Bovespa Index Elliott Wave Analysis – TradingLounge Daily Chart

Bovespa Index Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 3

Next Lower Degree Direction: Orange Wave 2

Wave Invalidation Level: 122,314.53

Details:

This Elliott Wave daily chart analysis of the Bovespa Index identifies a strong bullish trend characterized by impulsive wave behavior. The current wave count positions Orange Wave 1 within the broader Navy Blue Wave 3, signaling sustained upward movement within the larger trend.

The chart suggests Navy Blue Wave 2 has ended, allowing Orange Wave 1 of 3 to progress. As part of an impulsive sequence, this wave indicates potential for continued gains until Orange Wave 2 begins to form.

One of the most critical price markers is the wave invalidation level at 122,314.53. A price drop beneath this threshold would negate the current wave count, necessitating a revised outlook on market direction.

Trading Outlook:

Traders are advised to monitor Orange Wave 1's progression and prepare for the emergence of Orange Wave 2. Spotting these wave transitions early is essential for optimizing entry and exit strategies in harmony with the current trend.

This daily analysis enhances short- to medium-term trading setups by clarifying wave positions. A firm understanding of wave sequencing and adherence to invalidation points ensures traders can respond effectively to price changes.

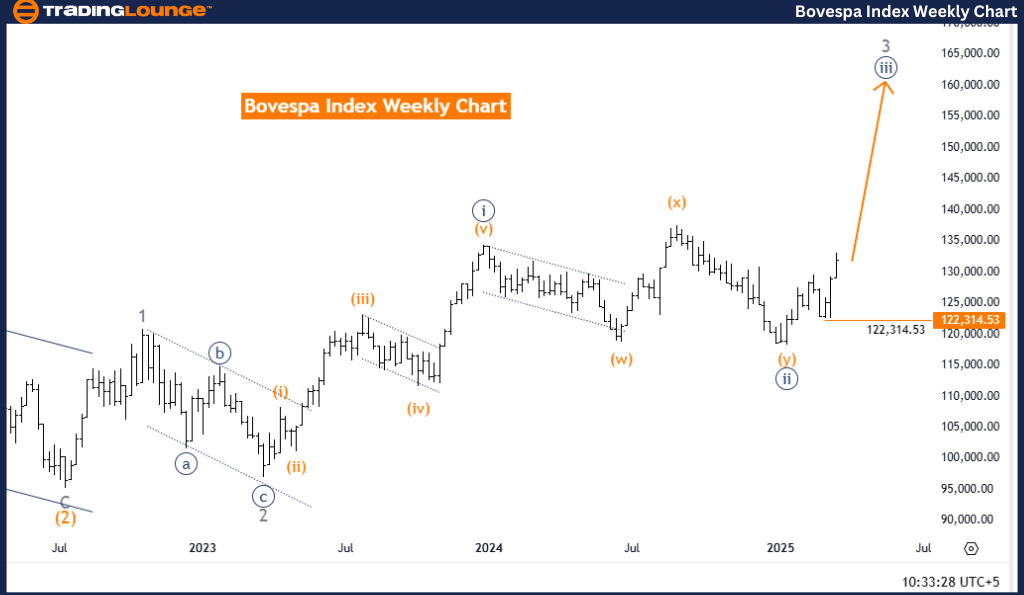

Bovespa Index Elliott Wave Analysis – TradingLounge Weekly Chart

Bovespa Index Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave 3

Next Lower Degree Direction: Navy Blue Wave 4 (In Progress)

Wave Invalidation Level: 122,314.53

Details:

This weekly Elliott Wave forecast for the Bovespa Index highlights a long-term bullish trajectory defined by impulsive wave formations. The key structure under focus is Navy Blue Wave 3, nested within the larger Gray Wave 3 phase.

Evidence suggests Navy Blue Wave 2 has finalized, making way for a strong and directional Navy Blue Wave 3, which is now underway. This movement is expected to continue upward until Navy Blue Wave 4 starts to take shape—which the current chart indicates has begun.

If the index retreats below 122,314.53, the wave count would be invalidated, implying a potential deviation from the expected bullish path.

Trading Outlook:

Market analysts should focus on the evolution of Navy Blue Wave 3 and anticipate developments in Navy Blue Wave 4. Accurate placement of wave positions is crucial to maintaining an informed trading perspective.

This weekly chart analysis provides a broader view for swing and position traders, helping to align strategies with prevailing macro trends. Recognizing the hierarchy of wave structures and monitoring invalidation points can enhance both decision-making and risk control.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: CAC 40 (France) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support