ASX: BHP GROUP LIMITED (BHP) Elliott Wave Technical Analysis TradingLounge Update

Welcome to today’s Elliott Wave update for ASX:BHP GROUP LIMITED – BHP. According to our latest technical analysis, BHP stock shows bullish potential, with wave 2)–orange now complete as a Zigzag pattern. Wave 3)–orange is currently in progress with the potential for further upward movement. Below, we outline the expected price targets and the critical invalidation level to watch.

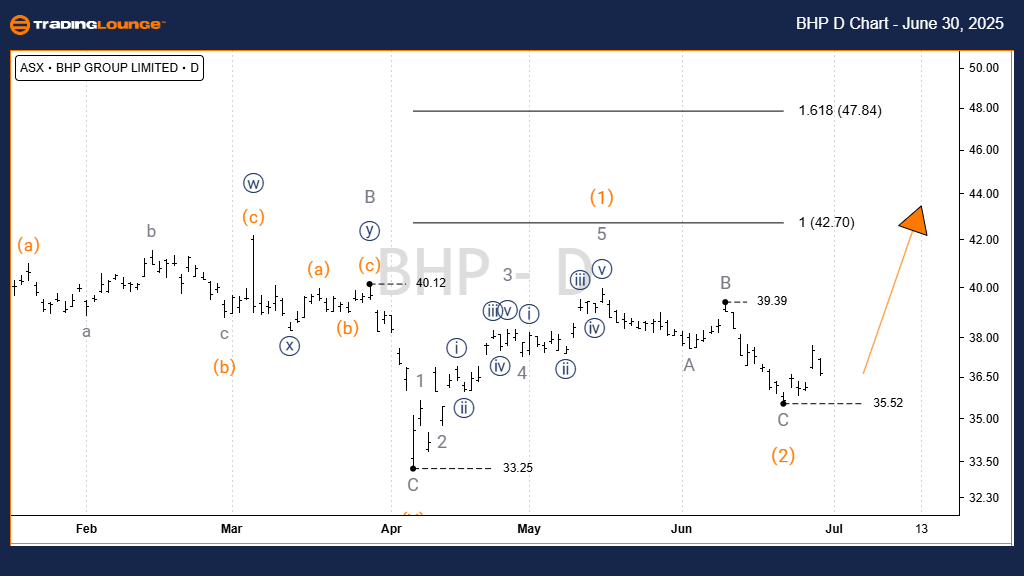

ASX: BHP GROUP LIMITED – BHP 1D Chart Analysis (Semilog Scale)

Function: Intermediate Trend (Orange Degree)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave 3)–orange

Technical Summary:

- After bottoming at 33.25, wave 1)–orange formed a clear five-wave impulse.

- Subsequently, wave 2)–orange completed as a standard A–B–C Zigzag correction.

- This sets the stage for wave 3)–orange, projected to reach between 42.70 and 47.84.

- For this upward Elliott Wave count to remain valid, the support level at 35.52 must hold.

Critical Invalidation Level: 35.52

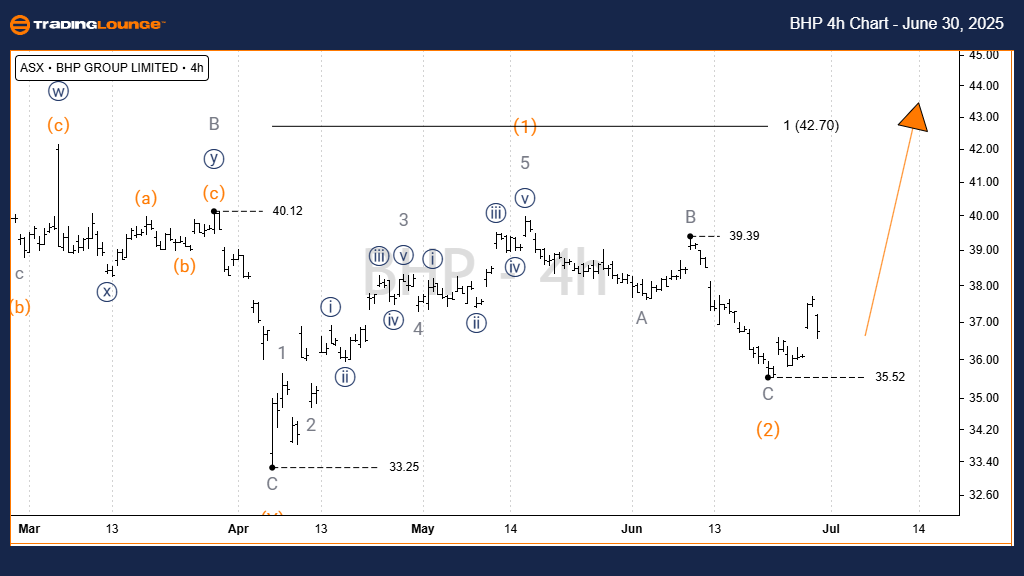

ASX: BHP GROUP LIMITED – BHP 4-Hour Chart Technical Analysis

Function: Intermediate Trend (Orange Degree)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave 3)–orange

Analysis Overview:

- The 4-hour chart aligns with the daily view, confirming wave 3)–orange development.

- A bullish trade setup may trigger once the price moves above the Entry level.

- Maintaining support above 35.52 remains crucial to validate the bullish bias.

Critical Invalidation Level: 35.52

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our Elliott Wave analysis for ASX: BHP offers a professional, objective outlook supported by clear price action signals. By specifying target zones and key invalidation levels, traders can increase confidence in directional bias and act accordingly. This structured approach helps identify profitable trading opportunities in BHP shares.