ASX: COMPUTERSHARE LIMITED (CPU) Elliott Wave Technical Analysis

Chart: TradingLounge

Today’s Elliott Wave analysis for COMPUTERSHARE LIMITED (ASX: CPU) indicates a potential bullish breakout as wave iv) – orange concludes and wave v) – orange initiates an upward move. This technical outlook identifies key Elliott Wave target zones, invalidation levels, and trend continuation signals, offering strategic insight for ASX stock traders.

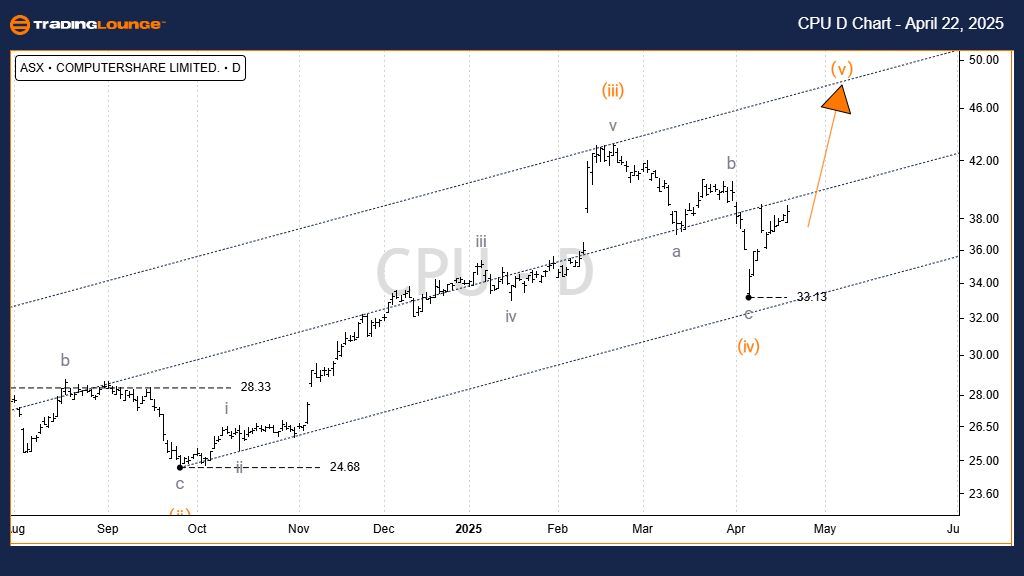

ASX: COMPUTERSHARE LIMITED (CPU) – Daily Chart Analysis (Semilog Scale)

Function: Major Trend (Minor degree – grey)

Mode: Motive

Structure: Impulse

Current Position: Wave v) – orange

Details:

Wave iv) – orange unfolded as a classic zigzag (a, b, c – grey), completing at the 33.13 low. The current price action suggests the beginning of wave v) – orange, pushing higher toward the upper boundary of the Elliott channel, reinforcing bullish potential.

Invalidation Level: 33.13

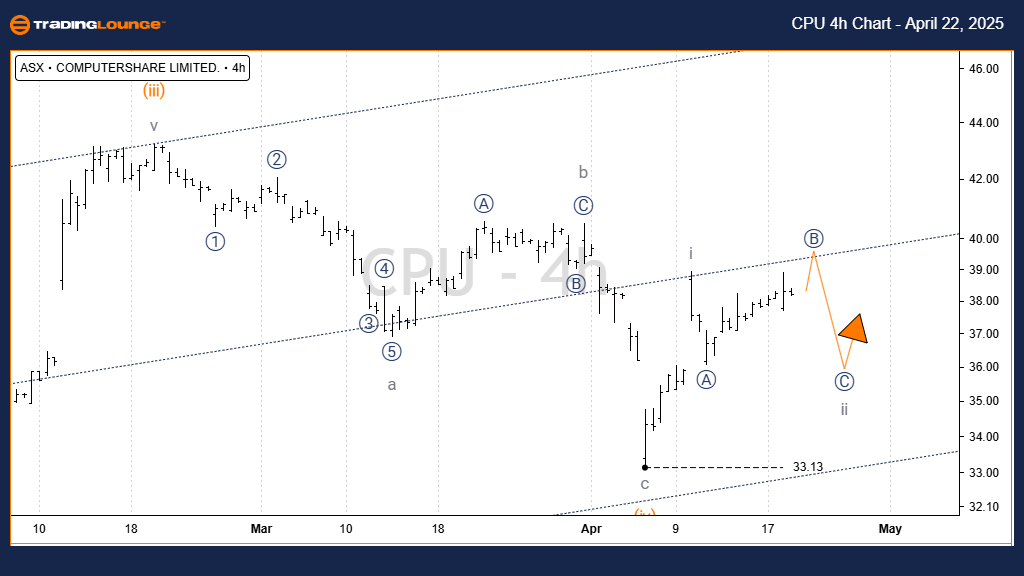

ASX: COMPUTERSHARE LIMITED (CPU) – 4-Hour Chart Analysis

Function: Major Trend (Subminuette degree – grey)

Mode: Motive

Structure: Impulse

Current Position: Wave b)) – navy of Wave ii – grey

Details:

Following the 33.13 low, wave v) – orange has initiated. The market appears to have completed wave i – grey, and is now forming wave ii – grey as a flat correction (a)), b)), c)) – navy). A brief retracement is expected before wave iii – grey of wave v) – orange resumes the upward trajectory.

Invalidation Level: 33.13

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave forecast for COMPUTERSHARE LIMITED (ASX: CPU) provides traders with a precise technical roadmap, identifying high-probability trend continuation levels and reversal zones. With a defined structure and clear invalidation points, this analysis enhances confidence in navigating short- and medium-term price movements within the ASX market.