ASX: BLOCK, INC (XYZ) Elliott Wave Technical Forecast

Greetings, Today’s Elliott Wave analysis from TradingLounge centers on BLOCK, INC – XYZ (ASX: SQ2), listed on the Australian Stock Exchange. Current chart patterns suggest the stock is nearing the final stage of an Expanded Flat correction, potentially setting up a bullish reversal opportunity.

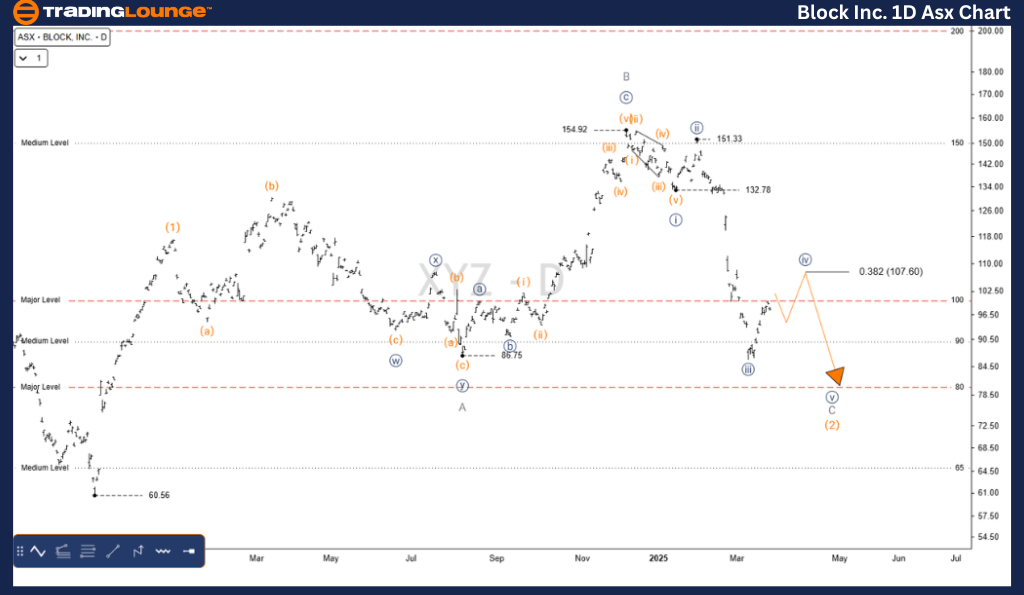

ASX: BLOCK, INC – XYZ Elliott Wave Analysis (TradingLounge Daily Chart)

Chart Type: 1D (Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave C – grey of Wave (2) – orange

Analysis Summary:

Wave (2) – orange appears to be finalizing a complex Expanded Flat pattern. The last leg, identified as wave C – grey, needs one more downward push. Upon completion, wave (3) – orange may begin, suggesting a trend reversal with potential upside momentum.

Critical Invalidation Level: 60.56

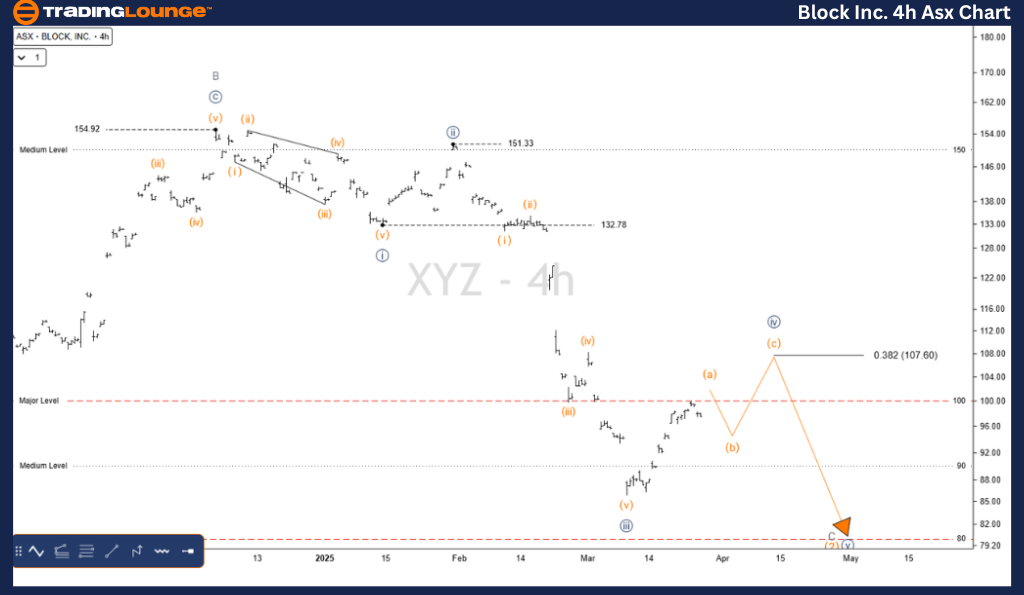

ASX: BLOCK, INC – XYZ Elliott Wave Outlook – TradingLounge (4-Hour Chart)

Chart Type: 4-Hour

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iv)) – navy

Analysis Summary:

Wave C – grey unfolds within a typical five-wave impulse. Currently, wave ((iv)) – navy is advancing slightly higher. A final downward move with wave ((v)) – navy is expected next. If the price breaks cleanly above the 0.382 Fibonacci retracement, it could signal the early start of wave (3) – orange.

Key Fibonacci Level: 0.382

Critical Invalidation Level: 132.76

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: INSURANCE AUSTRALIA GROUP LIMITED Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave breakdown for ASX: BLOCK, INC – XYZ (ASX:SQ2) provides both medium and short-term perspectives. Clearly defined invalidation points and Fibonacci markers support trading confidence and enhance the reliability of the wave count. This detailed forecast aims to assist traders in identifying and acting on potential trend shifts in a professional and timely manner.