Meta Platforms Inc., Elliott Wave Technical Analysis

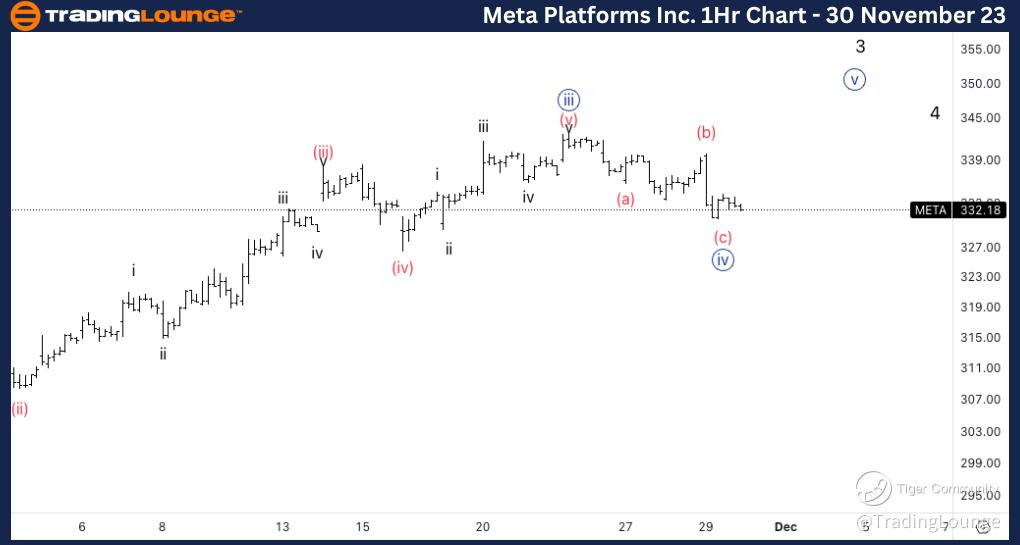

Meta Platforms Inc., (META: NASDAQ): 4h Chart 30 November 23

META Stock Market Analysis: We are looking for continuation higher on Meta as we are forecasting a potential wave 4. There is an alternate count with a more bullish scenario which will be discussed on the 1h chart. This count is forecasting a Minor Wave 4 near completion to then resume higher.

META Elliott Wave Count: Wave {c} of 4.

META Technical Indicators: Below 20EMA.

META Trading Strategy: Looking for longs into wave 5 on 330$ tested support.

TradingLounge Analyst: Alessio Barretta

Source: Tradinglounge.com get trial here!

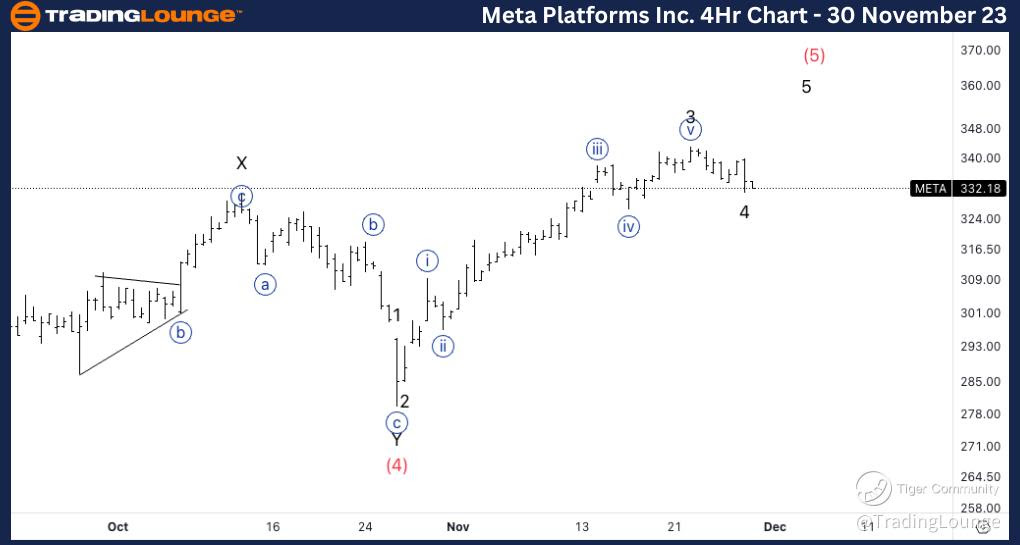

Meta Platforms Inc., META: 1-hour Chart 30 November 23

Meta Platforms Inc., Elliott Wave Technical Analysis

META Stock Market Analysis: Looking for minute wave {iv} instead of Minor wave 4 to be in the making. Looking for equality of (c) vs. (a) to then look for additional upside.

META Elliott Wave count: Wave (c) of {iv}.

META Technical Indicators: Between averages.

META Trading Strategy: Looking for longs into wave {v} on 330$ tested support.