TradingLounge Copper Elliott Wave Analysis

Function: Counter-Trend

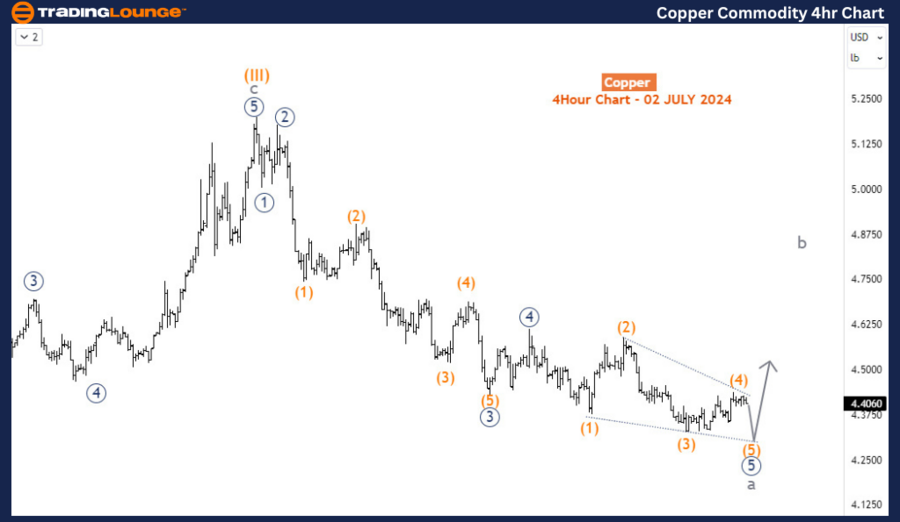

Mode: Impulse wave a of (IV)

Structure: Impulse wave

Position: Wave (3) of 5 (circled)

Direction: Wave (4)

Details: The decline from May 20th is best described as an impulse structure. The price is expected to drop further to complete the cycle degree wave a. Currently, it is in wave 5 (circled) of the cycle degree, nearing the end of an ending diagonal structure.

Copper Elliott Wave Technical Analysis

Since May 17th, 2024, Copper has lost nearly 15%, correcting the strong rally from October 2023. The correction from May 2024 seems to be deeper, aiming to complete at least a 3-swing chart structure. However, the long-term trend still indicates an upside, but buyers should proceed with caution. Before the decline continues, the commodity might experience a minor bounce, correcting the current sell-off from May 17th, 2024.

In the long term, Copper appears to be in a bullish corrective cycle - wave A-B-C of the grand supercycle degree. Wave B completed a triangle structure lasting 17 months, ending in April 2022. Since then, a bullish diagonal structure has formed for wave C of the supercycle degree. Hence, the long-term trend favors buyers, though sharp pullbacks are expected.

Copper Day Chart Analysis

On the daily chart, the diagonal completed its 3rd sub-wave, wave (III) of the supercycle degree, in May 2024. A decline for wave (IV) began and is currently ongoing. Wave (IV) is expected to complete a corrective structure - ABC or WXY. Wave a of (IV) is close to completion, indicating a possible resurgence for wave b of (IV). The H4 chart shows the extent of wave a of (IV) and its potential progression before concluding and allowing wave b to commence upwards.

Copper 4-Hour Chart Analysis

On the H4 chart, the sell-off from May 2024 is forming into an impulse wave for wave 5 (circled) of a. Currently, it is in the sub-waves (4) of a diagonal wave 5 (circled), expected to be the last leg. If the diagonal concludes as anticipated, sellers should be cautious of a corrective surge. However, buyers should not be overly optimistic as the rally will likely be corrective, leading to another round of sell-offs before wave (IV) ends and the price starts pushing upwards for wave (V) in the long term.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: GX Uranium ETF Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support