Welcome to our latest Elliott Wave analysis on the Australian Stock Exchange (ASX) featuring CSL LIMITED – CSL. We aim to provide an insightful overview of CSL’s stock movement using Elliott Wave principles.

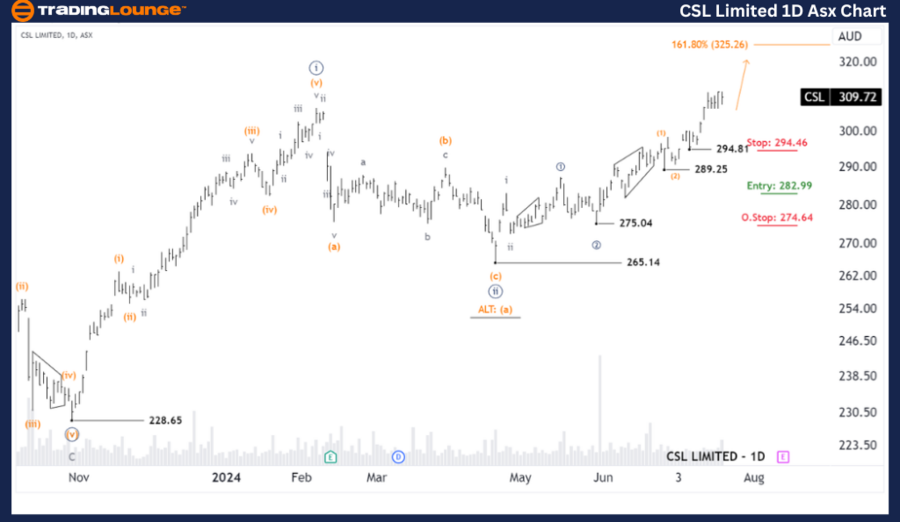

ASX: CSL LIMITED – CSL Elliott Wave Technical Analysis (1D Chart)

ASX: CSL LIMITED – CSL Day Chart Analysis

CSL Elliott Wave Technical Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (3) - orange of Wave ((3)) - navy of Wave iii - gray of Wave ((iii)) - navy

Details: Wave (3) - orange is advancing, targeting 325.26, requiring the price to stay above 294.81. This view holds as long as the price does not dip below this level. The Long Trade position in CSL has been profitable and is expected to continue growing.

Invalidation point: 294.81

ASX: CSL LIMITED – CSL Elliott Wave Technical Analysis (4-Hour Chart)

ASX: CSL LIMITED – CSL 4-Hour Chart Analysis

Function: Major trend (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (3) - orange of Wave ((3)) - navy of Wave iii - gray of Wave ((iii)) - navy

Details: Wave (3) - orange is still in an upward trajectory, aiming for 325.26, with the price needing to stay above 300.00 to maintain this outlook. The Long Trade position in CSL remains profitable and is poised for further gains.

Invalidation point: 300.00

Conclusion

Our analysis comprehensively forecasts CSL LIMITED – CSL’s market trends and short-term outlook. We highlight specific price points that act as validation or invalidation signals, bolstering confidence in our wave count. By integrating these elements, we offer an objective and professional perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: SOUTH32 LIMITED – S32 Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support