NVIDIA Corporation (NVDA) is currently exhibiting strong upward trends, as indicated by the Elliott Wave Theory analysis on both daily and 4-hour charts. This technical analysis aims to provide traders with insights into the likely future movements of NVDA stock, helping them make informed trading decisions.

NVDA Elliott Wave Analysis Trading Lounge Daily Chart

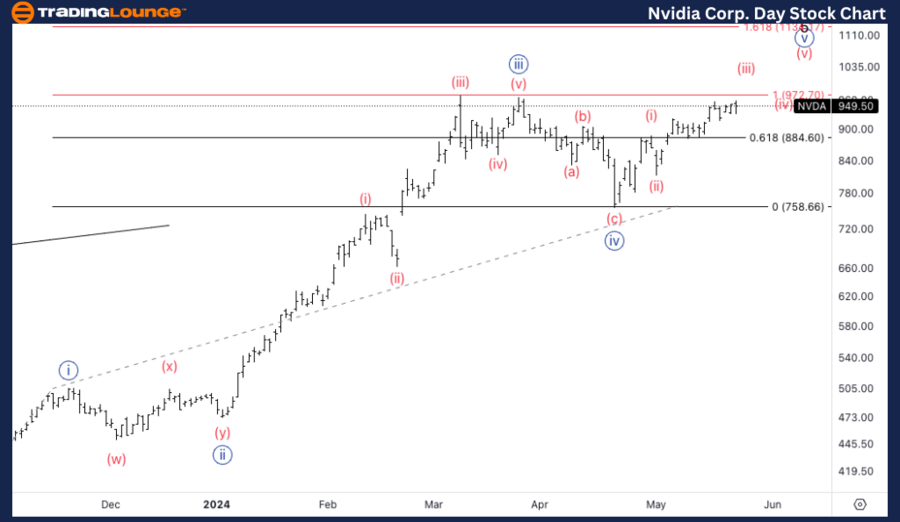

NVIDIA Corp. (NVDA) Daily Chart Analysis

NVDA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minute {v}

Direction: Upside in {v} of 1

Details: The equality of {v} versus {i} is projected at $972, with resistance anticipated near the top of TL1 at $1000.

On the daily chart, NVDA is in an impulsive mode within a motive structure. This structure is currently positioned at Minute wave {v}, moving upwards in wave {v} of 1. The equality of wave {v} compared to wave {i} stands at $972. Traders should be vigilant as resistance is anticipated at the top of TL1 around $1000. This critical level could serve as a significant barrier, potentially causing a retracement or consolidation.

NVDA Elliott Wave Analysis Trading Lounge 4Hr Chart

NVIDIA Corp. (NVDA) 4Hr Chart Analysis

NVDA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (v) of {v}

Direction: Upside in (v)

Details: The current pattern suggests a bullish correction, indicating a likely further upside. Resistance is expected on the next upward move within potential wave (v).

The 4-hour chart further supports the daily analysis with a similar impulsive mode within a motive structure. NVDA is positioned in wave (v) of {v}, showing an upward movement in wave (v). The bullish correction indicates a continuation of the upward trend, suggesting further gains. Traders should watch for resistance in the upcoming wave (v), which could mark a crucial turning point.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Spotify Technology S.A., (SPOT) Stocks Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion

The NVDA Elliott Wave Analysis provides a comprehensive view of the stock's current and potential future movements. By understanding the trend functions, impulsive modes, and motive structures, traders can better navigate the market and make strategic decisions. With resistance levels identified, traders have clear markers to watch for potential breakouts or reversals. This analysis underscores the importance of combining technical analysis with strategic trading plans to optimize performance in the stock market.