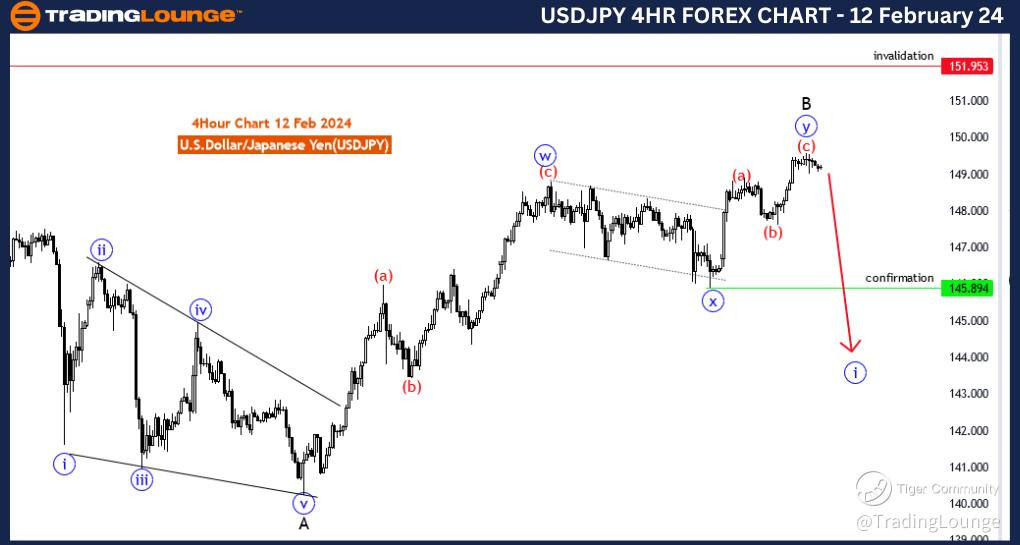

USDJPY Elliott Wave Analysis for the 4-Hour Chart: February 12, 2024

TradingLounge U.S.Dollar/Japanese Yen (USDJPY) 4-Hour Chart

USDJPY Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: blue wave 1

POSITION: black wave C

DIRECTION NEXT LOWER DEGREES: blue wave1 (started)

DETAILS: blue wave y of B looking completed. Now blue wave 1 of C is in play . Wave Cancel invalid level: 151.953

The "USDJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 12 February 24, provides a detailed analysis of the U.S. Dollar/Japanese Yen (USDJPY) currency pair using Elliott Wave theory, offering insights into potential market movements.

The identified "FUNCTION" is "Counter Trend," indicating that the analysis is focused on a potential reversal or corrective move against the prevailing trend. Traders may be exploring opportunities within the context of a countertrend scenario, seeking to capitalize on potential price reversals.

The specified "MODE" is "Impulsive," suggesting that the current market structure exhibits characteristics of an impulsive wave. Impulsive waves are typically associated with strong and directional price movements aligned with the dominant trend.

The "STRUCTURE" is defined as "Blue wave 1," indicating the current position within the Elliott Wave sequence. This suggests that the analysis is honing in on the first wave within the broader structure.

The "POSITION" is labeled as "Black wave C," providing information about the subwave count within the larger structure. Understanding these nested waves is crucial for Elliott Wave analysts seeking to identify potential turning points.

In terms of "DIRECTION NEXT LOWER DEGREES," the analysis points to "Blue wave 1 (started)," indicating the expected direction of the next lower-degree wave. This nested wave structure is essential for traders using Elliott Wave principles to navigate market trends.

The "DETAILS" section notes that "blue wave y of B" is considered completed, signaling the end of a corrective pattern. Now, "blue wave 1 of C" is in play, suggesting the initiation of a new impulsive wave.

The "Wave Cancel invalid level" is specified as "151.953." This level serves as a critical reference point, and a breach of this level may prompt a reassessment of the current wave count and market trajectory.

In summary, the USDJPY Elliott Wave Analysis for the 4 Hour Chart on 12 February 24, highlights the potential for a counter-trend move with the initiation of "blue wave 1 of C." Traders are advised to closely monitor the market, especially the specified invalidation level at 151.953, for potential shifts in market sentiment.

