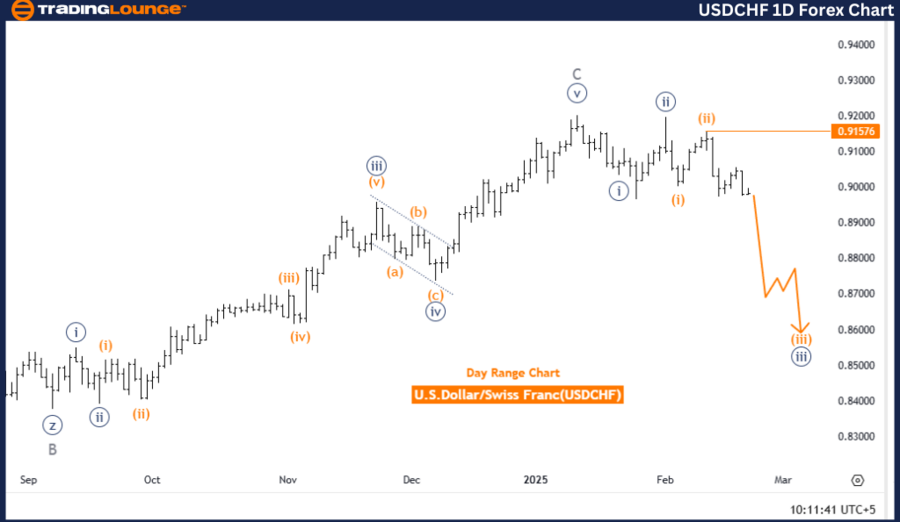

U.S. Dollar / Swiss Franc (USDCHF) Elliott Wave Analysis – Trading Lounge Daily Chart

USDCHF Elliott Wave Technical Analysis

Trend: Bearish

Wave Mode: Impulsive

Wave Structure: Orange Wave 3

Current Position: Navy Blue Wave 3

Next Lower-Degree Wave: Orange Wave 3 (Active)

Wave Invalidation Level: 0.91576

Analysis Details

The USDCHF daily chart continues to exhibit a bearish Elliott Wave structure, maintaining strong downward momentum. The market is currently moving within Orange Wave 3, reinforcing the bearish outlook.

The completion of Orange Wave 2 has paved the way for Orange Wave 3, confirming that the market remains in a downward phase. With the structure holding, further price declines are expected in the coming sessions.

The market is also positioned within Navy Blue Wave 3, further validating the broader bearish trend. Additionally, the next lower-degree wave (Orange Wave 3) has already started, intensifying the downward movement.

Summary

- The USDCHF daily outlook remains bearish, with Orange Wave 3 actively developing.

- The completion of Orange Wave 2 marks the beginning of a stronger downward trend.

- The key invalidation level remains at 0.91576—a break above this level could signal a potential shift in market direction.

- As long as the Elliott Wave structure holds, further downside movement is anticipated.

U.S. Dollar / Swiss Franc (USDCHF) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

USDCHF Elliott Wave Technical Analysis

Trend: Bearish

Wave Mode: Impulsive

Wave Structure: Gray Wave 3

Current Position: Orange Wave 3

Next Lower-Degree Wave: Gray Wave 3 (Active)

Wave Invalidation Level: 0.91576

Analysis Details

The 4-hour Elliott Wave analysis of USDCHF confirms a strong bearish trend, driven by an impulsive wave structure. The market is currently forming Gray Wave 3, which is part of the larger Orange Wave 3.

The previous Gray Wave 2 has completed, giving way to Gray Wave 3, which is considered one of the strongest and longest waves in the Elliott Wave sequence. This reinforces the strong downward market momentum.

Since the next lower-degree wave (Gray Wave 3) has already begun, further bearish price action is likely in the near term.

Key Levels to Watch

- The wave cancel invalidation level is set at 0.91576. If the price rises above this level, the current Elliott Wave count will be invalidated, potentially leading to a trend reversal.

- Traders should closely monitor this level as it serves as a key threshold for maintaining the bearish outlook.

Summary

- The USDCHF 4-hour chart confirms a strong bearish outlook, with Gray Wave 3 currently active.

- The completion of Gray Wave 2 and initiation of Gray Wave 3 reinforce downward momentum.

- The 0.91576 invalidation level is critical—a break above it could alter the bearish scenario.

- As long as the impulsive wave structure remains intact, further downside movement is expected in the near term.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support