Microsoft Inc. (MSFT) – Elliott Wave Analysis

This combined multi-timeframe Elliott Wave analysis of Microsoft (MSFT) offers valuable insight for traders. It highlights potential turning points and supports strategic decision-making during the current corrective market phase.

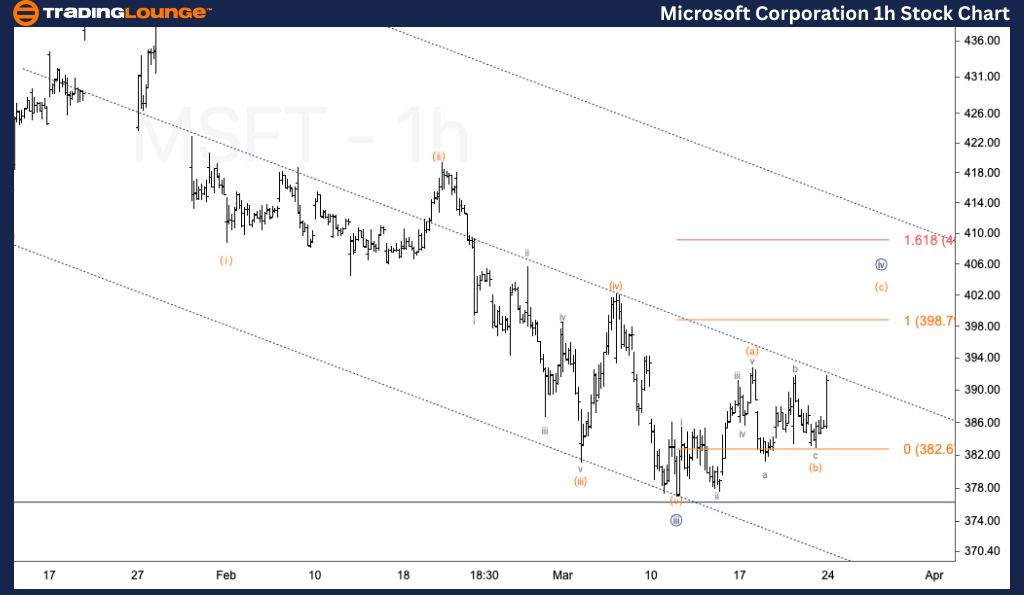

Microsoft Inc. (MSFT) – Elliott Wave Analysis by TradingLounge Daily Chart

MSFT Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: ZigZag

Position: Wave {iv} of C

Direction: Continued Downside Expected in Wave C

Details:

Microsoft Corporation (NASDAQ: MSFT) is currently in Minor wave C on the daily timeframe, according to Elliott Wave theory. So far, three sub-waves have been identified, with a visible pullback in wave {iv} of C. This indicates that the corrective wave structure is still ongoing. Additional downward movement is anticipated once this pullback completes, signaling a continuation in wave {v} of C.

Microsoft Corporation (MSFT) – Market Analysis Brief

Based on Elliott Wave analysis, Microsoft stock (MSFT) is undergoing a corrective pattern on the daily chart. The structure appears to be a ZigZag, currently in Minor wave C. A noticeable retracement within wave {iv} suggests the correction hasn't ended yet, and further decline in wave {v} could follow. Traders should prepare for more downside as the correction evolves.

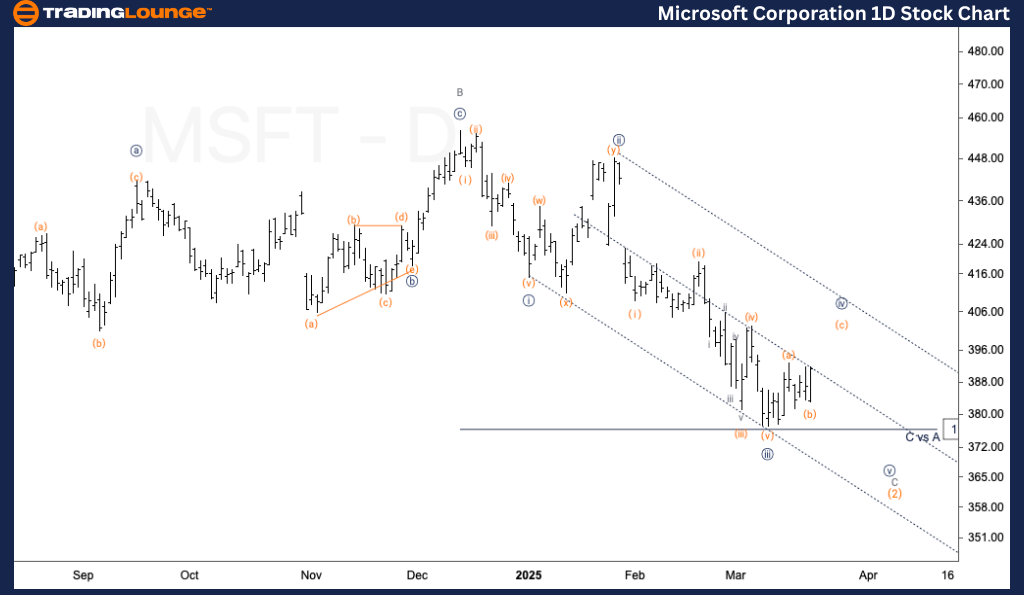

Microsoft Corporation (MSFT) Elliott Wave Analysis by TradingLounge 1-Hour Chart

Function: Counter-Trend

Mode: Corrective

Structure: ZigZag

Position: Wave (c) of {iv}

Direction: Short-Term Upside Toward Completion of Wave (c)

Details:

On the 1-hour chart, Microsoft stock shows signs that wave (b) may have concluded. The current move is likely wave (c) of {iv}, with a short-term upside target near $400. This projection is based on wave equality between waves (a) and (c). Once this rally completes, it may signal the end of wave {iv} before the price resumes its decline into wave {v}.

Microsoft Corporation (MSFT) – Market Analysis Brief

In the short-term timeframe, Elliott Wave analysis highlights an upward movement in wave (c) of {iv}, following the likely completion of wave (b). The anticipated target for wave (c) aligns near $400, providing a potential inflection point before the broader downtrend continues.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Spotify Technology S.A. (SPOT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support