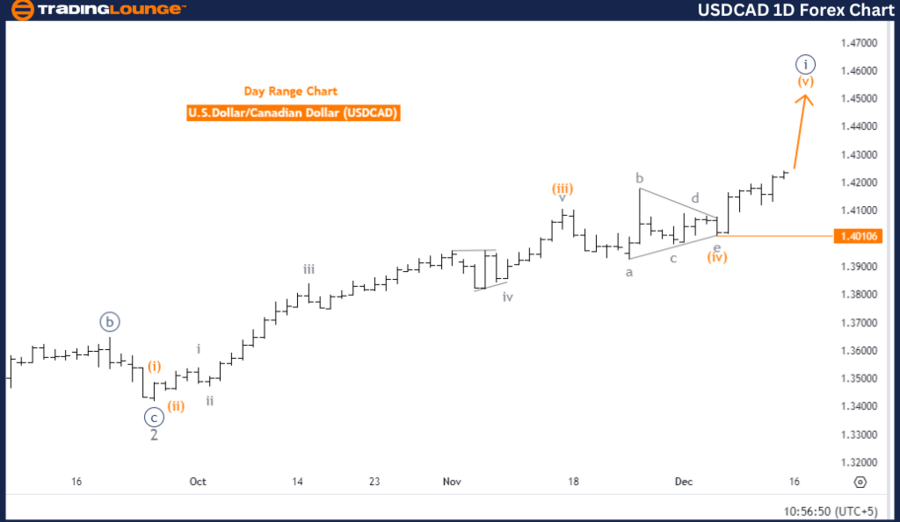

U.S. Dollar / Canadian Dollar (USDCAD) Elliott Wave Analysis - Trading Lounge Daily Chart

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 5

Position: Navy Blue Wave 1

Direction for Next Lower Degrees: Navy Blue Wave 2

Details

Current Status

- Orange wave 4 appears completed.

- Orange wave 5 of navy blue wave 1 is in progress.

- Invalidation Level: 1.40106 (A drop below this level invalidates the current Elliott Wave structure).

Analysis Overview

The daily chart for USDCAD demonstrates a bullish trend based on Elliott Wave analysis. The impulsive mode highlights robust upward momentum within the wave structure.

Key Highlights

Key Considerations

- Bullish Sentiment:

- Orange wave 5 is actively driving prices upward, reinforcing a bullish outlook.

- Potential Reassessment:

- A drop below 1.40106 would invalidate the current structure and necessitate reanalysis.

Strategic Implications for Traders

- Capitalizing on the Trend:

- Align trading strategies with the bullish momentum of orange wave 5 to leverage the ongoing uptrend.

- Preparing for Corrective Wave 2:

- Be ready for the potential navy blue wave 2 correction to manage risk effectively.

- Close Observation:

- Monitor price action and wave development closely to adapt strategies to market dynamics.

This Elliott Wave analysis outlines a clear bullish trajectory for USDCAD on the daily chart. Traders should remain vigilant to price levels and wave progression for optimized strategies during this phase.

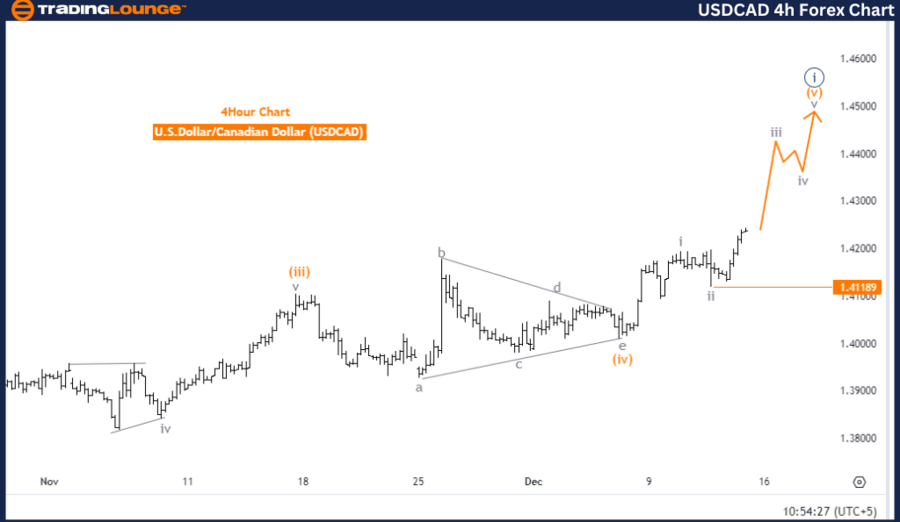

U.S. Dollar / Canadian Dollar (USDCAD) Elliott Wave Analysis - Trading Lounge- 4-Hour Chart Analysis

USDCAD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 5

Direction for Next Lower Degrees: Gray Wave 4

Details

Current Status

- Gray wave 2 appears completed.

- Gray wave 3 is in progress, with the market positioned in orange wave 5.

- Invalidation Level: 1.41189 (A drop below this level invalidates the current Elliott Wave structure).

Analysis Overview

The USDCAD 4-hour chart exhibits a bullish trend based on Elliott Wave analysis. The impulsive mode reflects strong upward momentum within gray wave 3, a critical phase of the ongoing uptrend.

Key Highlights

-

Wave Progression:

- Gray wave 2 completion has initiated the active phase of gray wave 3.

- The market is currently in orange wave 5, signaling the final stage of gray wave 3.

-

Upward Momentum:

- Gray wave 3 is characterized by robust price increases and strong bullish sentiment.

-

Upcoming Correction:

- Gray wave 4 is expected to follow gray wave 3, signaling a potential corrective phase in the broader impulsive sequence.

Key Considerations

- Bullish Sentiment:

- The ongoing gray wave 3 phase aligns with a strong upward trajectory, suggesting further price gains.

- Potential Reassessment:

- A drop below 1.41189 would negate the current Elliott Wave structure and require reevaluation.

Strategic Implications for Traders

- Capitalizing on the Trend:

- Exploit the sustained bullish momentum in gray wave 3 to align with the uptrend.

- Preparing for Gray Wave 4:

- Stay prepared for the corrective phase of gray wave 4 to manage risk and plan exits effectively.

- Monitoring Sub-Waves:

- Closely track orange wave 5 progression and key price levels for optimal market navigation.

This analysis emphasizes the strength of the USDCAD uptrend on the 4-hour chart, providing actionable insights for traders to align strategies with the prevailing bullish market conditions.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: GBPAUD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support