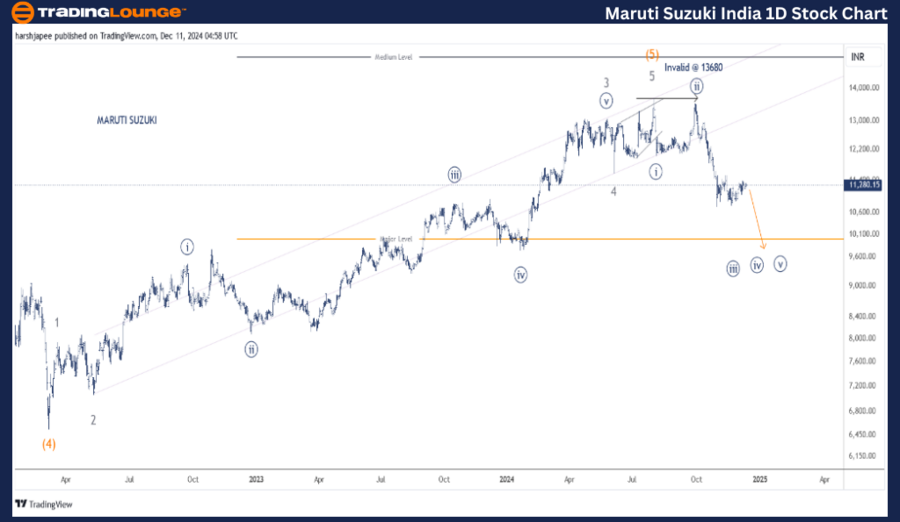

MARUTI SUZUKI INDIA – MARUTI (1D Chart) Elliott Wave Technical Analysis

MARUTI Elliott Wave Technical Analysis

Function: Counter Trend Lower (Intermediate Degree, Orange)

Mode: Corrective

Structure: Impulse within Larger Degree Wave A

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) continues moving lower, extending against the resistance zone at 13,680.

Invalidation Point: 13,680–13,685

MARUTI SUZUKI Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart for MARUTI SUZUKI highlights a possible trend reversal after the completion of Minor Wave 5 Grey within Intermediate Wave (5) Orange, peaking around the 13,680 resistance level. The stock appears poised to finalize its initial impulse wave lower, with Minute sub-waves unfolding against the 13,680 resistance.

Key observations:

- MARUTI SUZUKI saw a significant drop to 6,530 in March 2022, marking the conclusion of Intermediate Wave (4) Orange.

- The subsequent rally unfolded as an impulse consisting of Minor Waves 1 through 5 Grey.

- Notably, Wave 3 was an extension, while Wave 5 formed a diagonal pattern.

If this analysis is accurate, a major top has been established near the 13,680 levels, with the first impulse wave lower continuing to take shape.

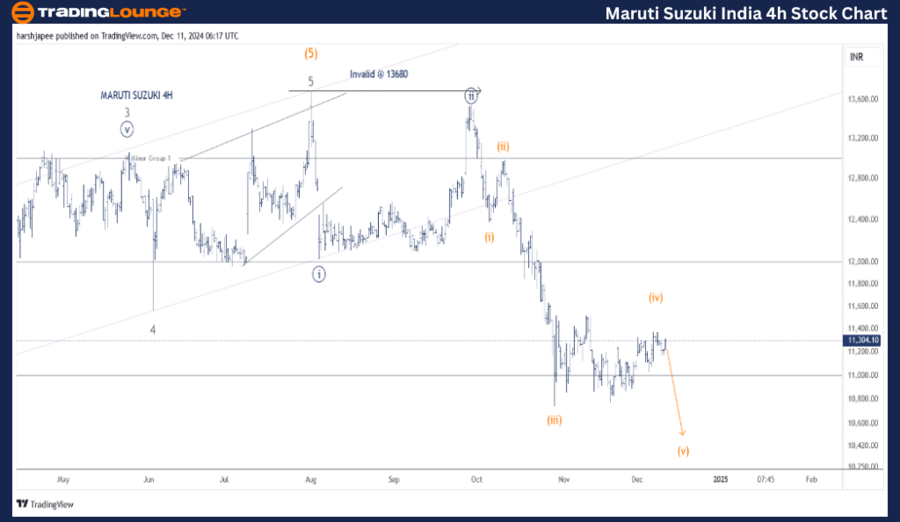

MARUTI SUZUKI INDIA – MARUTI (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend Lower (Intermediate Degree, Orange)

Mode: Corrective

Structure: Impulse within Larger Degree Wave A

Position: Minute Wave ((iii)) Navy

Details: Minute Wave ((iii)) remains in progress, moving lower as an extension against the 13,680 resistance. Minuette Wave (iv) may currently be developing as a triangle.

Invalidation Point: 13,680–13,685

MARUTI SUZUKI 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart for MARUTI SUZUKI outlines sub-wave developments after Minor Wave 3 Grey terminated around the 13,065 level. Minor Wave 4 unfolded as a zigzag, concluding near 11,540, while Minor Wave 5 surpassed 13,680, forming an ending diagonal.

Additional insights:

- The stock sharply reversed from the 13,680 levels, initiating an impulse wave downward.

- Minute Waves ((i)) and ((ii)) have already formed around 12,060 and 13,600–13,650 levels, respectively.

- If this wave structure holds, prices are expected to continue trending lower as Minute Wave ((iii)) extends further.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: HDFCLIFE Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

MARUTI SUZUKI is trending lower within Minute Wave ((iii)) Navy, maintaining resistance at 13,680.