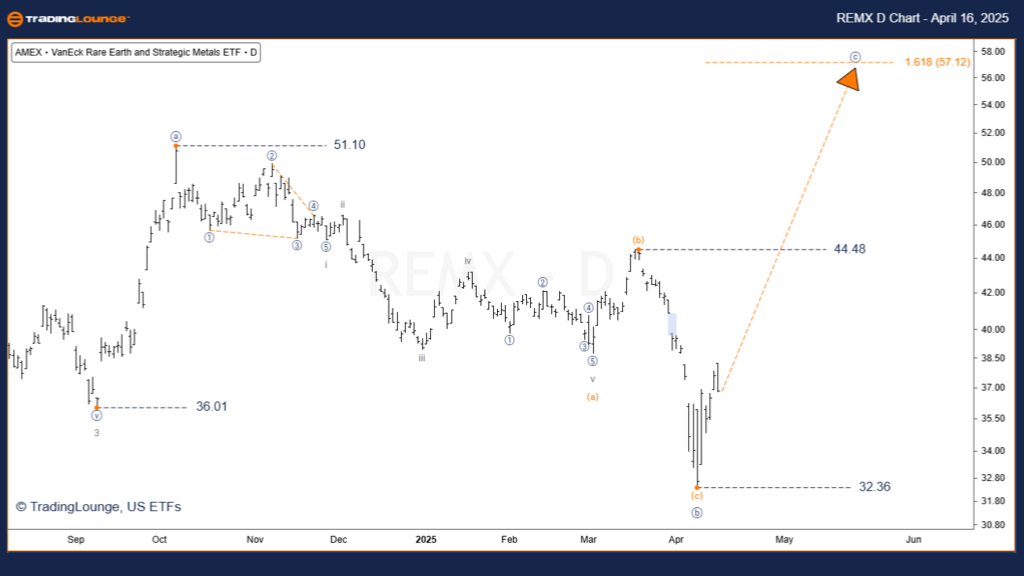

VanEck Rare Earth & Strategic Metals ETF – REMX (1D) Elliott Wave Analysis

REMX Daily Chart Analysis

Market Function: Countertrend

Wave Mode: Corrective

Pattern Structure: Zigzag

Wave Position: Wave [c] of 4

Short-Term Trend: Bear Market Rally

Critical Invalidation Level: $32.36

Elliott Wave Analysis Summary:

The VanEck Rare Earth & Strategic Metals ETF (REMX) is unfolding a corrective wave 4 pattern, currently developing its final subwave. This wave 4 is expected to retrace between 38.2% and 50% of the preceding wave 3 decline, aligning with a classic zigzag formation. Confirmation of this expanded flat correction will occur if the price breaks above the $51.10 high.

Based on Fibonacci projections and wave symmetry, wave 4 is likely to complete around the $57.12 resistance area. Once wave 4 concludes, the broader downtrend is anticipated to resume with wave 5, potentially driving the ETF price below the start of wave 4. Traders and investors should track price action closely as the corrective phase nears exhaustion.

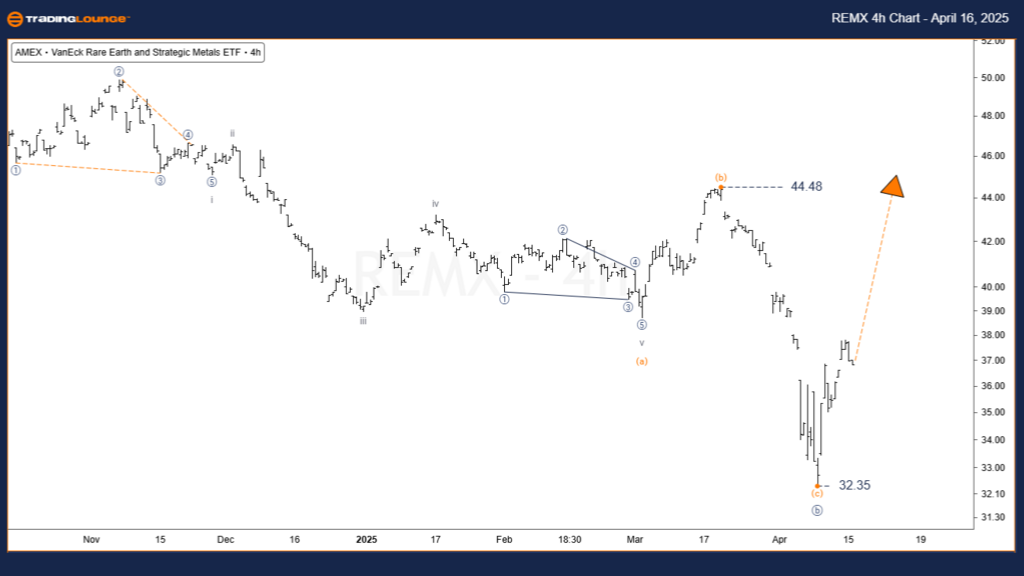

VanEck Rare Earth & Strategic Metals ETF – REMX (4H) Elliott Wave Analysis

Market Function: Major Trend (Minor Degree)

Wave Mode: Motive

Pattern Structure: Impulse

Wave Position: Wave [c] (navy) of 4 (grey)

Short-Term Trend: Rally

Critical Invalidation Level: $32.35

Short-Term Elliott Wave Forecast:

REMX’s 4-hour chart suggests a strong impulsive advance in wave [c], completing the corrective wave 4 structure. This final leg of the rally is targeting a break above the $51.10 high and could stretch further toward the wave [a] peak. Bullish momentum is building rapidly, suggesting further upside in the near term.

Technical Analyst: Siinom

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: VanEck Gold Miners ETF – GDX Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

REMX ETF Elliott Wave Conclusion:

The REMX ETF is entering a bullish short-to-medium term phase, driven by the final stages of wave 4. The target range of $51.10 to $57.12 presents a potential opportunity for long positions. Traders should closely monitor price developments and maintain awareness of the key invalidation levels to mitigate downside risk. This Elliott Wave setup provides strategic insights for navigating REMX’s next market move.