Spotify Technology S.A. (SPOT) Elliott Wave Analysis – TradingLounge Daily Chart

Spotify Technology S.A. (SPOT) Daily Chart Analysis Using Elliott Wave Theory

Spotify Technology S.A. (SPOT) Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (iii) of {iii}

DIRECTION: Upside in wave (iii)

DETAILS: Bullish outlook remains intact, with SPOT targeting the $800 level as wave (iii) progresses within the broader wave {iii} structure.

The daily chart for Spotify stock (SPOT) reveals a robust impulsive wave structure, now advancing in wave (iii) of a higher degree wave {iii}. According to Elliott Wave analysis, this phase typically shows accelerating momentum, confirming bullish sentiment. As long as price remains above key support levels, the SPOT stock forecast favors continued strength, potentially reaching the $800 zone. This aligns with classic motive wave behavior under Elliott Wave theory, validating sustained upside pressure.

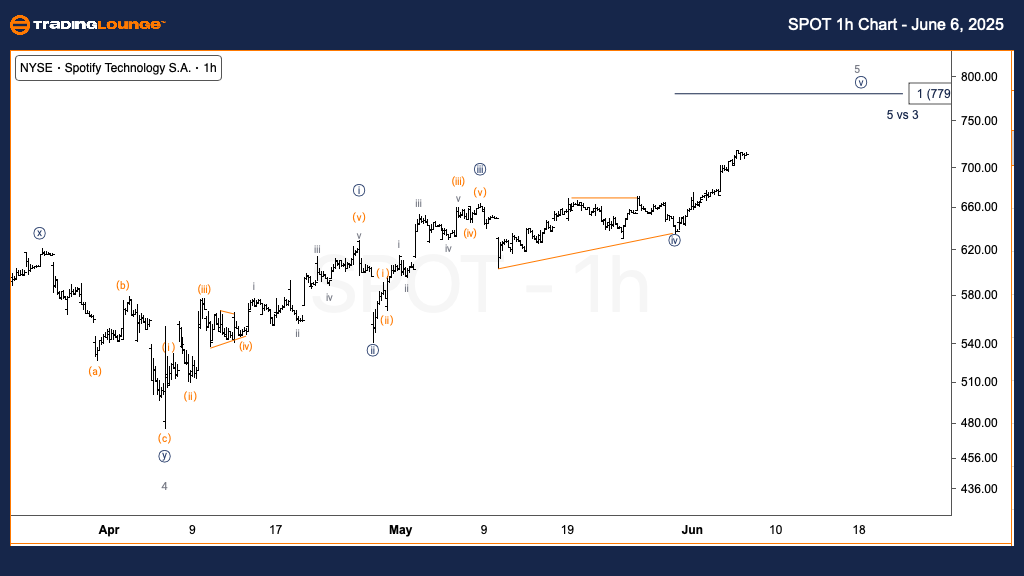

Spotify Technology S.A. (SPOT) U.S. Stock Analysis – TradingLounge 1-Hour Chart

Technical Analysis Using Elliott Wave Theory

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {v} of 5

DIRECTION: Upside in wave {v}

DETAILS: Conservative projection limits upside to $779 due to wave {iii} being shorter than wave {i}, signaling a potential high.

In the 1-hour chart view, Spotify stock continues to unfold in wave {v} of 5. Given that wave {iii} failed to extend beyond wave {i}, Elliott Wave guidelines suggest wave {v} could top near $779. This scenario implies reduced bullish strength in the short term and a probable reversal or corrective move thereafter. The SPOT technical outlook signals that traders should monitor for signs of exhaustion as the wave structure nears completion.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Apple (AAPL) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support