Technical Analyst: Malik Awais

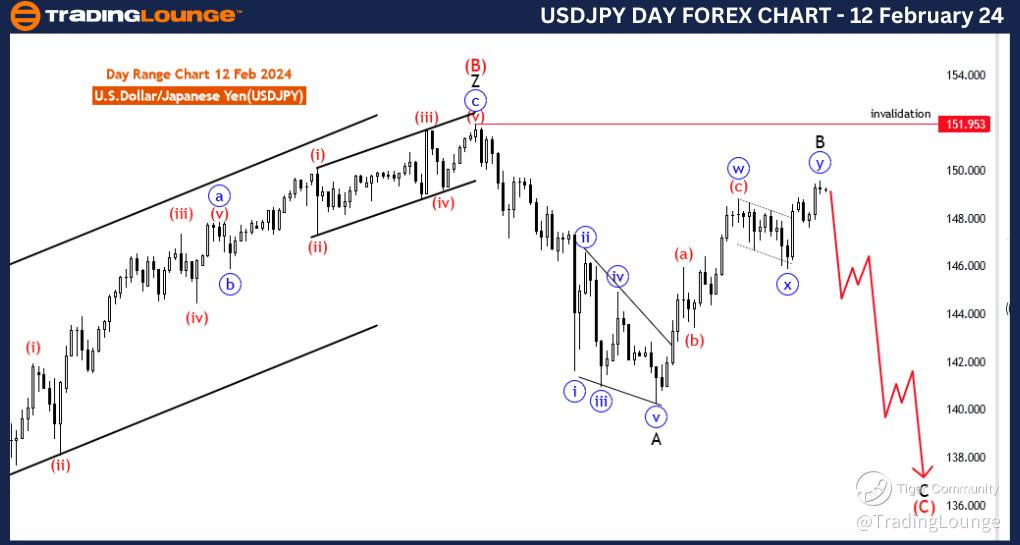

USDJPY Elliott Wave Analysis Trading Lounge Day Chart,12 February 24

U.S.Dollar/Japanese Yen (USDJPY) Day Chart

USDJPY Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: black wave C

POSITION: Red wave C

DIRECTION NEXT LOWER DEGREES: black wave C (started)

DETAILS: blue wave y of B looking completed. Now black wave C is in play . Wave Cancel invalid level: 151.953

The "USDJPY Elliott Wave Analysis Trading Lounge Day Chart" dated 12 February 24, presents a comprehensive analysis of the U.S. Dollar/Japanese Yen (USDJPY) currency pair using Elliott Wave principles, providing insights into potential price movements in the daily timeframe.

The identified "FUNCTION" is "Counter Trend," signaling that the analysis is focused on a potential reversal against the prevailing trend. Traders may be exploring opportunities within the context of a countertrend move, anticipating a shift in market dynamics.

The specified "MODE" is "Impulsive," suggesting that the current market structure is displaying characteristics of an impulsive wave. Impulsive waves are often associated with strong, directional price movements that align with the dominant trend.

The "STRUCTURE" is described as "Black wave C," indicating the current position within the broader Elliott Wave sequence. This emphasizes the subwave count and helps traders understand the intricacies of the ongoing market movement.

The "POSITION" is labeled as "Red wave C," providing information about the subwave count within the black wave C structure. This nested wave analysis is essential for traders using Elliott Wave theory to identify potential turning points and forecast future price action.

In terms of "DIRECTION NEXT LOWER DEGREES," the analysis points to "Black wave C (started)," indicating the expected direction of the next lower-degree wave. This insight into the nested wave structure is crucial for understanding the progression of the Elliott Wave pattern.

The "DETAILS" section notes that "blue wave y of B" is considered completed, marking the end of a corrective pattern. The analysis now suggests that "black wave C" is in play, indicating the potential initiation of a new impulsive wave.

The "Wave Cancel invalid level" is specified as "151.953," serving as a critical reference point. A breach of this level may prompt a reevaluation of the current wave count and potential shifts in the market trajectory.

In summary, the USDJPY Elliott Wave Analysis for the Day Chart on 12 February 24, suggests a counter-trend move with the initiation of "black wave C." Traders are advised to monitor the market closely, especially the specified invalidation level at 151.953, for potential changes in market sentiment.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: U.S.Dollar /Canadian Dollar(USD/CAD)