Corn Commodity Elliott Wave Technical Analysis – Daily and H4 Chart Review

Corn Elliott Wave Analysis

Function – Counter-Trend

Mode – Correction

Structure – Flat pattern in wave ((2))

Position – Wave ((2))

Direction – Toward wave ((3))

Corn Price Action Overview

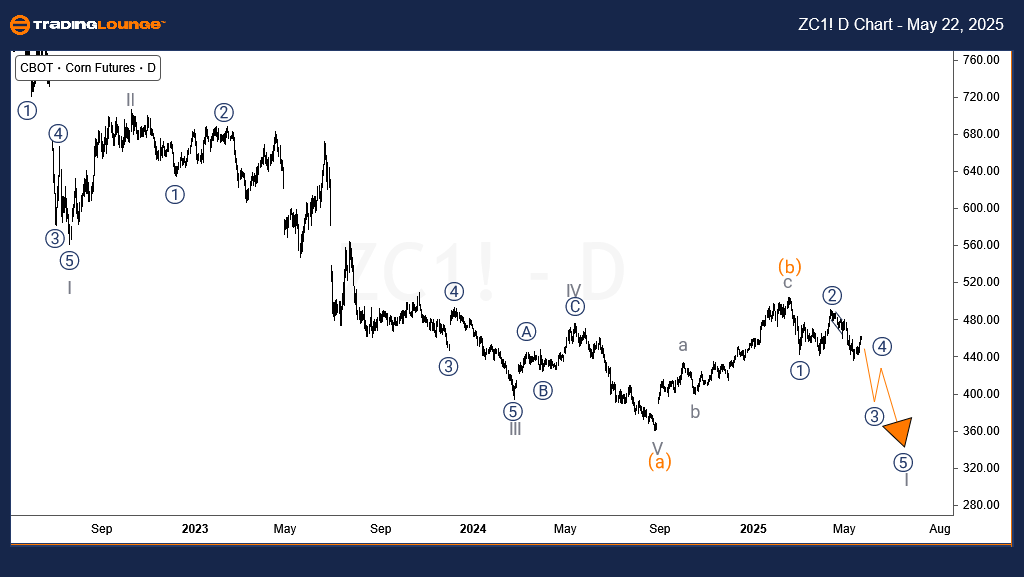

As of May 13, corn futures began a recovery phase, likely marking a counter-trend move in line with Elliott Wave principles. This corrective phase is anticipated to target the 426–386 price zone, countering the prior downward momentum seen from April’s peak. This rebound could represent the initial stage of a broader technical correction in the corn market.

Corn Daily Chart Analysis

Since April 2022, corn prices have followed a clear downward trajectory, characterized by a series of lower highs and lows. This bearish trend culminated in August 2024, completing a full five-wave impulse decline. In alignment with Elliott Wave Theory, such impulsive trends are often succeeded by a three-wave corrective structure. The rally that started from the August 2024 low aligns with this corrective expectation.

By February 2025, the wave (b) correction, structured as a zigzag (highlighted in orange), was completed. The downward movement post-February might be developing another zigzag correction that may test the 426–386 area or could evolve into a new bearish impulse targeting sub-360 levels. This scenario would reinforce a negative outlook for corn prices in the medium term.

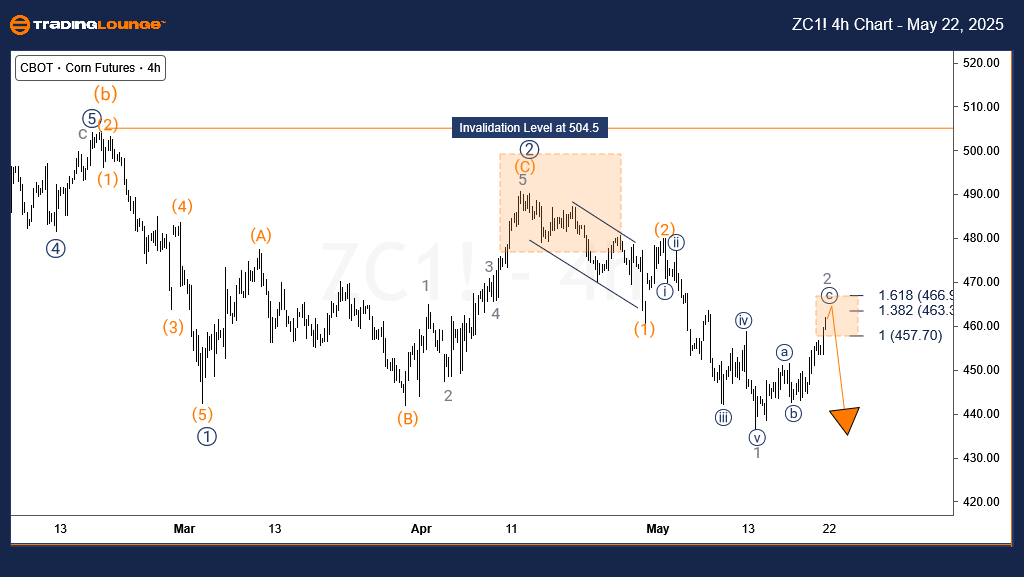

Corn H4 Chart Analysis

The 4-hour chart reflects the completion of waves ((1)) and ((2)) during March and April 2025. From mid-April, corn futures began to drop in a strong bearish wave 1 of (1) of ((3)). This initial impulsive leg was followed by a retracement move, which is forming as wave 2 of (1).

Wave 2 is projected to terminate within the 457–467 resistance range. After its completion, further downside pressure is expected, likely dragging prices back to the 400 level. This forecast supports the broader wave ((3)) decline as part of a continued bearish Elliott Wave forecast in corn futures.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: GX Uranium ETF (URA) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support