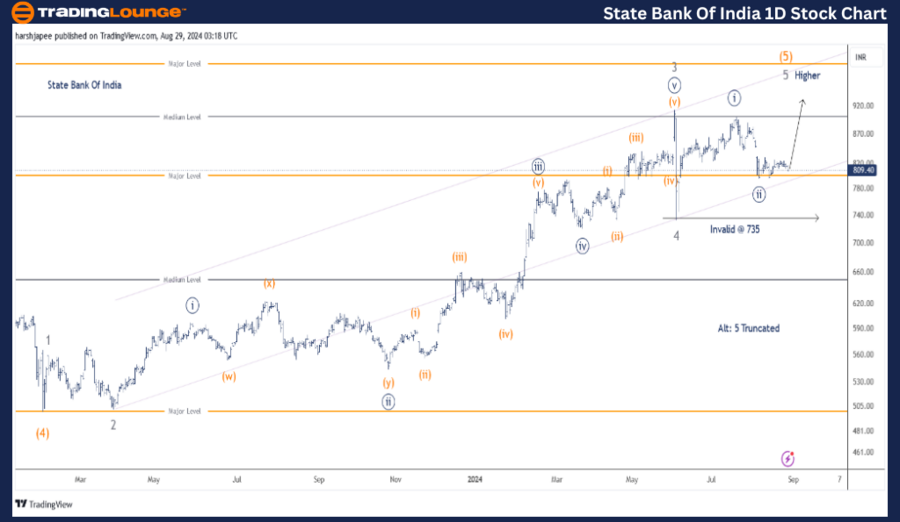

STATE BANK OF INDIA – SBIN Elliott Wave Analysis (1D Chart)

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((ii))

Details: Minute Wave ((ii)) Navy is likely complete around 810. If this is accurate, prices should rise as Minute Wave ((iii)) Navy begins to develop within Minor Wave 5 Grey of Intermediate Wave (5) Orange. Alternatively, Minor Wave 5 Grey might have ended as a truncation below 920.

Invalidation point: 735

SBIN Elliott Wave Technical Analysis

State Bank of India Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart for State Bank of India suggests a continued upward movement above 920 levels as Minute Wave ((iii)) unfolds within Minor Wave 5 Grey, leading to the completion of Intermediate Wave (5) Orange. If this scenario holds, the interim low near 800 levels should remain intact.

Since February 2023, the stock has been on an upward trend after completing Intermediate Wave (4) around the 500 mark. Analyzing the sub-waves, Minor Waves 1, 2, 3, and 4 appear complete, with Wave 5 Grey unfolding above the 735 level.

If the larger degree trend continues as expected, prices should remain above 735, potentially leading to an impulse that completes Minor Wave 5 Grey. Alternatively, if Wave 5 Grey was truncated, it may have concluded around the 920 highs.

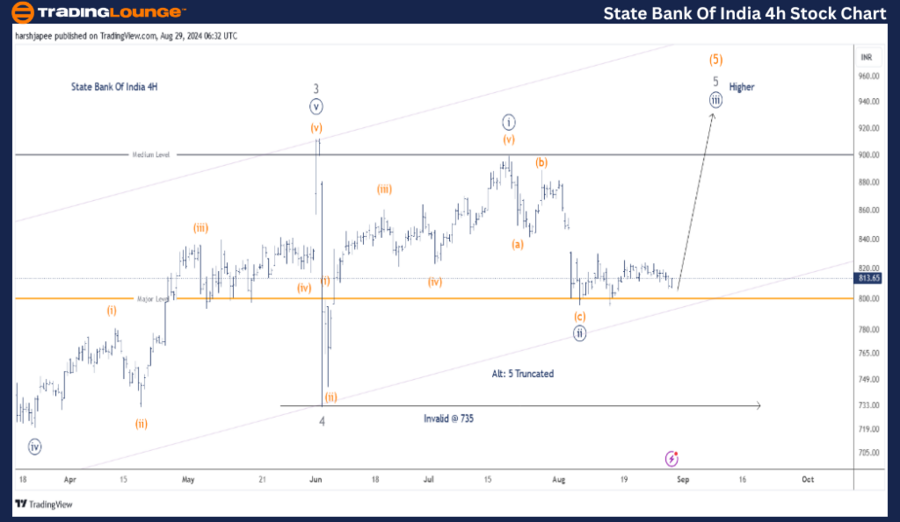

STATE BANK OF INDIA – SBIN Elliott Wave Analysis (4H Chart):

Function: Larger Degree Trend Higher (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((ii))

Details: Minute Wave ((ii)) Navy seems to be complete around 810. If accurate, prices should rise as Minute Wave ((iii)) Navy starts to develop within Minor Wave 5 Grey of Intermediate Wave (5) Orange. Alternatively, if Minor Wave 5 Grey has already ended as a truncation below 920, the stock could continue downward, producing an impulse wave.

Invalidation point: 735

State Bank of India 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4H chart of State Bank of India provides a detailed view of Minute Waves ((i)) and ((ii)) Navy since Minor Wave 4 ended near the 735 level. The stock has completed an impulse wave (Minuette waves (i) through (v) orange) between 735 and 920, marking the end of Minute Wave ((i)).

Additionally, Minute Wave ((ii)) has formed a Zigzag pattern. If this analysis is correct, Minute Wave ((iii)) should commence shortly, targeting the 735 mark.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Reliance Industries Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

State Bank of India appears to be advancing higher, with a potential move above 920 as Minute Wave ((iii)) progresses within Intermediate Wave (5) Orange. A break below 735 would indicate that the alternate scenario is likely unfolding.