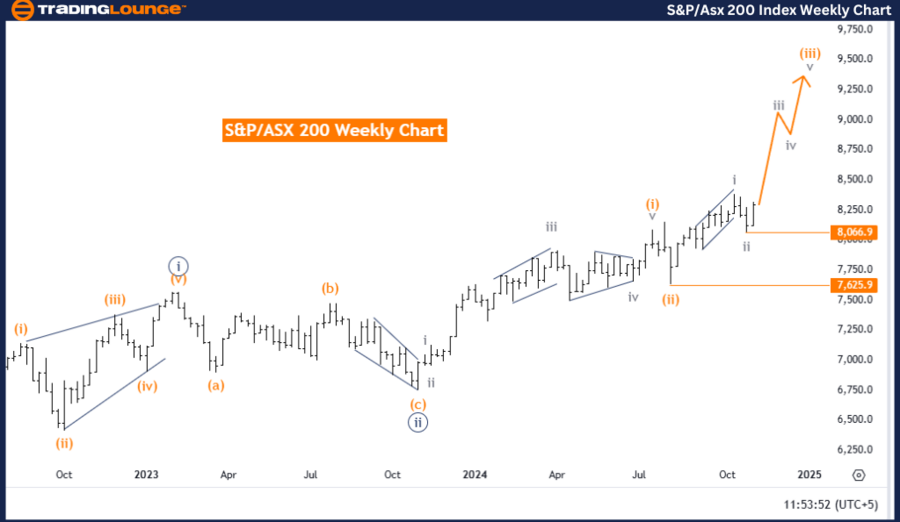

S&P/ASX 200 Elliott Wave Analysis Trading Lounge Weekly Chart

S&P/ASX 200 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 3

POSITION: Orange Wave 3

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3 (initiated)

DETAILS: Gray Wave 2 appears completed, with Gray Wave 3 now active.

Wave Cancel Invalid Level: 7,066.9

The S&P/ASX 200 Weekly Chart Elliott Wave Analysis indicates a bullish trend, driven by an impulsive pattern in Gray Wave 3. The completion of Gray Wave 2 has set the stage for the ongoing development of Gray Wave 3, reflecting strong directional momentum.

Key Insights:

Critical Levels:

Summary:

The S&P/ASX 200 Weekly Chart analysis supports a bullish trend within an impulsive Gray Wave 3 phase. Positioned in Orange Wave 3, the chart signals ongoing upward momentum with the potential for significant gains. The 7,066.9 invalidation level acts as a critical support level, ensuring the wave count's validity and reinforcing the bullish outlook.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: CAC 40 Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support