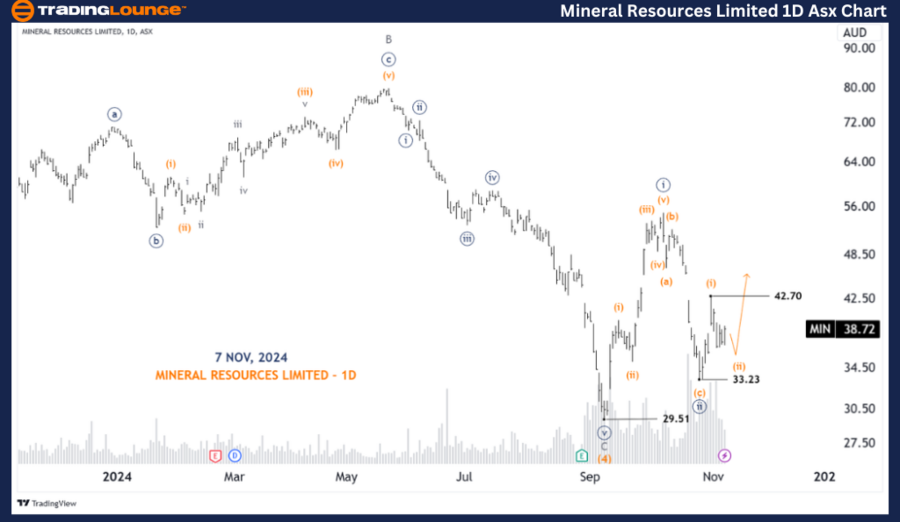

Mineral Resources Limited (MIN) - Elliott Wave Analysis Daily Chart

Welcome to today’s Elliott Wave analysis for the Australian Stock Exchange (ASX) ticker Mineral Resources Limited (MIN). According to our assessment, MIN.ASX may be on the verge of an upward movement in wave (iii)-orange within wave ((iii))-navy.

ASX: Mineral Resources Limited (MIN) - Daily Chart Analysis (1D, Semilog Scale)

ASX: MIN Elliott Wave Technical Analysis

Trend: Major trend at the Minute degree (navy)

Mode: Motive

Wave Structure: Impulse

Current Position: Wave (ii)-orange of Wave ((iii))-navy

Analysis Details:

Our analysis indicates that wave ((ii))-navy may have completed its formation as an (a)(b)(c)-orange zigzag. Starting from the 33.23 price point, wave ((iii))-navy is currently developing with an extended wave formation. This extended wave is expected to complete wave (ii)-orange soon, which should lead to the upward movement of wave (iii)-orange.

Invalidation Point: 33.23

ASX: Mineral Resources Limited (MIN) - 4-Hour Chart Analysis

Trend: Major trend at the Minute degree (navy)

Mode: Motive

Wave Structure: Impulse

Current Position: Wave (ii)-orange of Wave ((iii))-navy

Analysis Details:

Starting from the low at 33.23, wave ((iii))-navy is progressing towards higher levels. Currently, this wave is subdividing into wave (ii)-orange. Although some instability is present, suggesting a possible brief decline, a confirmed upward push in wave (iii)-orange may follow. Additionally, if the price moves above 42.70, it would provide further confirmation that wave (iii)-orange is progressing.

Invalidation Point: 33.23

Confirmation Point: 42.70

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: REECE LIMITED - REH Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our updated Elliott Wave analysis of ASX: Mineral Resources Limited (MIN) offers a forecast of the key trends and market signals, presenting potential opportunities to capitalize on these movements. Specific price levels, such as the confirmation and invalidation points, provide clear indicators for our wave count. With these insights, we aim to give a comprehensive and objective perspective on the likely market trajectory for MIN, enabling informed trading decisions.