ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis

Greetings,

This Elliott Wave analysis provides a fresh outlook on the Australian Stock Exchange (ASX) Newmont Corporation (ASX: NEM) with a technical approach for traders and investors.

Our analysis indicates that ASX :NEM has strong long-term bullish potential, currently unfolding within the third wave of the third wave. This report highlights key price levels and optimal trading setups using a data-driven, visually guided approach to confirm market trends.

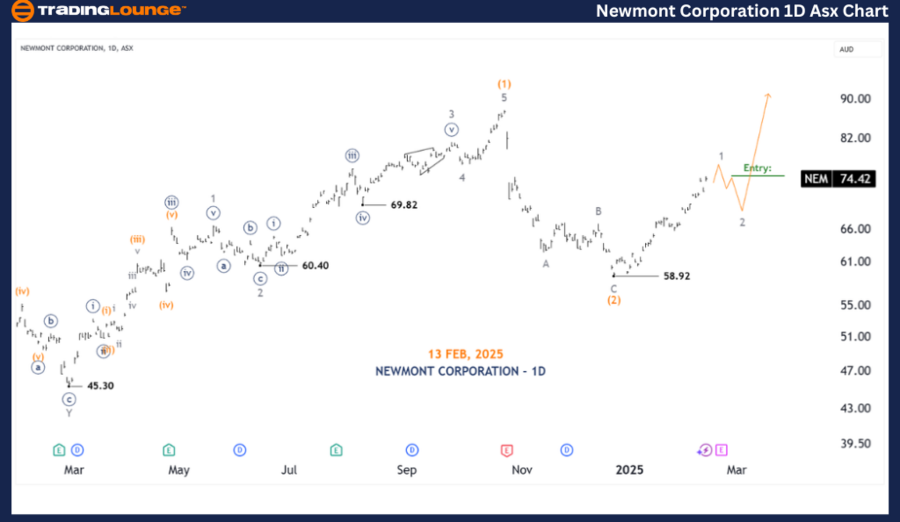

ASX: NEWMONT CORPORATION - NEM 1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 1 - grey of Wave (3) - orange

Details:

- Wave (2) - orange likely completed at 58.92, signaling the potential start of Wave (3) - orange, which is expected to push higher.

- The structure suggests an Extended Wave, where Wave 1 - grey is nearing completion before a minor rally.

- Upon completion of Wave 1 - grey, Wave 2 - grey is anticipated, setting up a potential long trade opportunity.

Invalidation Point: 58.92

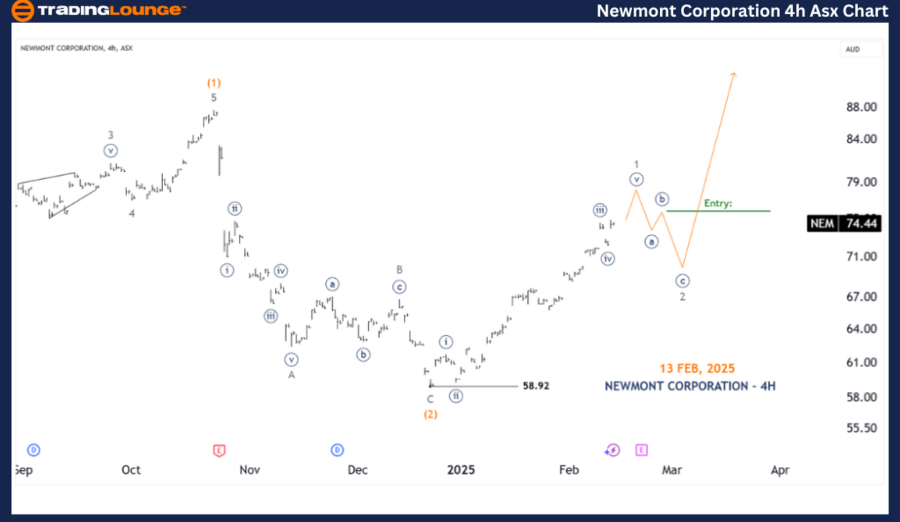

ASX: NEWMONT CORPORATION - NEM 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((v)) - navy of Wave 1 - grey

Details:

- From the 58.92 low, Wave 1 - grey is nearing completion, displaying a five-wave structure from Wave ((ii)) - navy to Wave ((v)) - navy.

- The next anticipated move is a corrective decline into Wave 2, providing traders a chance to wait for a breakout above Wave ((b)) - navy of Wave 2 - grey before considering a long trade setup.

Invalidation Point: 58.92

Key Level: End of Wave ((b)) - navy

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: COMMONWEALTH BANK OF AUSTRALIA - CBA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave analysis offers a structured trading forecast for ASX: Newmont Corporation (NEM), providing a clear technical roadmap to navigate current market conditions. By identifying critical validation and invalidation levels, we aim to enhance confidence in trend projections and market positioning.

Our objective, data-backed approach ensures traders receive insights into the market context and high-probability trading opportunities.