ASX: COMPUTERSHARE LIMITED. - CPU Elliott Wave Technical Analysis TradingLounge

Greetings,

Today's Elliott Wave analysis provides an update on the Australian Stock Exchange (ASX) with COMPUTERSHARE LIMITED. - CPU. According to our evaluation, ASX:CPU is nearing the completion of wave ((i))-navy, with a pullback to wave ((ii))-navy expected shortly.

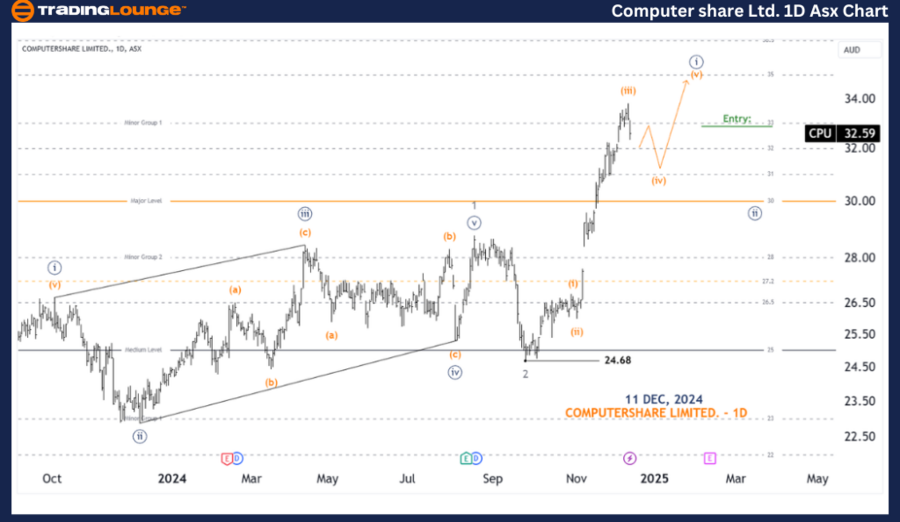

ASX: COMPUTERSHARE LIMITED. - CPU 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((i))-navy of Wave 3-grey

Details:

Wave 3-grey is progressing to higher levels. It is subdividing within wave ((i))-navy, which is expected to continue its upward momentum. Once completed, a pullback in wave ((ii))-navy is anticipated.

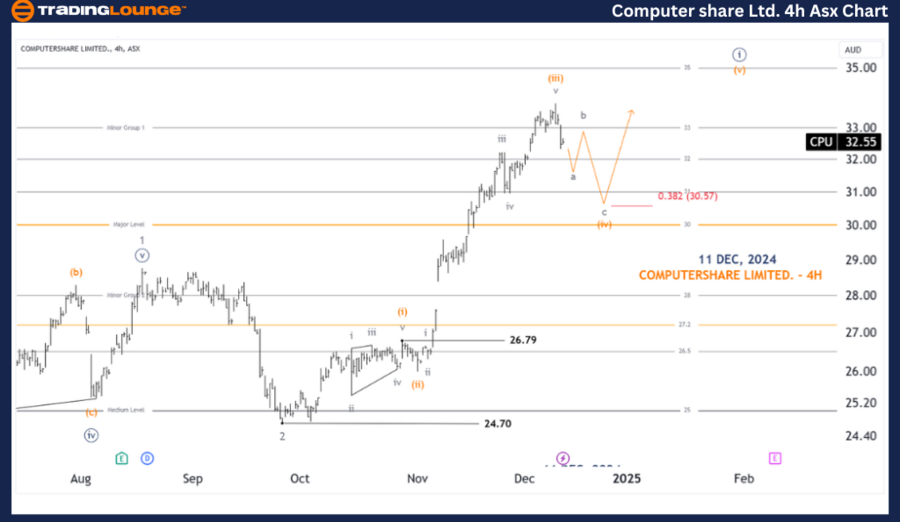

ASX: COMPUTERSHARE LIMITED. - CPU 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave a-grey of Wave (iv)-orange of Wave ((i))-navy

Details:

Wave (iii)-orange has completed its five-wave structure, labeled from wave i-grey to wave v-grey. Now, wave (iv)-orange is expected to move lower, targeting around 30.57. After this pullback, wave (v)-orange is likely to continue advancing higher.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: AMCOR PLC – AMC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our analysis provides a comprehensive outlook for ASX: COMPUTERSHARE LIMITED. - CPU, focusing on key price movements and market trends. By identifying specific price points for validation or invalidation, we enhance confidence in our wave count. This approach ensures readers gain an objective and professional perspective on current trends, helping them capitalize effectively on market opportunities.