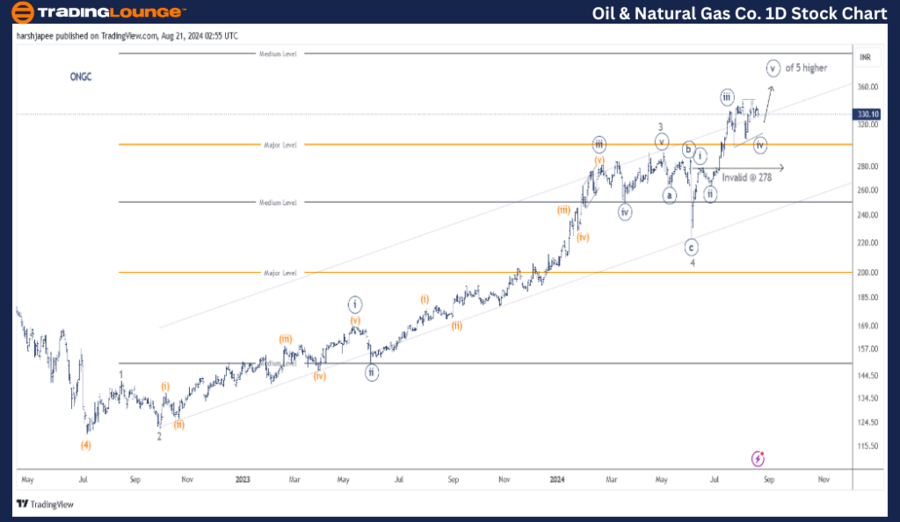

OIL & NATURAL GAS CO – ONGC Elliott Wave Analysis (1D Chart)

Function: Larger Trend Higher (Intermediate Degree Wave (5), Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iv))

Details: Minute Wave ((iv)) Navy is nearing completion or may already be complete as a triangle. If accurate, Minute Wave ((v)) should soon resume its upward movement.

Invalidation Point: 278

ONGC Elliott Wave Technical Analysis

ONGC Daily Chart Technical Analysis and Potential Elliott Wave Counts

The ONGC daily chart suggests that since July 22, the Intermediate Wave (5) Orange is approaching completion as prices progress within Minute Wave ((v)) Navy, targeting the 278 mark. If this scenario holds, prices should move higher from this level or within the 310-20 range in the near term.

The stock has rallied since its July 2022 low at the 120 mark, where Intermediate Wave (4) also terminated. Minor Wave 3 extended, and Minor Wave 4 was marked complete at 222 on June 04, 2022.

Since then, Minor Wave 5 has been unfolding and is potentially concluding Minute Wave ((iv)) as a triangle around the 310-20 range. If this analysis is correct, the final thrust Wave ((v)) Navy should resume from here and extend towards the 400 mark.

OIL & NATURAL GAS CO – ONGC Elliott Wave Technical Analysis (4H Chart)

Function: Larger Trend Higher (Intermediate Degree Wave (5), Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((iv))

Details: Minute Wave ((v)) Navy is expected to resume soon within Minor Wave 5 of Intermediate Wave (5) Orange.

Invalidation Point: 278

ONGC 4H Chart Technical Analysis and Potential Elliott Wave Counts

The ONGC 4H chart indicates the progressive structure of Minor Wave 5 Grey within Intermediate Wave (5) Orange, against the 222 low established since June 04. The price should ideally stay above 278, Minute Wave ((i)) Navy, to maintain the Impulse.

The stock has likely completed Minute Waves ((i)) through ((iv)) Navy and should resume its Wave ((v)) rally towards the 390-400 zone as projected here. Minute Wave ((iv)) is unfolding as a triangle, and sub-Minuette wave e appears to be near completion.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HCL Technologies Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

ONGC is expected to resume its final thrust, Minute Wave ((v)) Navy, towards the 390-400 range, within Minor Wave 5 of Intermediate Wave (5) Orange.