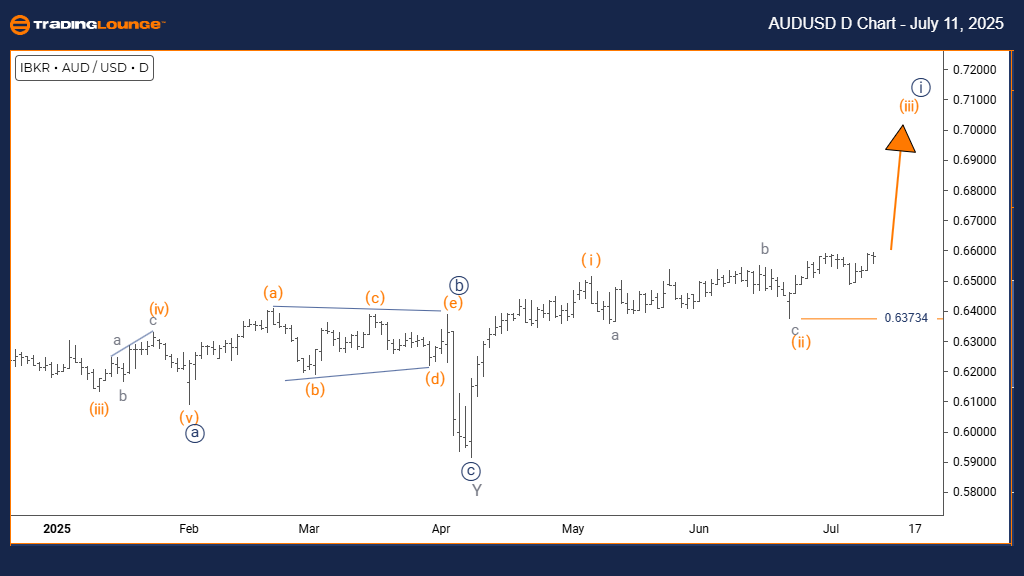

AUDUSD Elliott Wave Analysis – Trading Lounge Day Chart

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange wave 3

POSITION: Navy blue wave 1

DIRECTION NEXT LOWER DEGREES: Orange wave 4

DETAILS: Orange wave 2 appears finalized; orange wave 3 is currently advancing.

Invalidation Level: 0.63734

The AUDUSD daily Elliott Wave forecast indicates a bullish momentum driven by an active impulsive structure. Currently, orange wave 3 is forming within navy blue wave 1, suggesting the emergence of a significant uptrend. The anticipated progression includes orange wave 4, a corrective move expected once wave 3 concludes. Technical signs point to the end of orange wave 2, confirming that orange wave 3—historically the most powerful in Elliott Wave formations—is in motion.

Upward momentum continues to support the current bullish stance, emphasizing strong buyer engagement. Should price fall below 0.63734, the wave count would be invalidated and require a reassessment of trend direction. Analyzing on the daily timeframe provides strategic clarity and highlights the upward potential typically associated with wave 3. Traders should monitor for validation signals while keeping the invalidation level in focus for risk control.

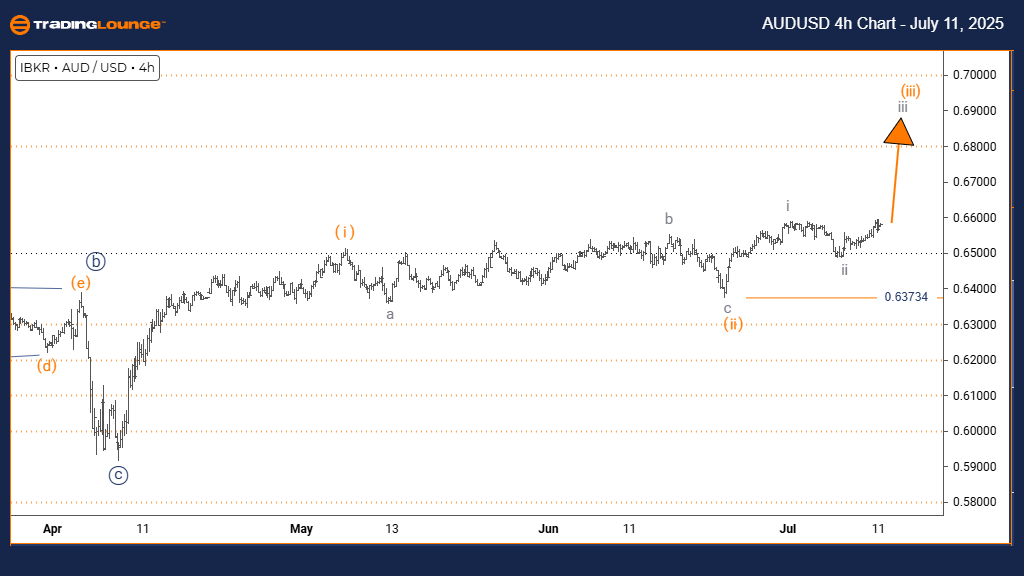

AUDUSD Elliott Wave Analysis – Trading Lounge 4-Hour Chart

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray wave 3

POSITION: Orange wave 3

DIRECTION NEXT HIGHER DEGREES: Gray wave 3 (initiated)

DETAILS: Gray wave 2 likely completed; gray wave 3 is progressing.

Invalidation Level: 0.63734

The AUDUSD 4-hour Elliott Wave analysis reveals a bullish structure with impulsive dynamics taking shape. The pair is currently inside gray wave 3 nested within orange wave 3, indicating a continued upward move. Following the probable completion of gray wave 2, this marks the early phase of a typically strong and extended gray wave 3, often considered ideal for trade setups due to directional clarity.

As long as price action stays above the 0.63734 invalidation level, the bullish Elliott Wave pattern remains valid. The impulsive behavior supports increasing buying momentum, aligning with broader market expectations for gains. This 4-hour perspective offers granular insights while aligning with the daily outlook, guiding traders in identifying key trade zones and maintaining trend alignment.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: GBPJPY Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support